If you don’t have a customer relationship management (CRM) solution for your investment banking business processes, you’re leaving money on the table.

Without the right tools, it’s easy to mismanage client data, fumble key relationships, and ultimately tank your business.

I’m AJ—here to make sure that doesn’t happen. I’ve helped many companies succeed while building my business to a multiple seven-figure exit.

I did the heavy lifting and compiled this list of the best CRM software for investment banks looking to scale to new heights.

Let’s dive in!

(Bonus points if you hang out until the end, where I offer some tips to help you pick a platform!)

After years of SBB testing, here is our list of the best CRM for investment banking:

- Best CRM For Investment Banking For Integrations: HubSpot

- Best CRM For Investment Banking For Lead Management: Zoho CRM

- Best CRM For Investment Banking For Telephony: Freshworks

- Best CRM For Investment Banking For Automation: Monday.com

- Best CRM For Investment Banking For Lead Prospecting: Zendesk Sell

- Best CRM For Investment Banking For Ease of Use: Close CRM

- Best CRM For Investment Banking For Startups: Less Annoying CRM

- Best CRM For Investment Banking For Client Management: Vtiger

How Did We Test The Best CRM For Investment Banking?

My team and I put each CRM platform to the test (over six months).

Here’s what we looked at:

- Hands-On Experience

- Feature Assessment

- Customer Support

- Scalability

- Ease of Use

- Third Party Reviews

How We Objectively Test Each Platform:

AJ's got a knack for kick-starting businesses, putting them on autopilot, and setting them up for acquisition. Over the past decade, he's been right in the thick of things with hundreds of small businesses, helping them with just about everything under the business sun. If you need advice on software suites and choices? AJ's your guy.

We roll up our sleeves and dive into the top CRM features we think are pretty crucial for small businesses. Stuff like reports and analytics, options to customize your pipelines, and the ability to link up with other apps and services. We know what makes small businesses tick, so we know what features they need to get the job done.

Money matters, folks! When it comes to picking a CRM system, price is usually the deal-breaker. We give a big thumbs up if a provider charges $30 or less per user each month for their starter plan. Extra brownie points for throwing in a freebie plan or trial, options to scale up or down as needed, and the freedom to pay monthly or yearly. We're looking for flexability for small businesses.

We all know support is mega important when you're choosing a CRM platform. This is especially true for those smaller businesses or sales teams who can't afford to have tech wizards on their payroll. We put our detective hats on to see if these companies offer round-the-clock support, and we looked at the different ways you can get help. We're talking live chat (like, real-time convo), email tickets, a good old-fashioned phone call, and self-service tools (for the DIY-ers out there).

When you're in the business of picking a CRM, integrations are like the secret sauce that takes your burger from 'meh' to 'mind-blowing'. Imagine, all your favorite apps and tools, working together in perfect harmony, making your workflow smoother than a fresh tub of Nutella. When we review a CRM, we look at the integrations most SMB owners are looking for.

When you're reviewing a Customer Relationship Management (CRM) system, it's essential to pay close attention to its ease of use. After all, a CRM is as beneficial as its usability. A simple, intuitive interface saves you and your team a great deal of time and headache. When we're reviewing each CRM, this is a crucial aspect that we look for.

The importance of Mobile CRM cannot be overstated in today's digital age. It's essential for fostering strong customer relationships and managing business activities. Mobile access to CRM makes it possible for sales teams to update and access customer information in real time, improving efficiency and ensuring up-to-date data. Mobile CRM can have a massive impact on SMBs, so thoroughly testing it is essential for each one of our reviews.

HubSpot CRM: Best For Integrations

HubSpot

Learn More Today!-

Tons of Free Tools From Each Hub

-

Live Chat Capabilities

-

Robust Integrations

Why We Picked HubSpot CRM

HubSpot is an all-in-one CRM solution that’s perfect for investment banks looking to scale.

Here are some of our favorite features:

- Tons of integrations

- Client management

- Reporting & analytics

- Workflow automation

- Mobile app

HubSpot is intuitive, extremely powerful, and 100% free!

It’s easily one of the best CRM solutions on the market.

HubSpot CRM Features

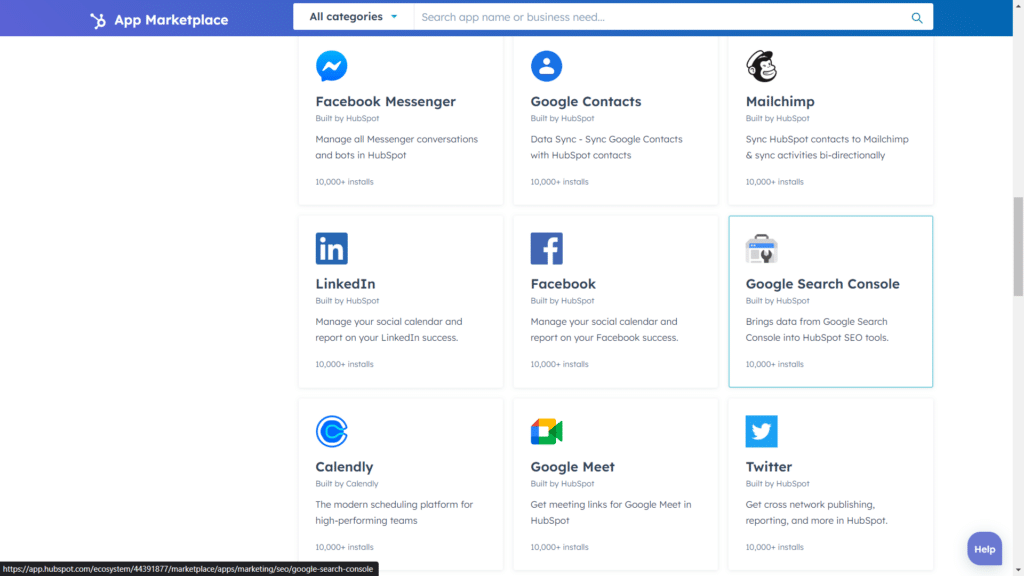

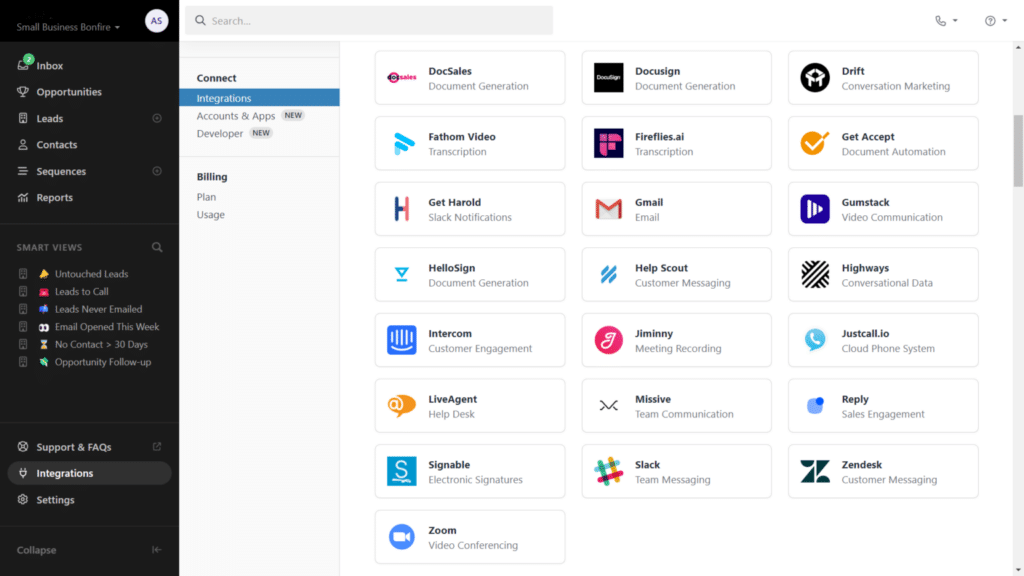

When it comes to integrations, HubSpot is king.

The robust CRM system offers over 500 native integrations on the HubSpot App Marketplace (shown below).

Here are a few that are great for investment banking:

- QuickBooks

- Google Meet

- DocuSign

- PandaDoc

- Mailchimp

- Zapier

HubSpot’s Zapier integration allows you to easily connect thousands of additional third-party applications!

This means that HubSpot offers just about any integration you could ever need.

Plus, with HubSpot’s APIs, you can quickly build custom integrations for your specific needs.

The need to know: If you want to connect your favorite platforms with your investment banking CRM software, look no further than HubSpot.

Your clients are the lifeblood of your investment banking business.

Without them, you’d have nothing to invest in or manage.

So, it’s essential to have a CRM system that helps you keep track of all your client data and interactions.

HubSpot delivers in this regard (in a big way).

HubSpot allows you to easily accomplish the following:

