Venture capitalists deal with risk on a daily basis. That’s why having the right customer relationship management (CRM) solution is critical.

Without a CRM, you could easily lose valuable relationships, limited resources, and, worst of all—money.

I’m AJ—here to help. I’ve spent the last decade building my business to a successful multiple seven-figure exit.

Now, I aim to help fellow entrepreneurs achieve financial freedom (in a fraction of the time it took me).

So let’s get into the nitty-gritty of my list of the best venture capital CRM software—guaranteed to take your investment management to the next level!

Stick around till the end, where I share some crucial tips to help you pick a CRM solution!

After years of SBB testing, here is our list of the best venture capital CRMs:

- Best Venture Capital CRM For Integrations: HubSpot

- Best Venture Capital CRM For Mobile: Capsule CRM

- Best Venture Capital CRM For Client Management: Vtiger

- Best Venture Capital CRM For Automation: Monday.com

- Best Venture Capital CRM For Lead Management: Zoho CRM

How Did We Test The Best CRM For Venture Capital Firms?

My team and I went in-depth (over six months) into each CRM platform on this carefully curated list.

Here’s what we looked at:

- Scalability

- Ease of Use

- Feature Assessment

- Customer Support

- Hands-On Experience

- Third-Party Reviews

How We Objectively Test Each Platform:

AJ's got a knack for kick-starting businesses, putting them on autopilot, and setting them up for acquisition. Over the past decade, he's been right in the thick of things with hundreds of small businesses, helping them with just about everything under the business sun. If you need advice on software suites and choices? AJ's your guy.

We roll up our sleeves and dive into the top CRM features we think are pretty crucial for small businesses. Stuff like reports and analytics, options to customize your pipelines, and the ability to link up with other apps and services. We know what makes small businesses tick, so we know what features they need to get the job done.

Money matters, folks! When it comes to picking a CRM system, price is usually the deal-breaker. We give a big thumbs up if a provider charges $30 or less per user each month for their starter plan. Extra brownie points for throwing in a freebie plan or trial, options to scale up or down as needed, and the freedom to pay monthly or yearly. We're looking for flexability for small businesses.

We all know support is mega important when you're choosing a CRM platform. This is especially true for those smaller businesses or sales teams who can't afford to have tech wizards on their payroll. We put our detective hats on to see if these companies offer round-the-clock support, and we looked at the different ways you can get help. We're talking live chat (like, real-time convo), email tickets, a good old-fashioned phone call, and self-service tools (for the DIY-ers out there).

When you're in the business of picking a CRM, integrations are like the secret sauce that takes your burger from 'meh' to 'mind-blowing'. Imagine, all your favorite apps and tools, working together in perfect harmony, making your workflow smoother than a fresh tub of Nutella. When we review a CRM, we look at the integrations most SMB owners are looking for.

When you're reviewing a Customer Relationship Management (CRM) system, it's essential to pay close attention to its ease of use. After all, a CRM is as beneficial as its usability. A simple, intuitive interface saves you and your team a great deal of time and headache. When we're reviewing each CRM, this is a crucial aspect that we look for.

The importance of Mobile CRM cannot be overstated in today's digital age. It's essential for fostering strong customer relationships and managing business activities. Mobile access to CRM makes it possible for sales teams to update and access customer information in real time, improving efficiency and ensuring up-to-date data. Mobile CRM can have a massive impact on SMBs, so thoroughly testing it is essential for each one of our reviews.

HubSpot CRM: Best for Integrations

HubSpot

Learn More Today!-

Tons of Free Tools From Each Hub

-

Live Chat Capabilities

-

Robust Integrations

Why We Picked HubSpot CRM

HubSpot is an incredibly powerful CRM solution for venture capital professionals.

Here are some standout features:

- Tons of native (and third-party) integrations

- Client management

- Pipeline management

- Mobile app

- Workflow automation

HubSpot is easy to use, extremely robust, and the cherry on top—it’s completely free.