- Quickly update relevant client details

- Manage associated deals

- Keep track of all customer interactions

- Store documents & notes

- Schedule tasks & reminders

- Create custom fields

- Customize your client dashboard

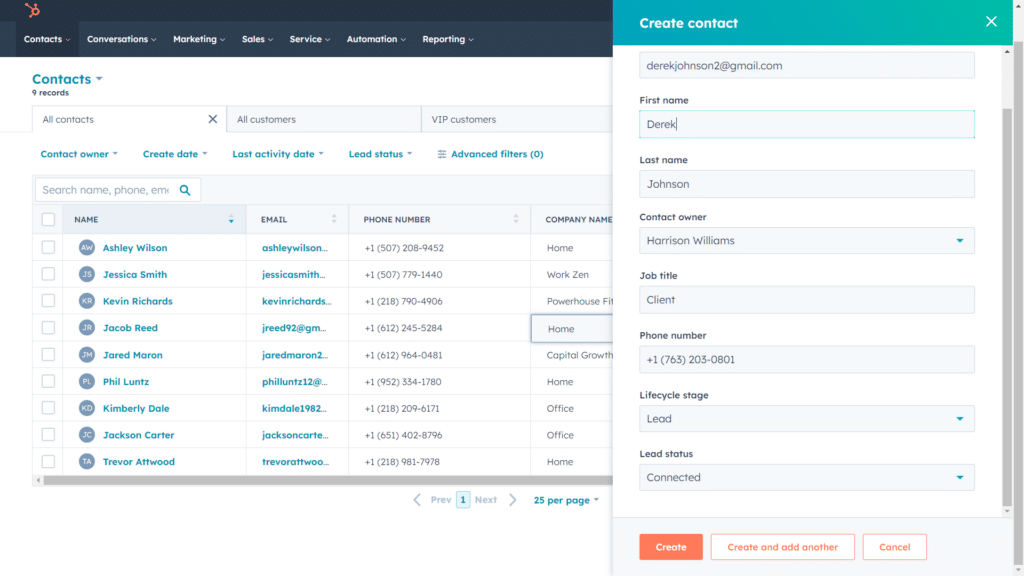

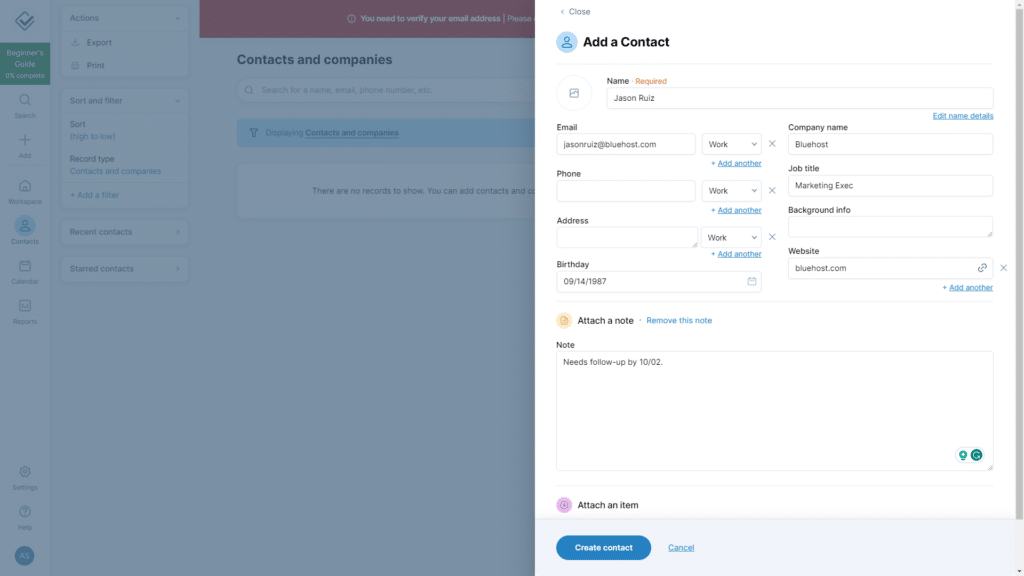

Adding a new contact is as easy as one click and filling out a few fields (shown below).

Each card contains a ton of data, giving you a view of the entire customer journey (at a glance).

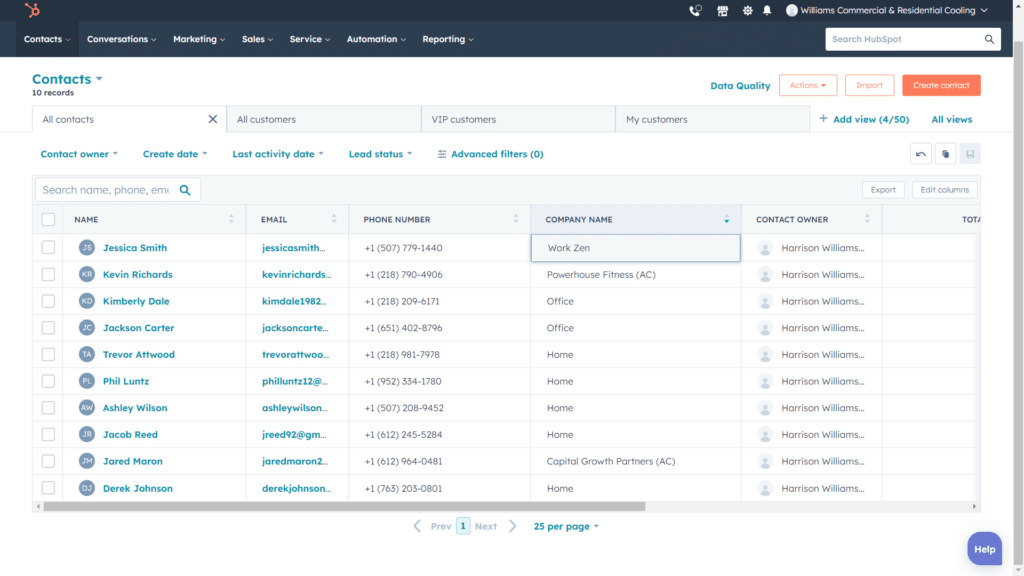

Once you have all your data in place, you can get a bird’s eye view of your client relationships with the client dashboard (pictured below).

This dashboard is fully customizable, so you can place the most important information front and center.

The breakdown: HubSpot’s client management tools make it easy to keep track of your clients, their interactions, and all associated data.

It’s a game-changer for investment banking firms looking for streamlined relationship management.

I’ve always been a huge fan of letting automation handle the heavy lifting while focusing on what’s essential—client relationships.

That’s why I love HubSpot’s workflow automation capabilities.

Here are some standout aspects of this feature:

- Helpful premade templates

- Powerful customization

- Easy visual workflows

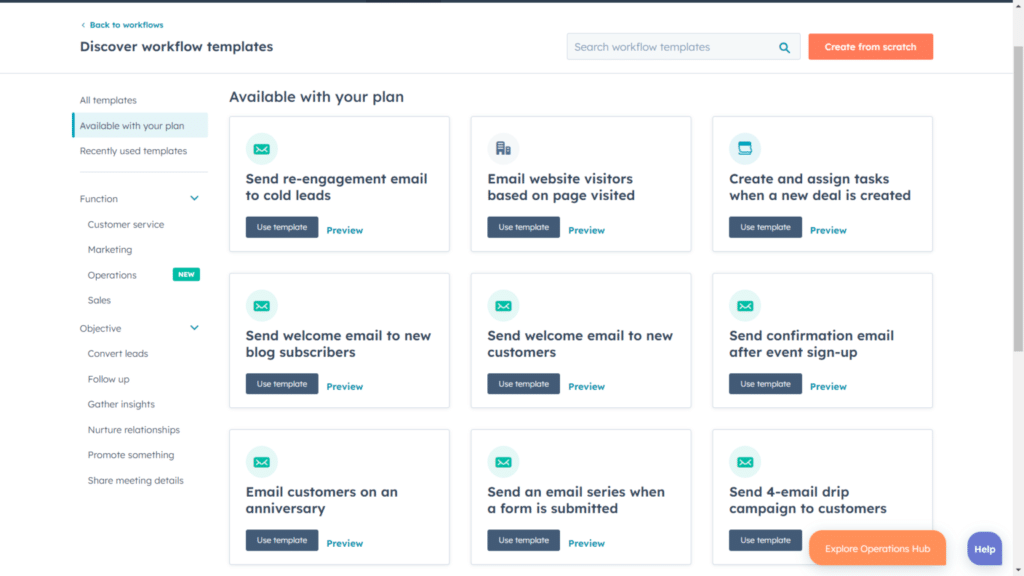

HubSpot’s beginner-friendly automation templates (shown below) allow you to implement powerful automation (no coding knowledge necessary).

These templates are fully customizable with HubSpot’s visual automation editor.

This editor allows you to customize and create unique sequences in just minutes.

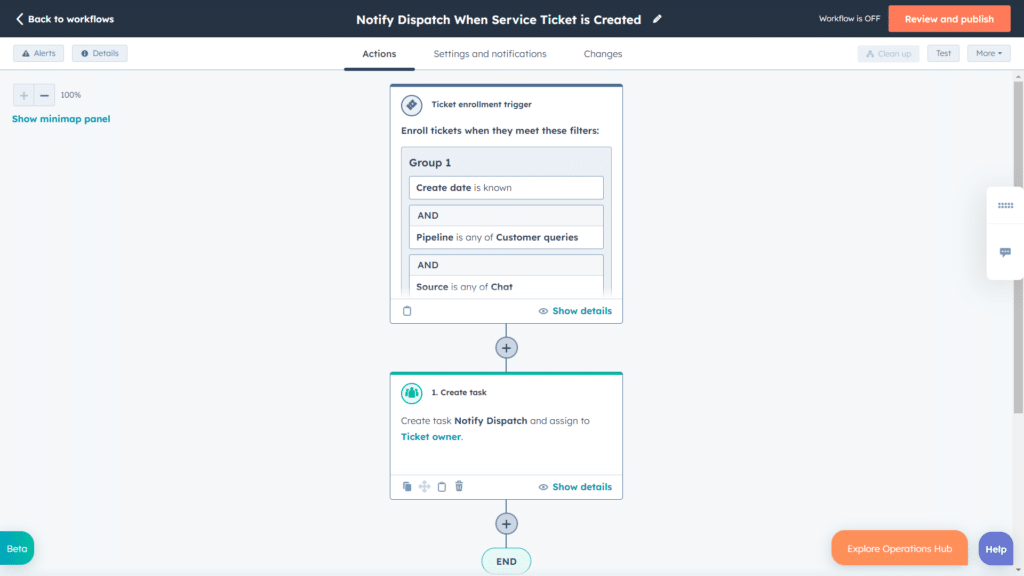

Here’s a look at the automation creation process (about halfway through).

The bottom line: If you’re serious about growing your investment banking company, HubSpot is a fantastic option.

HubSpot lets you automate tedious tasks (such as manual data entry) and relax as you scale with ease.

HubSpot CRM Pricing

HubSpot CRM offers a free plan in addition to three paid plans:

- Free Plan – Free Forever

- Starter CRM Suite – $30/Month

- Professional CRM Suite – $1,335/Month

- Enterprise CRM Suite – $5,000/Month

HubSpot CRM Pros and Cons

- Powerful free tools

- Fantastic customer support (with live chat)

- Intuitive interface

- Tons of integrations

- Great client relationship management

- Streamlined workflows

- Advanced plans are expensive

- CMS Hub lacks advanced customization options

Zoho CRM: Best For Lead Management

Zoho CRM

Learn More Today!-

Powerful Automation Capabilities

-

Deal, Lead, & Contact Management Tools

-

Customizable Pipelines & Dashboards

Why We Picked Zoho CRM

Zoho CRM is a powerhouse CRM system that can help investment banks succeed.

Here are a few standout features:

- Lead management

- Project management

- Mobile app

- Reporting & analytics

- Pipeline management

Zoho CRM is perfect for corporate and investment banking firms of any size, thanks to its powerful features, affordable pricing, and fantastic user interface.

Zoho CRM Features

Managing hot leads can be the difference between a successful and unsuccessful investment banking business.

Zoho CRM’s lead management system streamlines the process, making tracking and nurturing leads easy (see below).

With Zoho CRM’s lead management, you can accomplish the following:

- Assign leads to team members

- Create web forms (for lead capture)

- Nurture leads automatically

- Track lead progress & communication in one place

- Create custom fields

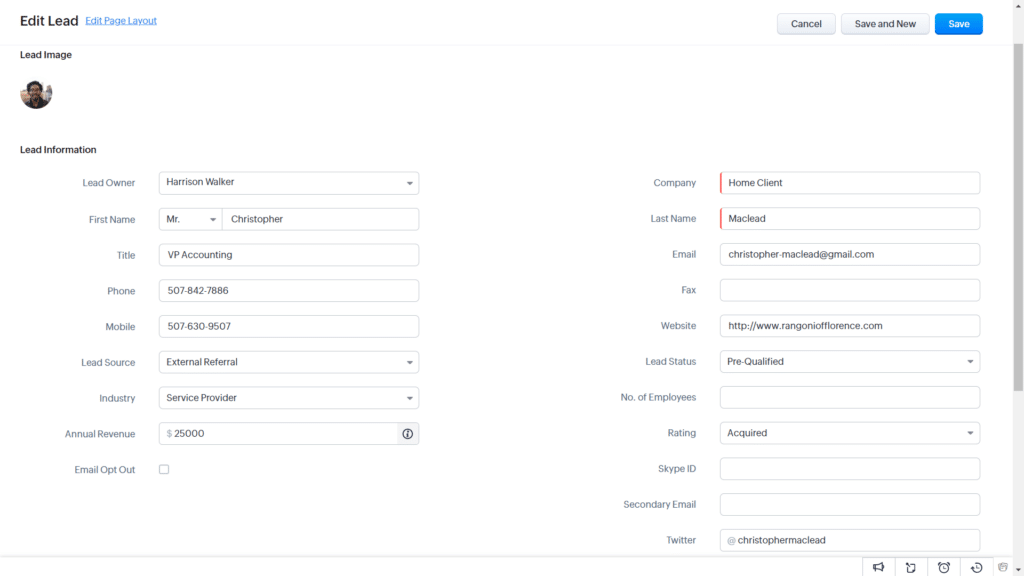

Here’s a look at a new lead card (to give you some context).

Each card displays a ton of information, making it easy to get a clear view of the entire lead lifecycle (in seconds).

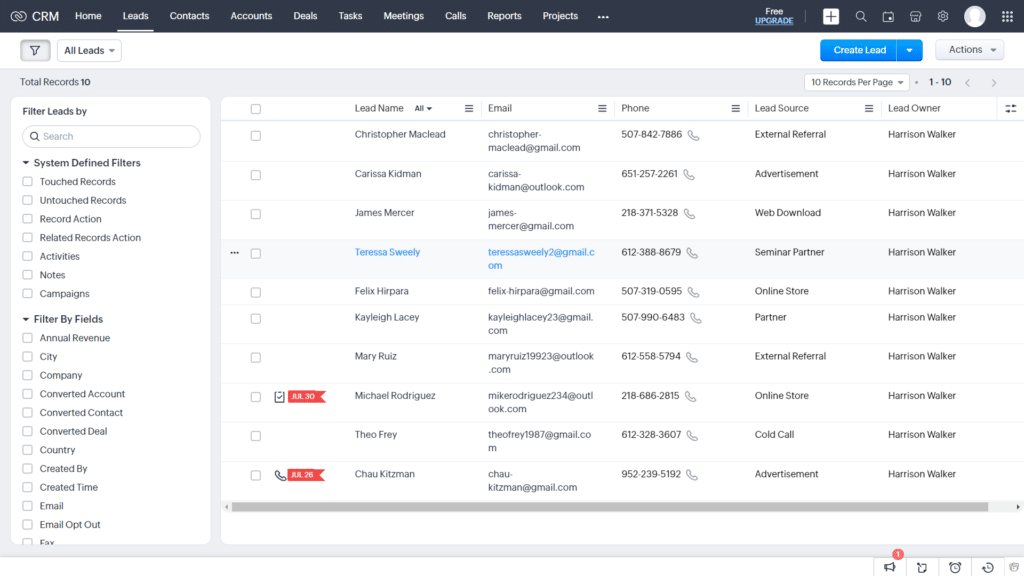

Once you have all your leads in place, you can easily view everything in one convenient location (shown below).

The leads dashboard is fully customizable, allowing you to tailor your CRM to your specific banking needs.

The need to know: Zoho CRM offers some of the best lead management on the market.

It’s incredibly easy to use, even for first-timers!

Zoho CRM’s reporting and analytics tools are top-of-the-line, making it easy to track key metrics and improve your processes.

With Zoho CRM, you can do the following:

- Create custom reports & dashboards

- Analyze data in real-time

- Export data (with just a click)

- Visualize data with charts & graphs

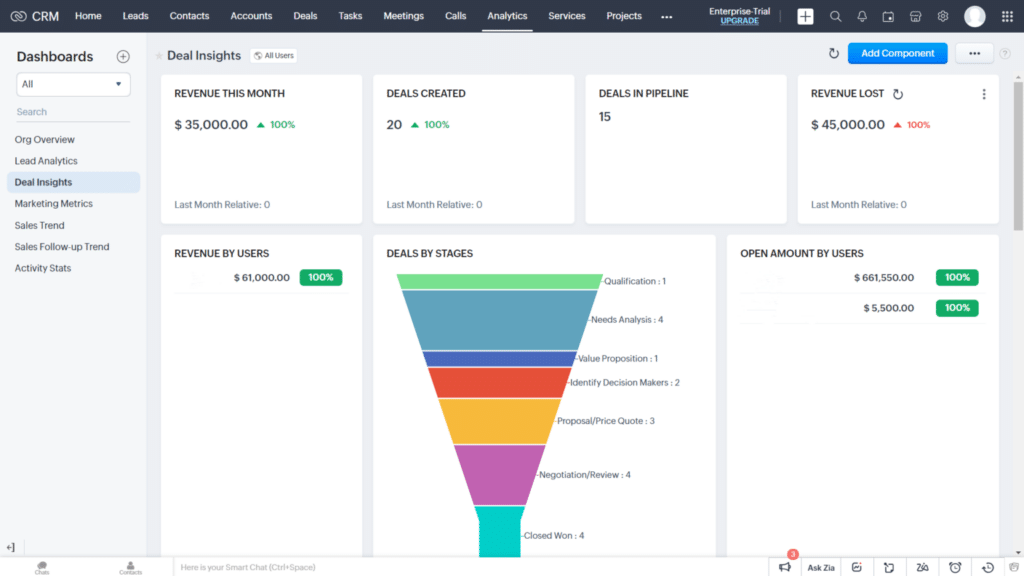

Here’s a look at a sample dashboard where you can track all your key metrics.

The customizable dashboards make it easy to see the big picture and identify areas for improvement.

Plus, the drag-and-drop interface makes it easy to create and customize unique reports and dashboards.

The lowdown: Zoho CRM makes it easy to track key performance indicators and make data-driven decisions to improve your investment banking business (from start to finish).

Zoho CRM provides many tools to help you easily manage your deal process!

Some standout features include:

- Comprehensive deal cards

- Drag-and-drop interface

- Multiple pipeline views

- Streamlined user interface

- Customizable pipelines

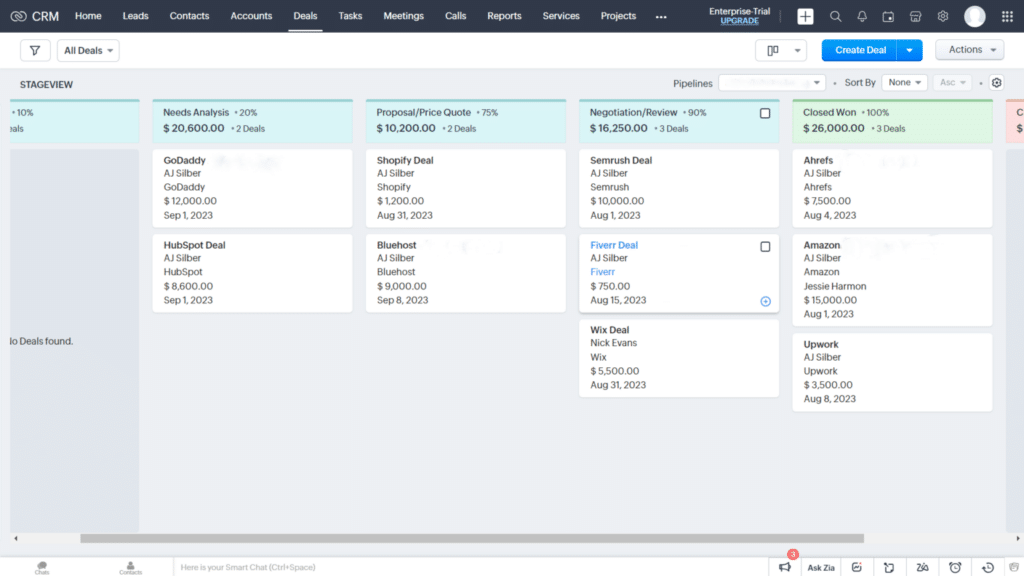

Here’s a look at a deal pipeline dashboard with Zoho CRM.

You can easily move deal cards from one stage to the next with a simple drag-and-drop.

Your entire team can stay on the same page while they close deals and grow your investment banking business (without missing a beat).

The nuts and bolts: Zoho CRM can take your deal execution to the next level as you scale your business to new heights!

Zoho CRM Pricing

Zoho offers a free plan in addition to four affordable paid plans.

They are the following:

- Free Version – Free for up to three users

- Zoho Standard – $20/Month

- Zoho Professional – $35/Month

- Zoho Enterprise – $50/Month

- Zoho Ultimate – $65/Month

Zoho CRM Pros and Cons

- Extremely affordable pricing

- Excellent lead management

- Intuitive user interface

- Exceptional customer support (with live chat)

- Great pipeline management

- The free plan is limited (to 3 users)

- Limited advanced marketing features

Freshworks: Best For Telephony

Freshworks

Learn More Today!-

Chatbot Customization

-

Affordable (and Scalable) Pricing

-

Fantastic Pipeline Management

Why We Picked Freshworks

Freshworks is a sales, service, and marketing CRM in one convenient package.

Here are some great features for investment banking:

- Reporting & analytics

- Telephony

- Client management

- Mobile app

- Lead management

Freshworks is feature-rich, easy to use, and won’t break the bank (pun intended).

It’s fantastic for scaling banks looking to connect with their clients like never before!

Freshworks Features

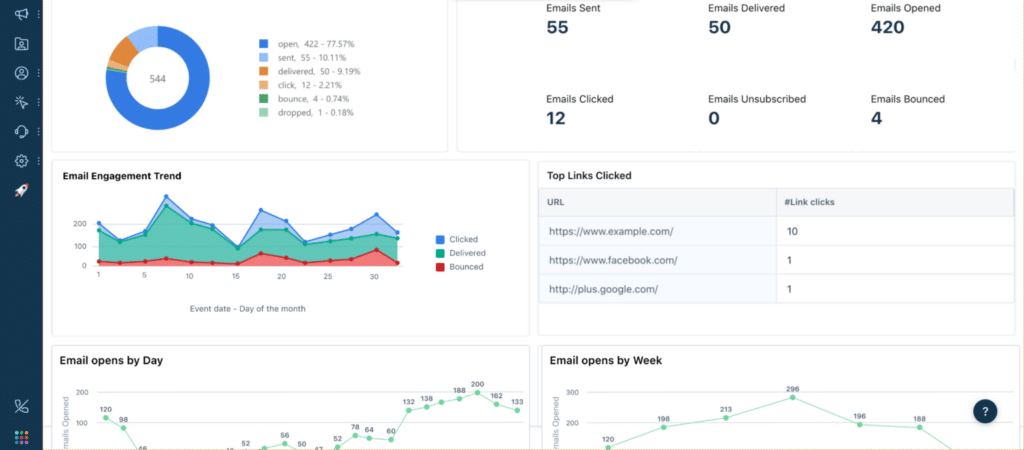

Freshworks offers robust reporting & analytics tools to help ensure your data is working for you.