If you’re looking to manage every aspect of your venture capital operations like a boss, look no further than HubSpot.

HubSpot CRM Features

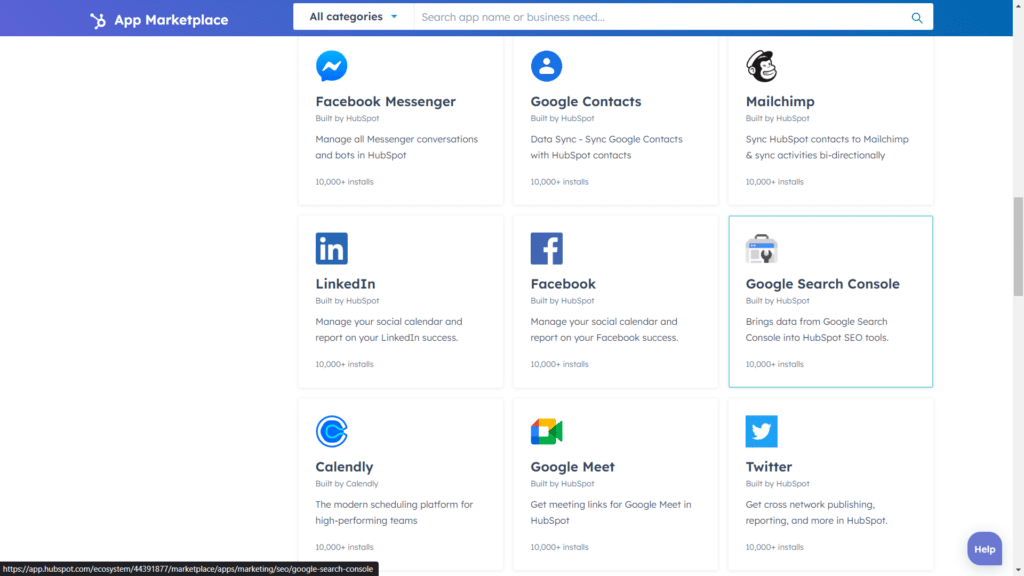

Venture capital professionals need a CRM system that integrates with many other tools (to easily manage investment operations).

That’s where HubSpot comes in.

The CRM powerhouse offers over 500 native integrations with its easy-to-navigate App Marketplace (shown below).

Some standout integrations for venture capitalists include the following:

- QuickBooks

- DocuSign

- Slack

- Evernote

- Google Meet

- Zapier

HubSpot pairs seamlessly with Zapier, unlocking over 6,000 additional third-party integrations.

This means that if you need a particular integration, HubSpot’s got you covered.

The bottom line: When it comes to integrating your favorite software with your CRM, it’s safe to say that HubSpot reigns supreme.