With Freshworks, you can track the following:

- Client insights

- Your entire sales process

- Communication history

- Pipeline health

- Customer segmentation

With customizable dashboards (like the one shown below), you can see all your data in one convenient location.

Plus, with a ton of unique report templates to choose from, you can easily drill down on any detail and view your data in almost any way imaginable.

Our two cents: Freshworks knocks it out of the park regarding reporting & analytics.

If you’re looking to make better decisions for your company as you scale, Freshworks is a safe bet.

Telephony might not be the first feature you think of regarding investment banking, but it’s essential for staying connected with clients and team members.

With Freshworks’ telephony features, you can:

- Make & receive calls directly within the CRM

- Track call data automatically

- Record calls for quality control

- Integrate with your existing phone system

- Purchase phone numbers in 90+ countries

Here’s a look at the telephony feature via mobile.

With this feature, your entire team can stay connected with clients and each other, even while on the go.

The important part: Telephony can play a significant role in client communication and overall business efficiency.

Take advantage of this feature, and you can thank me later (when your clients are raving about your communication skills)!

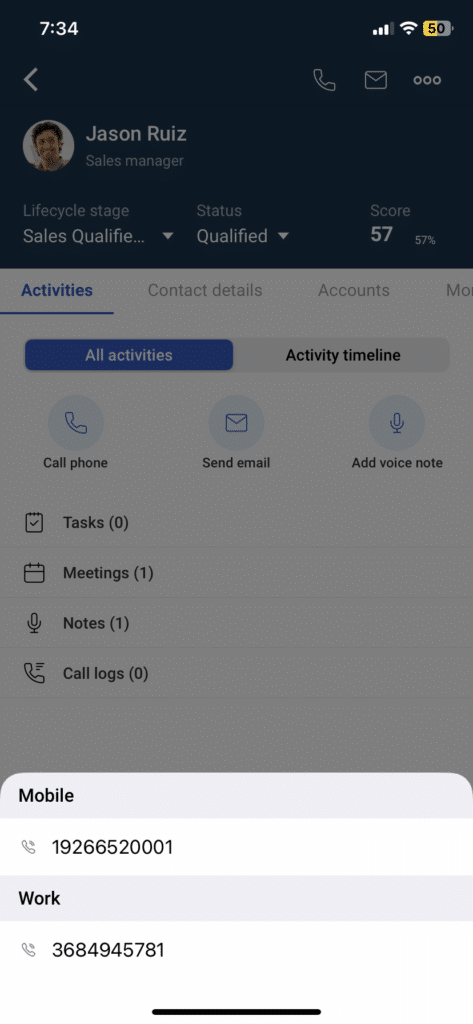

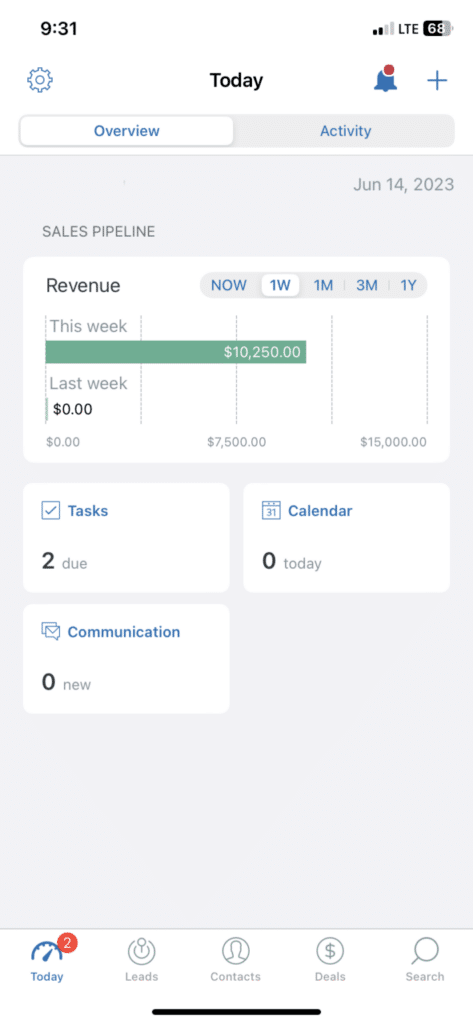

Banking never stops, and neither should your access to CRM data—no matter where you are!

Freshworks provides a fantastic solution with its solid mobile app (available on iOS and Android).

The app provides a ton of useful features for investment banks, such as the following:

- Lead management

- Contact management

- Telephony

- Pipeline management

- Email tracking

- Reporting & analytics

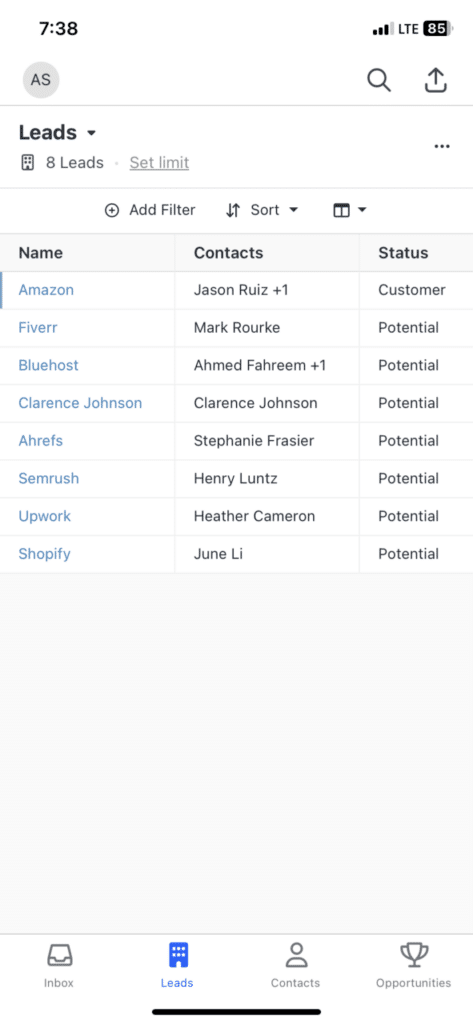

Here’s how Freshworks looks out of the office.

As you can see, the interface is sleek and easy to navigate, ensuring your team can access the tools they need to keep your clients happy and your business thriving.

The takeaway: Freshworks’ mobile app is a must-have for any investment banker looking to stay connected and be productive on the go!

Freshworks Pricing

In terms of pricing, Freshworks offers 3 plans in addition to a free plan.

Here are the plans they offer:

- Free Plan – Free Forever

- Growth – $18/Month

- Pro – $47/Month

- Enterprise – $83/Month

Freshworks Pros and Cons

- Sales, service, and marketing in one place

- Comprehensive telephony features

- User-friendly interface

- Fantastic mobile app

- Stellar reporting capabilities

- Customer support was slow to respond at times

- The free plan is limited

Monday.com: Best for Automation

Monday.com

Learn More Today!-

Tons of Project Management Tools

-

Affordable Pricing & Free Forever Plan

-

Powerful Analytics & Reporting

Why We Picked Monday.com

Monday.com earns its spot on our list because it’s easy to use, powerful, and extremely affordable.

Here are some great features for investment banks:

- Workflow automation

- Lead management

- Reporting & analytics

- Project management

- Mobile app

Monday.com offers everything you need to take your investment banking company to the next level!

Monday.com Features

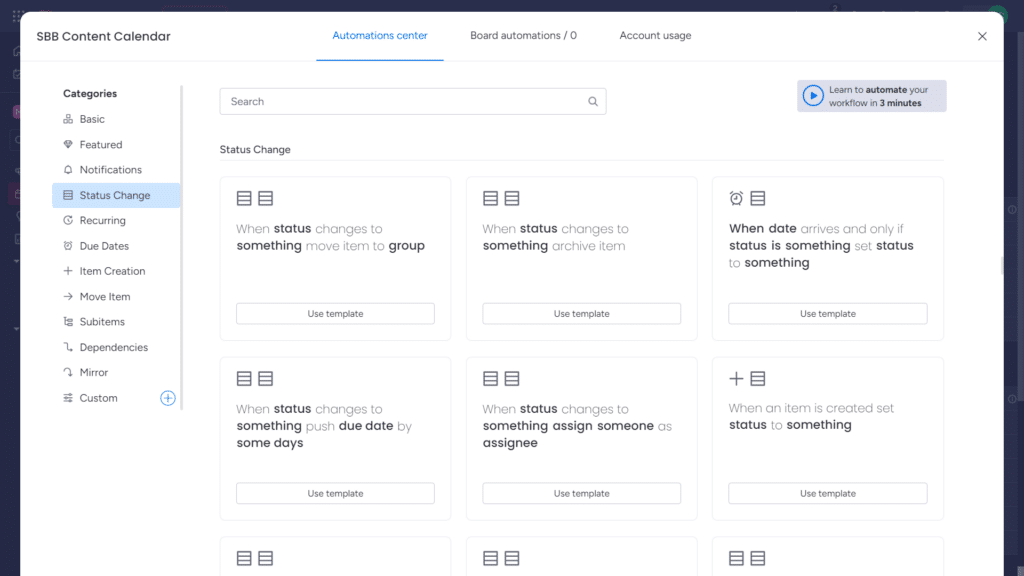

Investment bankers have a lot on their plates, so automating as many tasks as possible is important.

Thankfully, Monday.com offers some of the very best automation creation in the game.

Here are some standout aspects of this feature:

- Premade automation templates

- Fantastic visual editor

- Automation hub (to view all active automations)

- Customizable triggers & actions

With Monday.com, you can create complex automation without breaking a sweat.

Here are some processes you can automate with ease:

- Manual data entry

- Lead nurturing

- Streamlining client interactions

- Deal management

- Project management

The helpful premade templates (shown below) make it easy to create and customize automation in seconds.

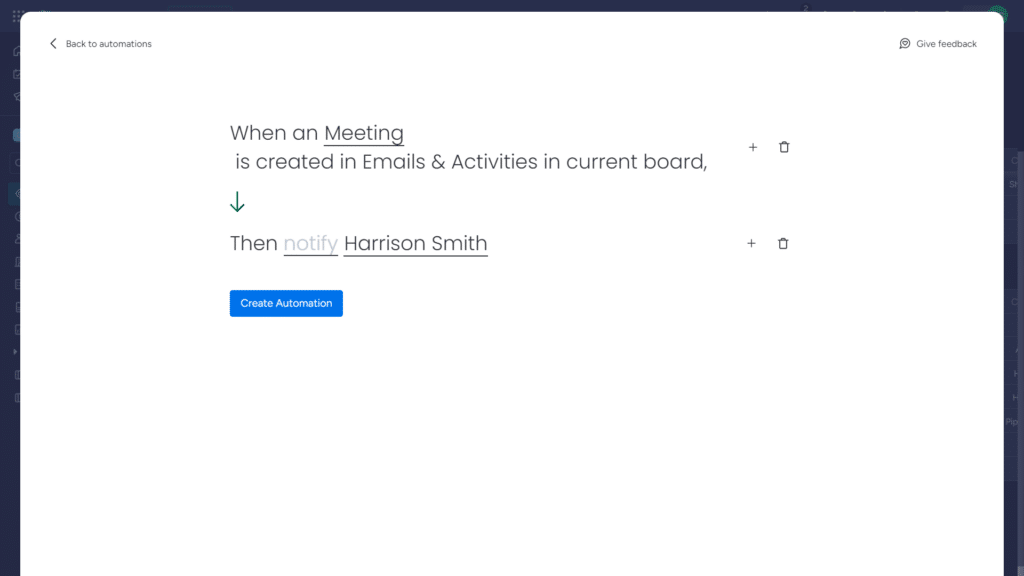

Plus, Monday.com has possibly the most intuitive visual editor in the game.

The “When/Then” interface (shown below) makes it a breeze to set up triggers and actions for your automation.

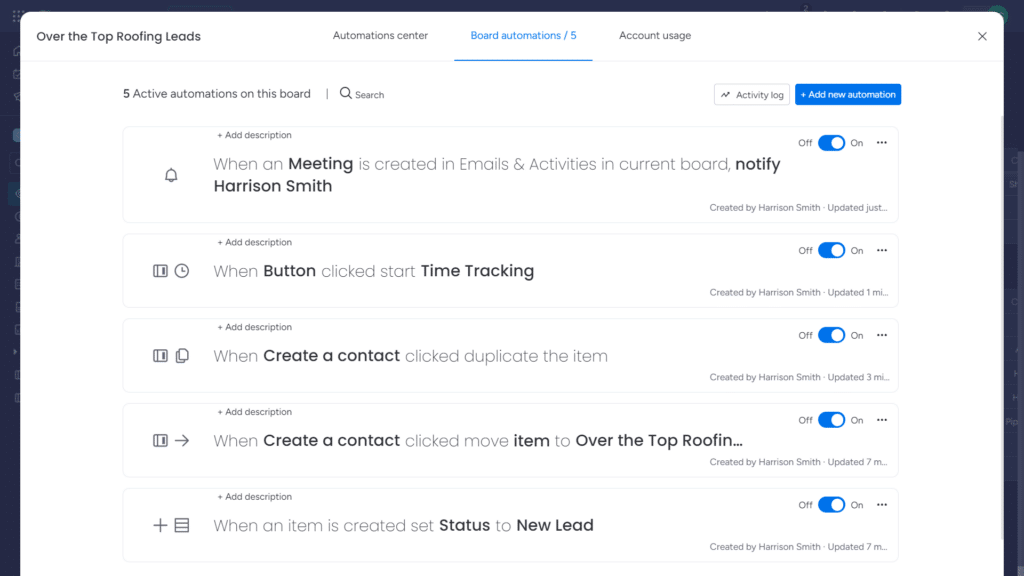

From there, you can easily view your active automations from the hub pictured below.

From this screen, you can quickly toggle each automation off and on and view exactly which sequences are active at a given time.

The skinny: Monday.com makes it incredibly easy to automate repetitive tasks and take your business up a notch!

Effectively managing hot leads is crucial to scaling your investment banking business.

That’s where Monday.com comes in.

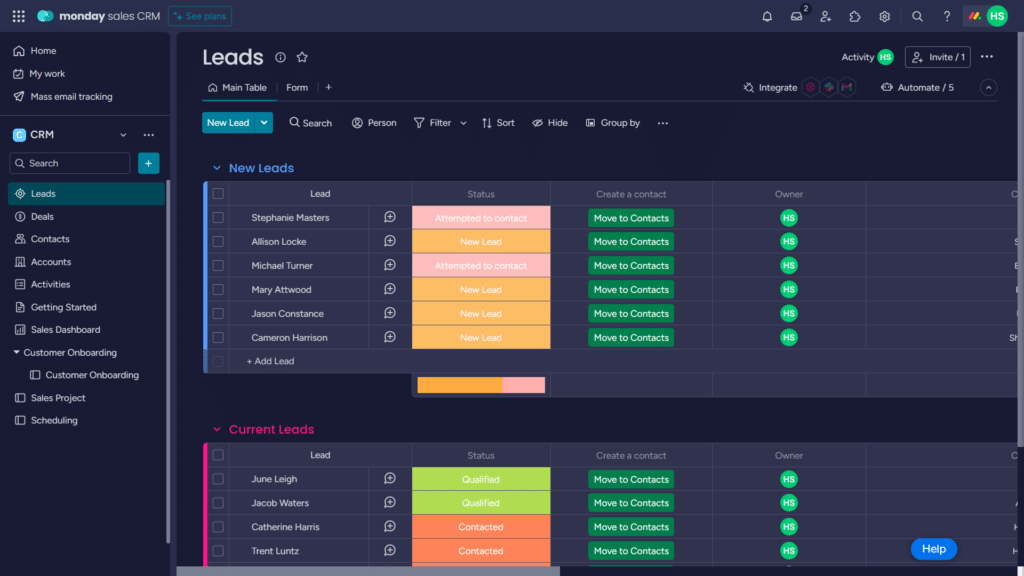

The CRM software makes it easy to add and track your leads in one convenient place with your leads dashboard (shown below).

This fully customizable dashboard gives you a top-down view of your lead management process.

You can edit any information on the fly by clicking the dashboard.

This means no confusing menus or tabs—just streamlined viewing and updating.

With Monday.com’s lead management, you can:

- Add & track leads

- Assign tasks to team members

- Set automatic reminders for follow-ups

- View all communication in one place (emails, calls, meetings)

Monday.com makes it easy to keep track of your leads and ensure they are effectively nurtured into customers.

Plus, with the ability to view all communication in one place, you’ll never lose important client information again.

In the fast-paced world of investment banking, having accurate and up-to-date data is vital for making informed decisions.

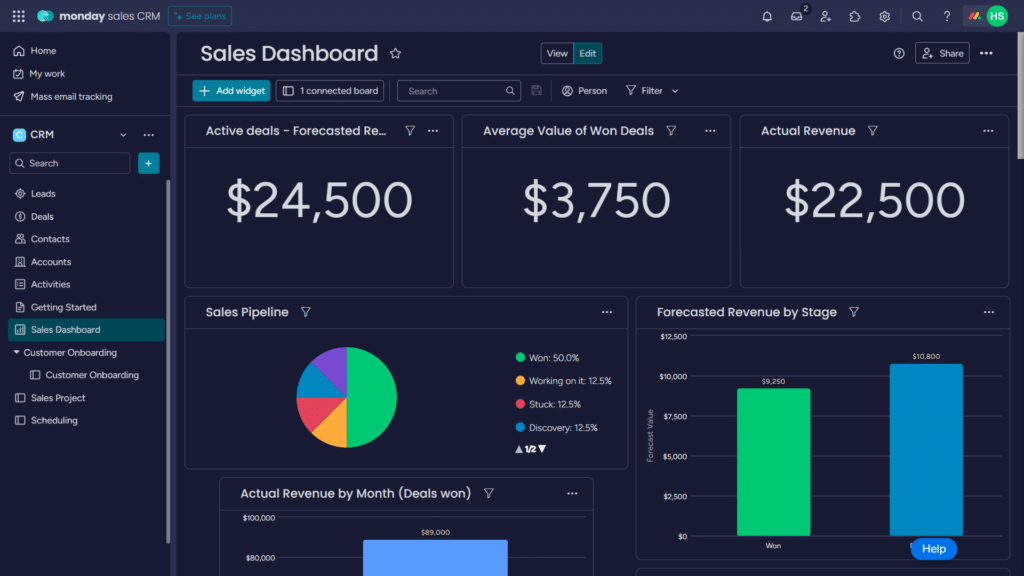

Monday.com offers powerful reporting and analytics tools to help you keep track of your key metrics.

Here’s what you can do with Monday.com’s reporting & analytics:

- Create custom reports and dashboards (with tons of widgets)

- Track key metrics in real-time

- Export data for further analysis

- Set automatic alerts for when certain metrics hit critical levels

With Monday.com, you can easily track and analyze your key performance indicators, giving you the data you need to make informed decisions.

Here’s a look at a customized sales dashboard in action.

The drag-and-drop interface makes it incredibly easy to customize your dashboard and track the metrics that matter most to your investment banking firm.

The lowdown: Monday.com has amazing reporting capabilities to help you analyze your data and make smarter decisions for your investment banking company.

Monday.com Pricing

Monday.com offers four paid plans in addition to a free plan.

These include the following:

- Free – Free Forever

- Basic – $10/Month

- Standard – $12/Month

- Pro – $20/Month

- Enterprise – Custom pricing

Monday.com Pros and Cons

- Intuitive interface

- Affordable, scalable pricing

- Great reporting & analytics

- Kick-a*s automation

- Excellent customer support (with live chat)

- Limited free plan

Zendesk Sell: Best for Enterprises

Zendesk Sell

Learn More Today!-

Deal Automation

-

Powerful Task Management

-

Awesome Mobile App

Why We Picked Zendesk Sell

Zendesk Sell is a powerful sales CRM for growing investment banking firms.

Here are some standout features:

- Lead prospecting

- Pipeline management

- Client management

- Reporting & analytics

- AI-Powered Chatbots

Zendesk Sell is a fantastic choice for sales-focused companies looking to scale from the ground up!