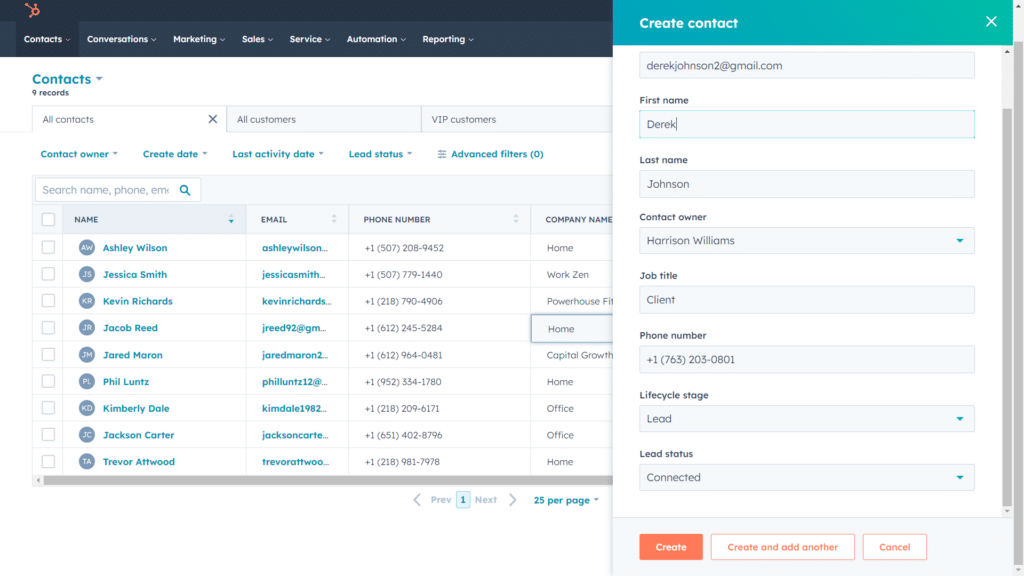

The ability to effectively manage relationships as you grow your venture capital firm is vital.

HubSpot’s client management tools make it super simple to centralize your entire client base (without breaking a sweat).

You can easily create, view, and manage individual records for each contact—making it easy to stay on top of everything.

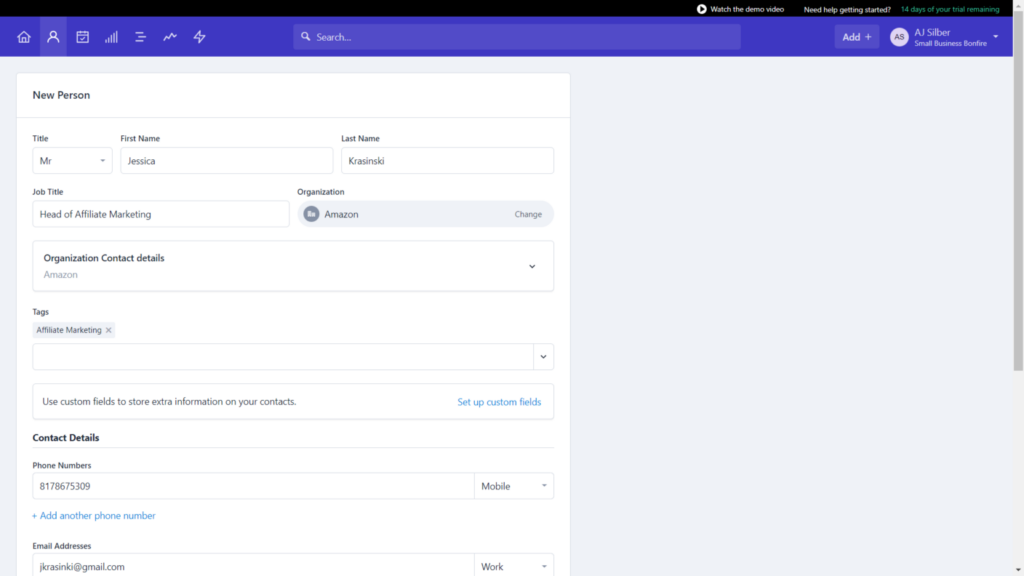

Here’s a look at a new contact card with HubSpot.

As you can see, everything is laid out in an organized, easy-to-understand format.

You can easily see any interactions with each contact and their entire customer journey.

This makes it easy to pick up where you left off in any conversation and stay on top of your client’s needs.