Zendesk Sell CRM Features

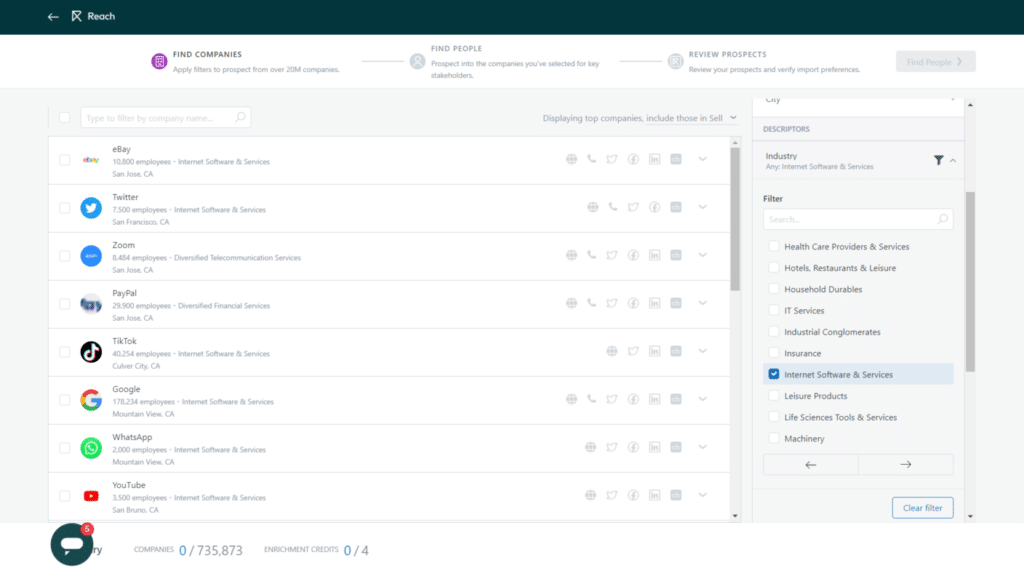

Let’s face it—finding new leads can be a hassle.

With Zendesk Sell, it doesn’t have to be.

The sales CRM software offers a fantastic lead prospecting tool called Reach.

With Reach, you can easily accomplish the following:

- Find thousands of new leads (in seconds)

- Make smarter decisions with AI-driven insights

- Stay compliant with GDPR regulations

- Quickly search for leads (based on industry, company size, and location)

- Automatically enhance lead data with important info

This powerful tool takes the guesswork out of lead generation.

How it works is you get a certain amount of tokens (based on your pricing plan).

With these tokens, you can unlock thousands of new leads and enrich your lead data (without lifting a finger).

Here’s how the feature looks in action.

Trust me when I say your sales team will thank you for investing in a lead prospecting tool like Reach.

The rundown: Zendesk Sell puts just about every other lead prospecting tool to shame with its Reach tool.

It’s perfect for growing investment banking companies looking to corner new markets.

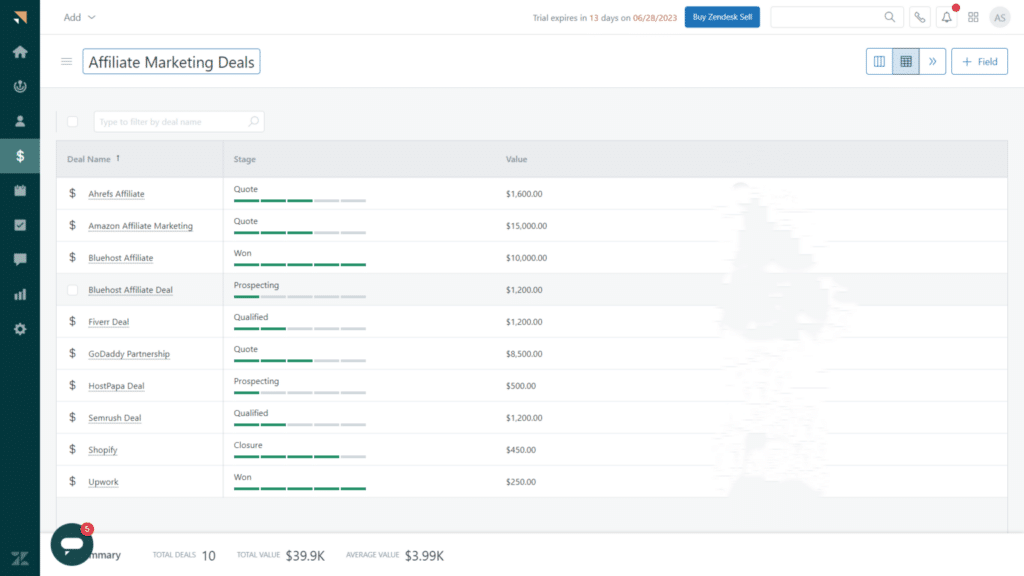

Investment bankers have a lot on their plate.

That’s why it’s crucial to have a robust pipeline management tool at your disposal.

Luckily, Zendesk Sell offers a powerful pipeline management tool that makes keeping track of deals easy.

Here are some features you’re going to love:

- Drag-and-drop functionality

- Customizable deal stages & properties

- Ability to view multiple pipelines (in multiple views)

- Forecasting tools (to help track future revenue)

With this pipeline management tool, you can easily keep track of all your deals in one place.

Here’s a look at this feature in action (with the list view).

This view makes it easy to get a quick overview of all your deals (and where they are in the pipeline).

The nitty gritty: Zendesk Sell makes it easy to manage your deals and forecast future revenue.

It’s perfect for investment banking firms that need a robust yet simple pipeline management tool.

In the competitive landscape of investment banking, connecting with your clients is key.

If you’re not available to answer their questions, someone else will.

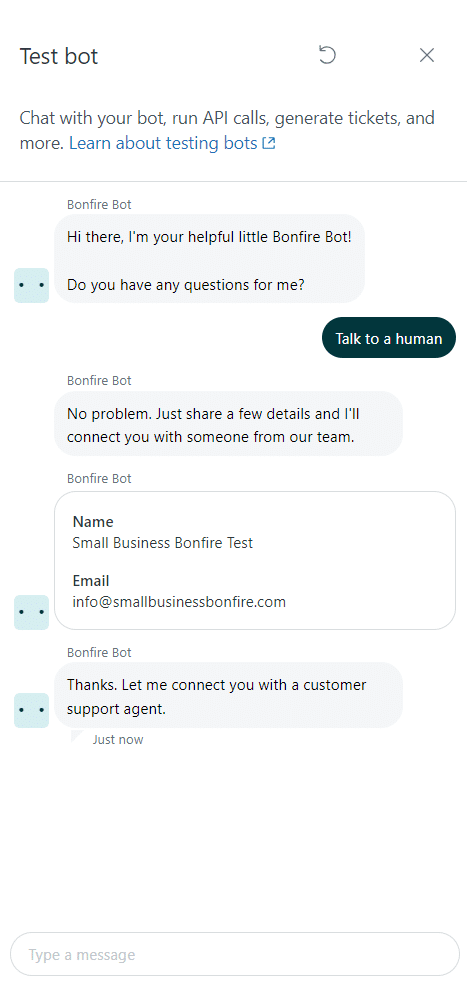

That’s where Zendesk Sell’s AI-powered chatbots come into play.

With these chatbots, you can easily manage and respond to client inquiries (without a second thought).

Here’s how it works:

- Chatbots are trained by your team (to answer commonly asked questions)

- Chatbots can help schedule appointments & process payments

- If the chatbot can’t answer a question, it will escalate to a live agent

- Agents have all the context of previous conversations (so clients don’t have to repeat themselves)

This feature streamlines communication with your clients and saves you time in the long run.

After all, who wants to spend hours responding to emails and phone calls when a chatbot can do it for you?

Here’s an example chatbot (that took a few minutes to create).

Down to business: Zendesk Sell’s AI-powered chatbots make client communication easy and efficient.

It’s a must-have feature for investment banking firms looking to provide instant support to their clients.

Zendesk Sell CRM Pricing

Zendesk Sell offers three pricing plans.

They are the following:

- Team – $25/Month

- Growth – $69/Month

- Professional – $149/Month

There is no free plan; however, Zendesk Sell does offer a 14-day free trial with every plan.

Zendesk Sell CRM Pros and Cons

- Stellar lead prospecting

- Affordable, scalable pricing

- Great mobile app

- Powerful chatbots

- Customizable pipeline management

- No free plan

- Limited advanced marketing features

Close CRM: Best For Ease of Use

Close CRM

Learn More Today!-

Sales Automation Sequences

-

Multichannel Support

-

Powerful Reporting & Analytics

Why We Picked Close CRM

Close CRM is a streamlined CRM system designed to be as user-friendly as possible.

Here are some standout features:

- Lead management

- Pipeline management

- Mobile app

- Client management

- Integrations

Close CRM eliminates all the clutter and confusion that can often come with CRM systems, making it perfect for busy investment bankers.

Close CRM Features

You need a CRM with a fantastic mobile app to keep up with the competition.

Close CRM’s app (available on iOS) has all the features you need to stay connected and make deals on the go.

With Close CRM’s mobile app, you have access to the following features on the move:

- Lead management

- Contact management

- Email & phone capabilities

- Pipeline management

- Reporting & Analytics

Here’s a look at Close CRM via mobile.

The mobile app is essentially like having an entire CRM that fits in your pocket.

Our only complaint with the app is that there isn’t an Android version yet.

This means your team will need iOS to take Close CRM on the go.

Integrating your favorite tools with your CRM can be a fantastic way to save time and simplify your workflow.

Close CRM offers integrations with a ton of popular apps, such as:

- Mailchimp

- DocuSign

- Gmail

- Slack

- Zoom

- Zapier

Here’s how the integrations marketplace looks (to give you a better idea).

Close CRM pairs seamlessly with Zapier to open the door to thousands of additional apps.

This means that if there’s no native integration, there’s still a good chance you can connect via a third-party pairing.

The final verdict: Close CRM offers a few key integrations perfect for investment bankers.

It may not offer the most native integrations on the market, but what it does have is incredibly valuable.

Close CRM’s pipeline management feature is designed to help make your life easier.

With Close CRM, you can expect the following benefits:

- Visualize & track your entire sales process

- Customize stages to fit your workflow

- Assign tasks & set reminders for each stage

- Collaborate with team members in real-time

Here’s a look at how Close CRM’s pipeline management looks.

With simple drag-and-drop functionality, you can easily move leads through the different stages of your sales process.

What sets Close CRM apart in terms of pipeline management is how incredibly user-friendly and customizable it is.

The nitty gritty: Close CRM offers a simple yet powerful pipeline management tool that any investment banker can use to streamline their workflow.

Close CRM Pricing

Close CRM provides three pricing plans.

They are the following:

- Startup – $59/Month

- Professional – $329/Month

- Enterprise – $749/Month

Close CRM Pros and Cons

- Extremely intuitive user interface

- Great client & lead management tools

- Powerful mobile app

- Effective sales automation capabilities

- Impressive integrations

- No free plan

- Limited marketing features

Less Annoying CRM: Best for Simplicity

Less Annoying CRM

Learn More Today!-

All Features Included for $15/Month

-

Customizable Workspace

-

Extremely Intuitive User Interface

Why We Picked Less Annoying CRM

Less Annoying CRM is a no-nonsense CRM system that’s perfect for startups in the investment banking industry.

Here are some noteworthy features:

- Client relationship management

- Reporting & analytics

- Task management

- Pipeline management

- Scheduling calendar

Less Annoying CRM offers all its features for the low price of $15/month.

This means you get everything the platform offers upfront, making it perfect for startups and investment banks on a budget.