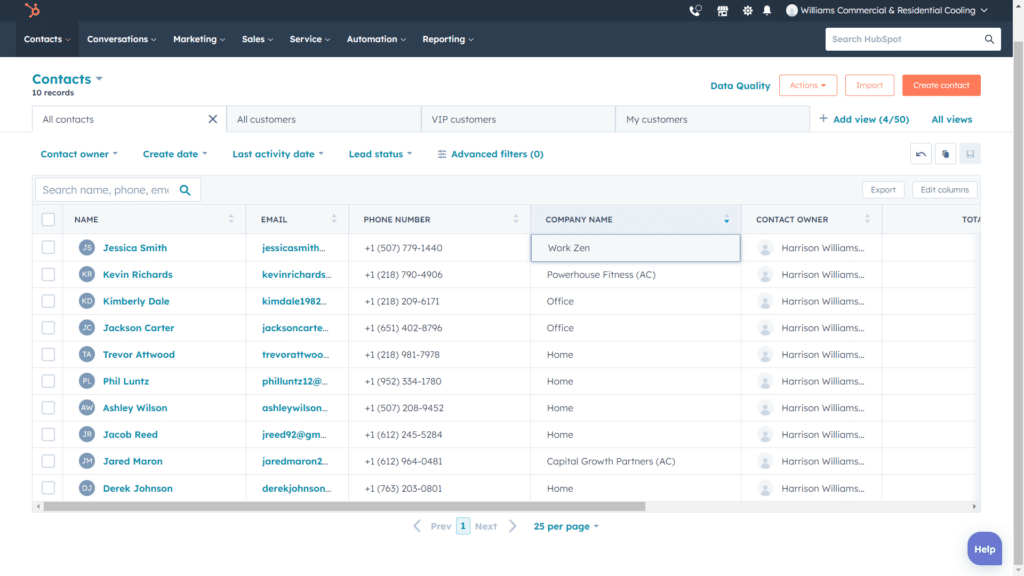

Once you’ve added all your client data, you can get a bird’s eye view of your data with HubSpot’s client dashboard (shown below).

This dashboard is fully customizable, allowing you to add any metrics or information that are important to your venture capital operations.

The need to know: HubSpot makes it easy for venture capital firms to take charge of their contact management.

It’s comprehensive, easy to use, and best of all—100% free to use.

If you’re serious about scaling your venture capital efforts, you’ll need some powerful workflow automation.

Luckily, HubSpot offers some of the best in the biz.

With HubSpot, you can easily automate the following:

- Creating & assigning venture capital deals

- Automating data entry

- Streamlining deal flow

- Managing follow-up tasks

- Generating reports

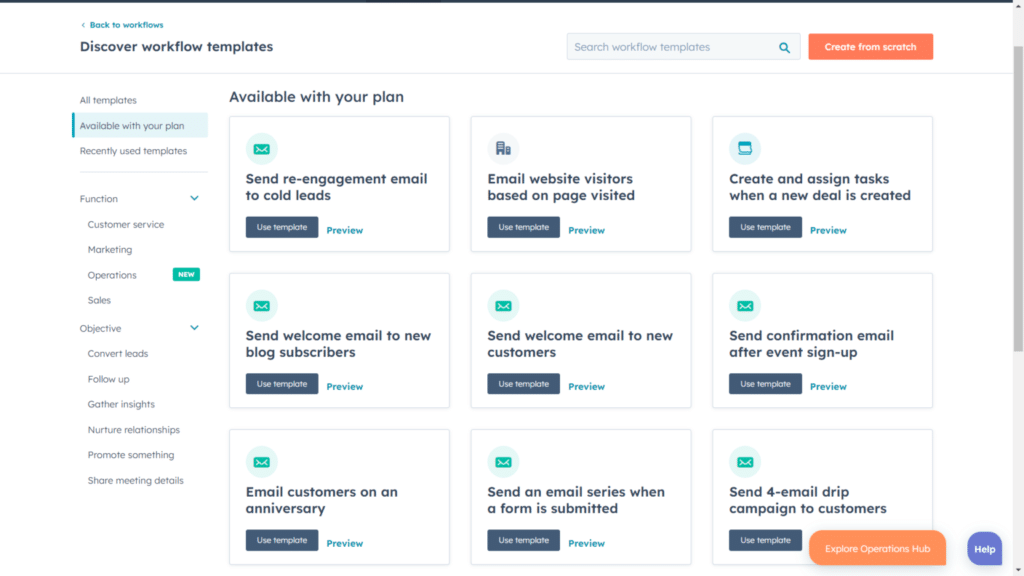

HubSpot provides fantastic beginner-friendly automation templates (shown below) that make it easy to hit the ground running with powerful automation.