Less Annoying CRM Features

Less Annoying CRM’s client relationship management tools are simple (but very effective).

You can quickly create and update client profiles (shown below) with just one click.

Within each card, you can easily view and edit the following info:

- Name

- Email & phone number

- Address

- Birthday

- Notes

- Attachments

- Company name

- Background info

- Website

- Job title

- Custom fields

As you can see, there’s a ton of information available on each card.

Less Annoying CRM does a fantastic job of making it easily digestible and available (with just one click).

The no-frills approach to contact management is perfect for startups who don’t have time to get bogged down with unnecessary features.

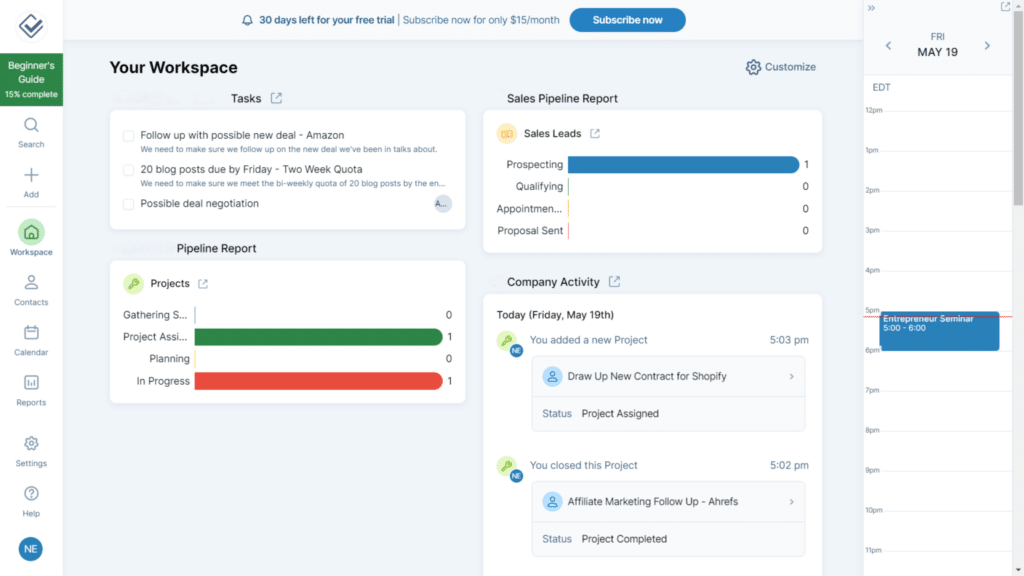

Access to data and analytics is crucial for making informed decisions for investment banking.

After all, without data, you’re just guessing about what’s working and what’s not.

Less Annoying CRM offers valuable insights at a glance with its workspace dashboard (shown below).

This fully customizable dashboard gives you an overview of all the important data for your investment banking business.

Here are some metrics you can track:

- Sales pipeline

- Projects & tasks

- Company activity

- Team performance

- Custom metrics

With this data at your fingertips, you can make informed decisions about your business’s growth and success.

Plus, the drag-and-drop interface makes it easy to customize your dashboard to fit your specific needs.

The brass tacks: Less Annoying CRM makes it easy to track important data and make informed decisions for your investment banking business!

It’s perfect for companies that don’t need all the bells and whistles of a bigger platform (but still want valuable insights).

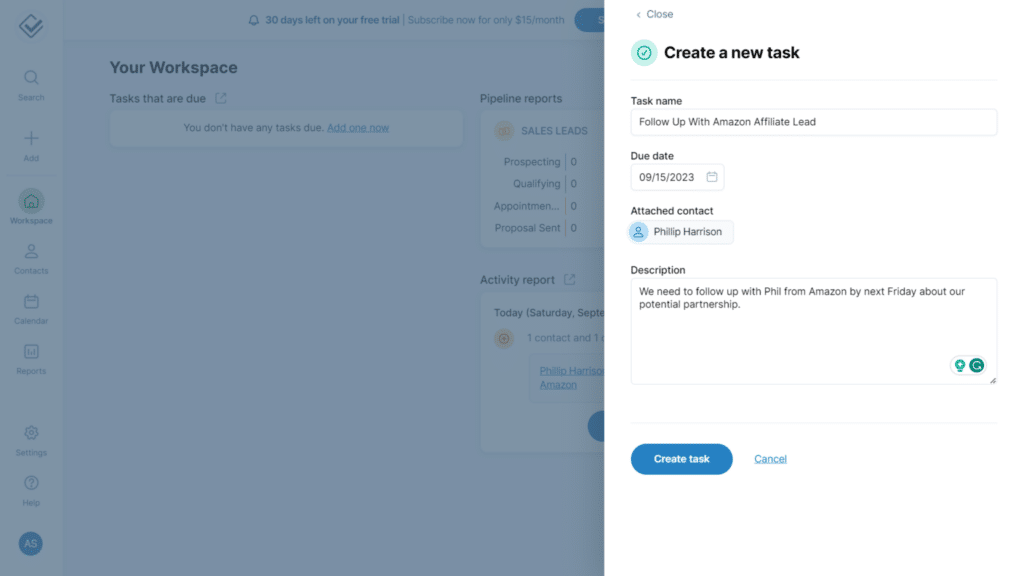

Less Annoying CRM offers a simple but powerful task management system.

With this, you can assign tasks to yourself or team members and track their progress (in real time).

You can easily set due dates and reminders to keep everyone on track.

Here’s how a new task card looks (to give you a better idea).

Each card allows you to edit the following for each task:

- Priority

- Task name

- Due date

- Associated contact

- Description

Less Annoying CRM essentially makes task management, well, less annoying.

The CRM software allows you to focus on the tasks at hand (and not get bogged down in the weeds).

Less Annoying CRM Pricing

Less Annoying CRM keeps it simple by offering only one pricing plan for $15/month.

The plan includes everything the CRM solution has to offer, meaning no additional charges down the line.

Less Annoying CRM Pros and Cons

- Intuitive user interface

- All features offered in one plan

- Great client & task management

- Fantastic reporting & analytics

- Customizable pipeline management

- No mobile app

- No free plan

Vtiger: Best For Client Management

Vtiger

Learn More Today!-

Deal, Task, Project, and Sales Management

-

Great Ticketing Tools (Case Management)

-

Powerful Analytics and Reporting

Why We Picked Vtiger CRM

Vtiger is a comprehensive CRM solution that’s tailor-made for scaling investment banking businesses.

Some impressive features include the following:

- Pipeline management

- Client management

- Reporting & analytics

- Mobile app

- Lead management

Vtiger is a powerful all-in-one solution for financial institutions of any size to take advantage of.

Vtiger CRM Features

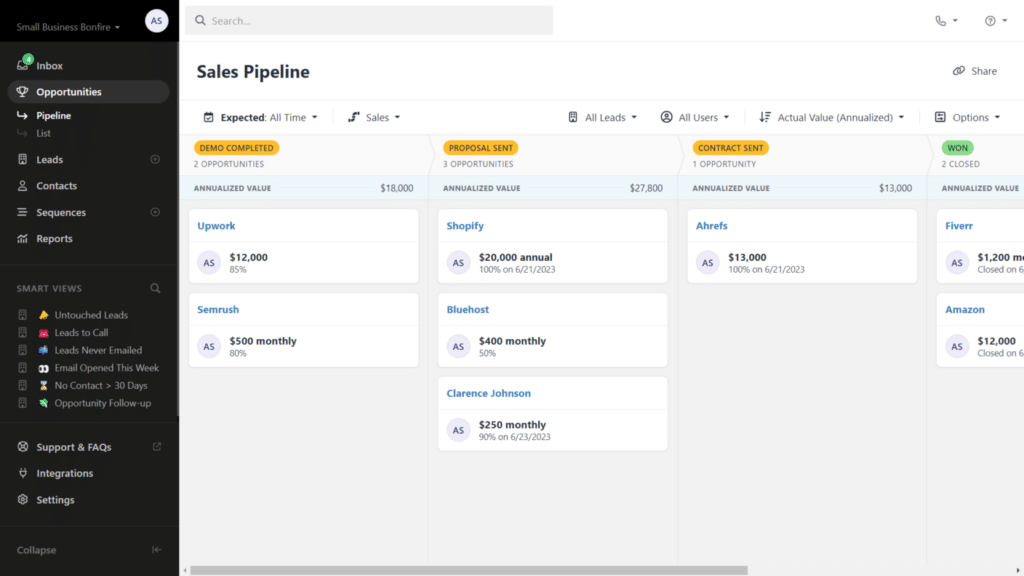

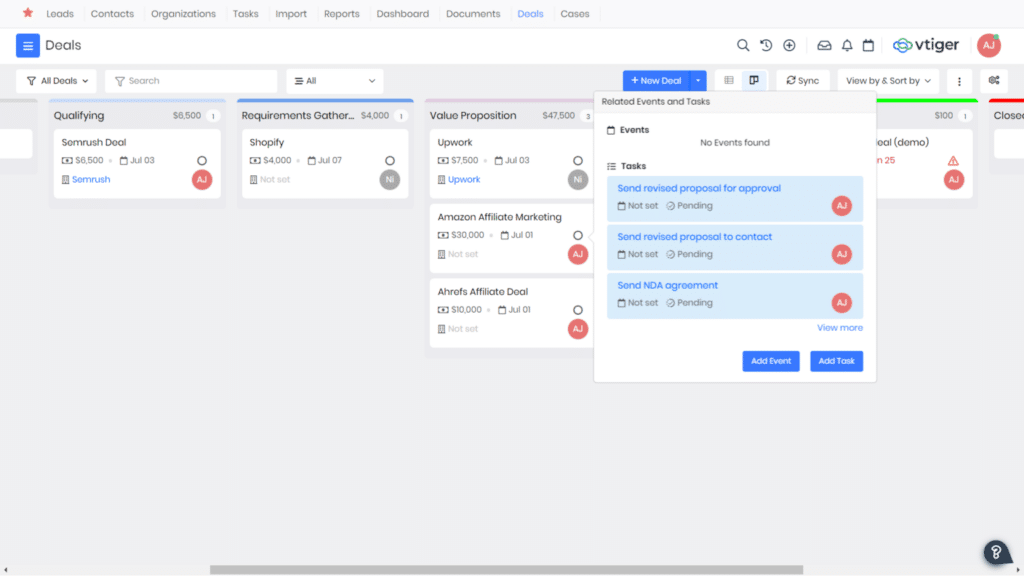

For investment bankers, managing pipelines is an essential part of the job.

Vtiger’s simplified pipeline management makes tracking your leads and deals easy in one centralized location (see below).

With Vtiger’s deal management, you can:

- Customize your pipeline stages

- Track deals & make data-driven decisions

- Assign tasks to team members

- Set automatic reminders for follow-ups

Vtiger’s drag-and-drop interface makes it extremely easy to manage your pipelines, giving you a clear view of each deal lifecycle (at a glance).