These templates essentially take the guesswork out of setting up automation for your venture capital firm (no coding knowledge needed).

HubSpot’s visual automation editor (shown below) is intuitive and powerful, allowing you to set up complex custom workflows easily.

With just a few clicks, you can set up actions to streamline just about every aspect of your venture capital business.

The nitty-gritty: HubSpot offers impressive automation creation that’s beginner-friendly and packs a punch.

If you’re serious about scaling, you’re going to want HubSpot’s automation creation capabilities.

HubSpot CRM Pricing

HubSpot CRM offers a free plan in addition to three paid plans:

- Free Plan – Free Forever

- Starter CRM Suite – $30/Month

- Professional CRM Suite – $1,335/Month

- Enterprise CRM Suite – $5,000/Month

Check out our in depth HubSpot pricing guide!

HubSpot CRM Pros and Cons

- Powerful client management

- Robust integrations

- Stellar customer support

- Great automation creation

- Intuitive interface

- CMS Hub lacks customization

- Advanced plans are expensive

Capsule CRM: Best For Mobile

Capsule

Learn More Today!-

AI Content Assistant

-

Project Management Tools

-

Customizable Sales Pipelines

Why We Picked Capsule CRM

Capsule is a simple yet effective CRM solution for venture capitalists to take advantage of.

Here are some of our favorite features:

- Mobile app

- Workflow automation

- Client management

- Deal flow management

- AI content assistant

Capsule is a lean, mean CRM machine that’s tailor-made for growing venture capital teams.

Capsule CRM Features

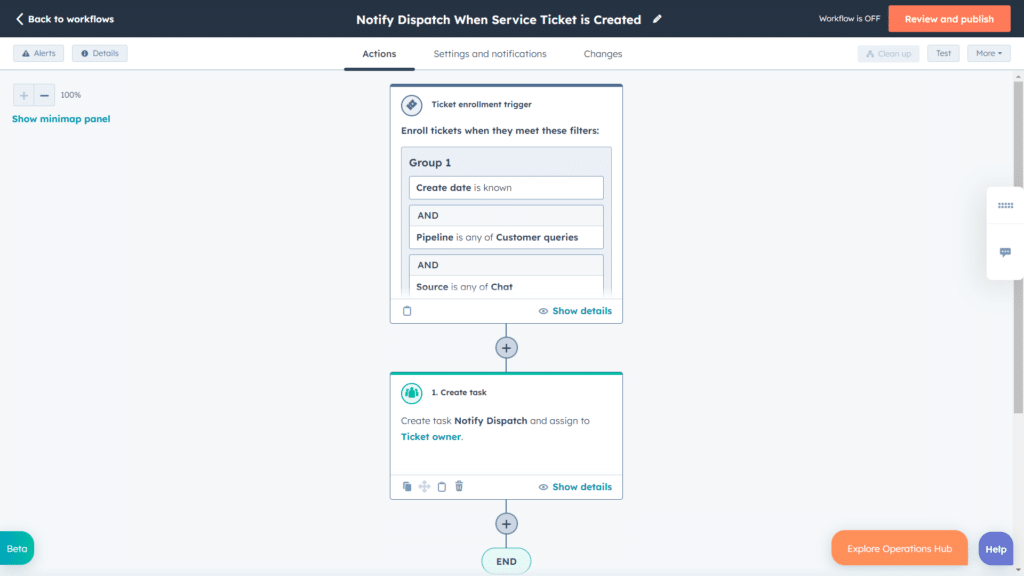

Having a mobile app for your CRM is crucial in today’s fast-paced business environment.

It provides both convenience and flexibility, allowing you to manage your venture capital firm’s operations from anywhere (at any time).

Luckily, Capsule CRM offers one of the best mobile experiences on the market (on iOS and Android).