You can click each deal card to view all associated tasks, ensuring nothing falls through the cracks.

Our take: Vtiger simplifies pipeline management, which means you can focus on closing deals and growing your investment banking business!

Many great investment banks fail due to outdated (and ineffective) client management methods.

Thankfully, Vtiger has some amazing features to help you keep your clients happy and coming back for more.

In fact, it’s one of the very best client relationship management platforms in the biz.

Here’s why:

- Customizable dashboards to view all client information in one place

- In-depth client data management

- Track interactions & communication history

- Create & manage tasks for each client

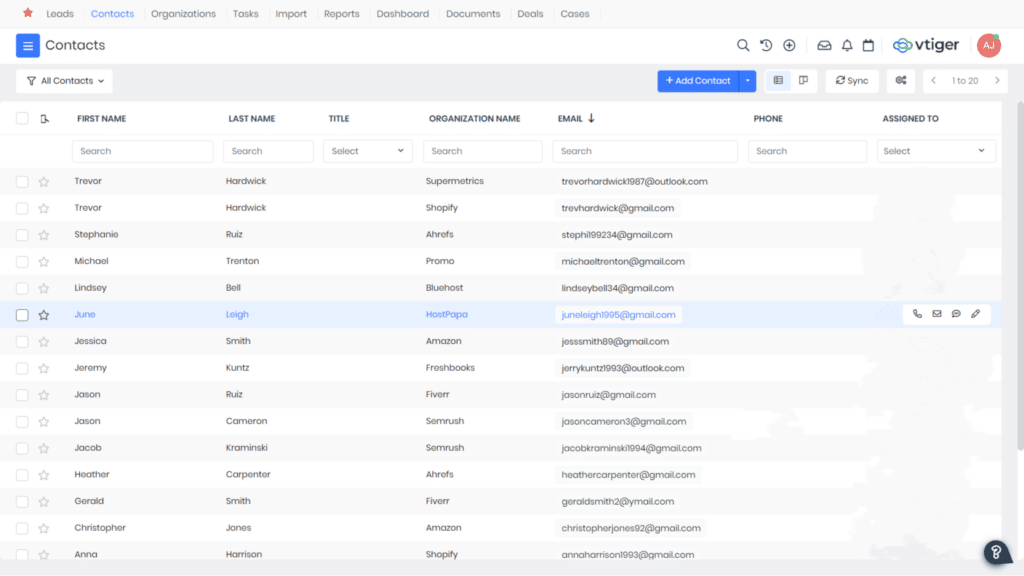

With Vtiger, you can easily view your client’s information in one place with customizable dashboards (shown below).

Vtiger stands out from the pack with its sleek layout and no-nonsense approach to managing client relationships.

You can easily track all client interactions and assign tasks, making it easy to nurture meaningful client relationships as you scale.

I’ve always been a firm believer in learning from data to continuously improve.

Vtiger offers powerful reporting and analytics tools to help you do just that (as you scale).

With Vtiger, you can easily do the following:

- Create custom reports & dashboards

- Track key metrics in real-time

- Export data for further analysis

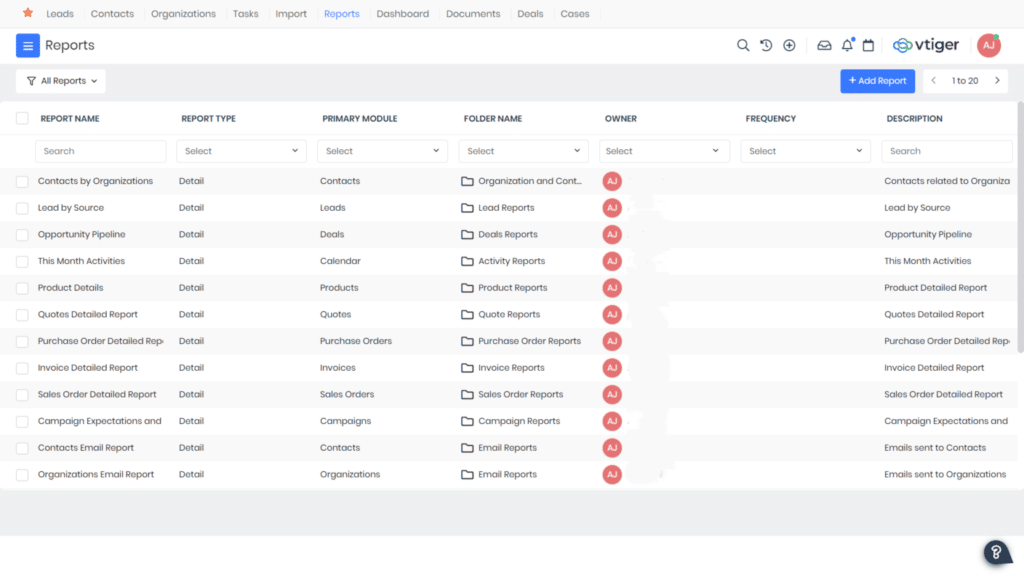

Here’s a look at some of the reports you can create with the banking CRM software.

As you can see, there’s a ton of potential for tracking and analyzing your data to make informed decisions.

The bottom line: Vtiger makes it easy to get a handle on your data and make smarter decisions as you build your investment bank.

Vtiger CRM Pricing

Vtiger provides a free version and two paid plans, each consisting of a “standard” cost and a “single app” cost.

The standard plans grant users access to the complete platform, encompassing the following:

- Sales

- Marketing

- Service

The single app plans offer read/write access to one specific aspect of the platform and read-only access to the remaining features.

The three plans are as follows:

One Pilot

- Free for 10 users

One Professional

- Standard – $42/month

- Single app – $28/month

One Enterprise

- Standard – $58/month

- Single app – $42/month

Vtiger CRM Pros and Cons

- Great free plan

- Powerful client management

- Effective pipeline management

- Impressive reporting & analytics

- Awesome lead management tools

- Advanced features have a bit of a learning curve

- The mobile app is a bit limited

What is an Investment Banking CRM?

An investment banking CRM solution is any platform that can help investment banks streamline growth (and ensure nothing falls through the cracks).

Benefits of Having a CRM for Investment Banking

Here are some standout benefits of investment banking software:

- Better customer relationships

- Improved sales

- Increased efficiency

- Enhanced communication & collaboration

- Better insights

Better Customer Relationships

A CRM can provide fantastic relationship intelligence for your investment banking company.

This will no doubt help you strengthen customer relationships across the board.

Improved Sales

As you streamline your business development with your CRM, you can expect an increase in revenue.

Here are just some ways that an investment banking CRM can help improve sales:

- More accurate forecasting

- Automated follow-up emails

- Lead & client management

- Smarter data analysis

- More deals closed

Increased Efficiency

Investment banking software can help you cut out manual tasks and save time.

Features like workflow automation and pipeline management make it easy to kick back and watch as your processes become more efficient.

Enhanced Communication & Collaboration

When you have a clear view of client communication and team collaboration, it’s easy to ensure everyone is on the same page.

With a CRM, you can keep track of conversations, share notes, and delegate tasks effortlessly.

Better Insights

One of the major benefits of an investment banking CRM is how valuable it can be for data analysis.

With a wealth of customer information at your fingertips, you’ll have no trouble making informed decisions that lead to better business outcomes.

Does an Investment Banker Need a CRM?

An investment banker absolutely needs a CRM to stay on top of their game.

Investment banking CRM software can help you stay organized, automate tasks, and keep track of valuable customer information all in one place.

After testing, we compiled a thorough list of our favorite CRMs for Small Businesses. Check it out now! The list might surprise you.

Investment Banker CRM Top Features

Let’s look at some of the most important features of an investment banker CRM.

Lead management is an essential feature for any investment banker CRM.

With this feature, you can track and manage leads from the initial point of contact to closing the deal.

Project management features are also critical for investment banking CRMs.

This allows teams to collaborate on deals, set reminders, and assign tasks for a more efficient workflow.

A mobile app is a must-have for CRM systems.

Accessing and updating important client information on the go is crucial for busy investment bankers.

Look for mobile computing solutions with features such as:

- Offline access

- Contact management

- Task assignment & tracking

- Pipeline management

- Lead management

- Reporting & analytics

Investment banking is all about numbers, so it’s crucial to have a CRM that offers robust reporting and analytics features.

This will help you make data-driven decisions and track important metrics for your business.

Lead prospecting is another key feature to look for in an investment banking CRM.

This allows you to search for potential clients based on specific criteria, making it easier to target and convert new business.

Integrations with other tools can be incredibly valuable for CRM systems.

Having the ability to connect with other apps you use daily can help streamline your processes and save time.

As mentioned earlier, pipeline management is a crucial feature of investment banking CRMs.

Tracking and managing leads at every stage of the sales process can greatly improve efficiency and increase revenue.

How to Choose an Investment Banking CRM

Let’s look at some steps to help narrow down your search.

These include the following:

- Outline specific CRM goals

- Choose an investment banker CRM

- Test drive the CRM in the field

- Finalize & implement your new CRM

Step 1: Outline Specific CRM Goals

Before you start searching for an investment banking CRM, it’s important to have a clear idea of what you want to achieve with it.

Here are some questions you can ask yourself to help define your goals:

- What are the pain points in my current workflow?

- What features do I need from a CRM to address these pain points?

- What metrics and data do I want to track and analyze?

Once you have a clear understanding of your CRM goals, you can narrow down your search.

Step 2: Choose an Investment Banker CRM

There are many investment banking CRM systems on the market, so it’s essential to do your research and choose one that aligns with your specific goals.

Lucky for you, we did the lion’s share of the work by compiling this list.

That means each platform is guaranteed to help your investment banking business succeed.

Step 3: Test Drive the CRM in the Field

Once you have a shortlist of potential CRM systems, it’s a good idea to test them out in the field.

Many CRM providers offer free trials or demos that allow you to explore the platform and see how it fits into your workflow.

Be sure to involve your team in the testing process, as they’ll be using the platform day in and day out.

Step 4: Finalize & Implement Your New CRM

After testing out different CRMs, it’s time to make a decision and implement your chosen CRM into your investment banking business.

Make sure to train your team on how to use the new system effectively and set up any necessary integrations.

How Much Should an Investment Banking CRM Cost?

A good investment banking CRM should cost anywhere from completely free to about $50/month.

Certain platforms (such as HubSpot) can cost up to $5,000, but that’s definitely the exception to the rule.

Final Thoughts on CRM for Investment Banking

You made it through, and now you’re armed with the knowledge you need to lock down a CRM.

Remember to choose a CRM with all the features you need to scale with ease!

Each of these hand-picked platforms offers a free plan (or trial) to take advantage of, so get out there and get to testing!

Newsletter Signup

Join The Leads Field Guide Newsletter for tips, strategies and (free) resources for growing your leads, and closing more deals.