Let’s break down why:

- It’s extremely user-friendly: Capsule’s mobile app is designed with an intuitive and user-friendly interface that makes it easy for anyone to use.

- Easy access to all CRM features: You can access Capsule’s features (such as contact management, task management, and reporting) from the mobile app.

- Perfect for on-the-go productivity: With Capsule CRM’s mobile app, you can easily manage your venture capital firm’s operations while on the go.

Here’s a look at this feature in action.

Capsule CRM is perfect for no-nonsense teams that frequently work on the move.

The lowdown: Capsule makes it easy to get work done out of the office with its impressive mobile offering.

If you’re struggling to find a CRM that caters to your team’s mobile needs, you can’t go wrong with Capsule CRM.

With powerful workflow automation, you can kick back and relax as you let Capsule CRM do the heavy lifting for you.

Here are some tasks you can easily automate with Capsule CRM:

- Manual data entry

- Task assignment & follow-up

- Email marketing campaigns

- Deal flow management

- Calendar reminders

- Notifications for important events

Here’s a look at Capsule’s automation creation process (about halfway through).

The interface could use a fresh coat of paint, but Capsule’s automation capabilities are nothing to scoff at.

The creation process takes just a few minutes (and ends up saving countless hours in the long run).

Our take: Capsule CRM provides a bare-bones (and, admittedly, outdated) approach to workflow automation.

It’s great for venture capital firms that don’t need all the bells and whistles of a more comprehensive platform.

Without any clients, you’re just a person with money (and no way to invest it).

This is where Capsule CRM shines, offering powerful client management features that help you keep track of all your valuable relationships.

Adding a new client is as easy as one click (and filling out a few fields).

Here’s how a new client card looks (to give you a better idea).

Within each card, you can easily add and edit the following info:

- Name

- Job title

- Tags

- Phone & email

- Attachments

- Notes

- Custom fields

Capsule CRM makes creating custom fields for each contact card easy, allowing you to tailor your client management to fit your unique business needs.

The bottom line: Capsule CRM’s client management features are a great asset for venture capital firms looking to keep track of their valuable relationships.

With easy customization and intuitive organization, Capsule makes managing clients a breeze.

Capsule CRM Pricing

Capsule CRM offers four pricing plans.

They are the following:

- Starter – $21/Month

- Growth – $38/Month

- Advanced – $60/Month

- Ultimate – $75/Month

Capsule CRM Pros and Cons

- Fantastic mobile app

- Affordable pricing plans

- Awesome client management

- Effective project management

- Powerful workflow automation

- The user interface is a bit outdated

- Limited advanced marketing features

Vtiger: Best For Client Management

Vtiger

Learn More Today!-

Deal, Task, Project, & Sales Management

-

Great Ticketing Tools

-

Powerful Analytics & Reporting

Why We Picked Vtiger

Vtiger is a powerful CRM solution that offers a ton of utility for venture capital firms.

Here are some of our favorite features:

- Client management

- Reporting & analytics

- Pipeline management

- Scheduling calendar

- Integrations

Vtiger allows you to manage service, sales, and marketing in one convenient package (perfect for venture capitalists)!

Vtiger Features

Vtiger leads the pack when it comes to contact management.

The customer relationship management platform is perfect for keeping track of your clients and streamlining communication (as your business grows).

With Vtiger, you can easily accomplish the following:

- Create & manage contacts

- Track customer interactions

- Manage associated deals & opportunities

- Create custom fields

- Fully customize your dashboard

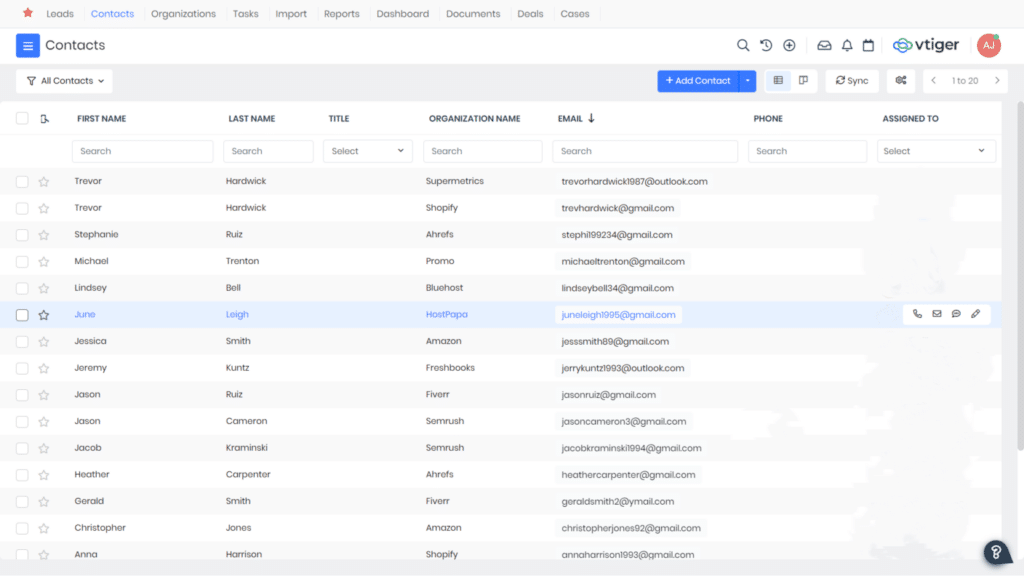

What sets Vtiger apart from the competition regarding client management is how streamlined and organized the process is.

Vtiger’s contact management dashboard (shown below) is easy to navigate and visually appealing (making it perfect for beginners).

You can easily customize every aspect of the dashboard to fit the needs of your venture capital firm.

The final word: Vtiger offers a top-tier client management system that’s perfect for venture capital firms of all sizes.

It’s easy to use, visually appealing, and offers a ton of customization options to fit your specific needs.

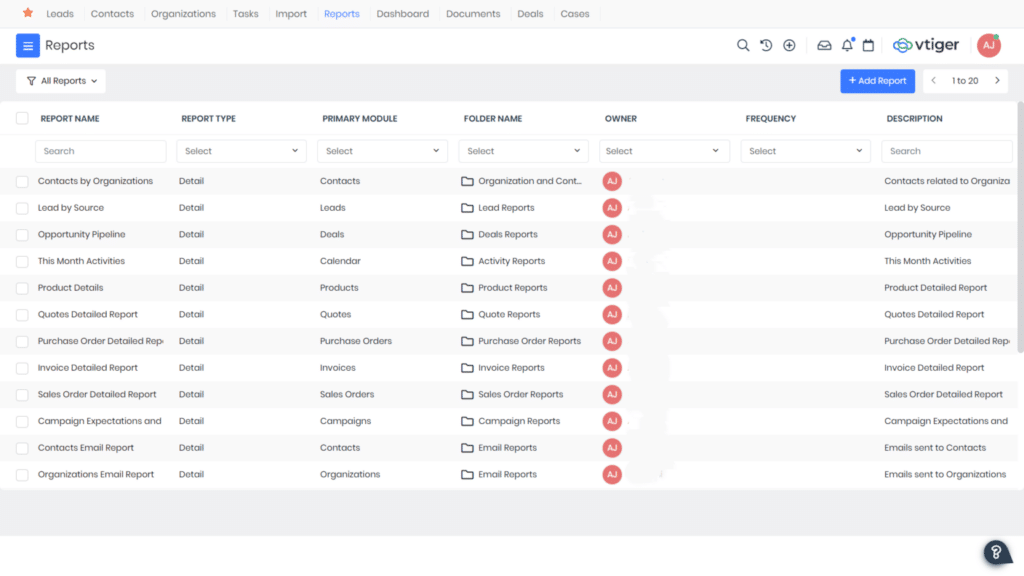

Making data-driven decisions is crucial to growing any venture capital business.

After all, you can’t improve what you can’t measure.

With Vtiger’s robust reporting and analytics features, you can easily track your firm’s performance and identify areas for growth.

Here are some metrics you can easily track with Vtiger:

- Revenue

- Top performing clients

- Sales pipeline progress

- Service tickets & response times

- ROI on investments

The reporting and analytics dashboard in Vtiger is fully customizable, making it easy to create reports tailored to your specific needs.

Here are just a few (of the many) custom reports you can create with the all-in-one CRM solution.

The final verdict: Vtiger offers powerful reporting and analytics features that make tracking your venture capital firm’s success easy.

With Vtiger, you can easily track and measure every aspect of your business (from client interactions to ROI on investments).

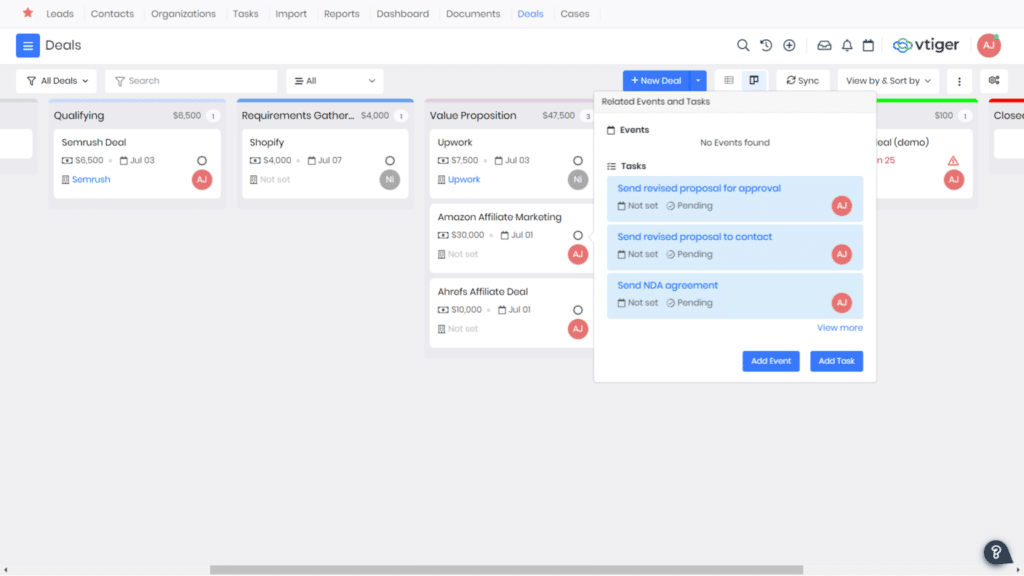

Deal flow management is an essential aspect of any venture capital firm.

That’s why Vtiger offers a comprehensive pipeline management system to help you stay on top of all your investment opportunities.

Here are some features included in Vtiger’s deal pipeline management:

- Automated workflows

- Customizable stages & fields

- Drag-and-drop interface

- Deal scoring

- Integration with email & calendar

Vtiger’s deal pipeline (shown below) is easy to navigate and customize to fit your specific needs.

You can easily keep track of deals at each stage, assign tasks, and monitor progress (all from one centralized hub).

The brass tacks: Vtiger provides an effective and streamlined deal management system that makes tracking and managing your investment opportunities easy.

Its customizable features and integrations make it a top choice for venture capital firms looking to streamline their operations.

Vtiger Pricing

Vtiger’s pricing can seem a little confusing at first glance.

They offer a free plan and two paid plans, but each of the paid plans contains a “standard” cost and a “single app” cost.

Standard plans give access to the full platform, including sales, marketing, and service.

Single app plans give read/write access to one aspect of the platform and read-only access to the rest.

Here’s a breakdown of the plans:

One Pilot

- Free forever plan

- 10 users

One Professional

- Standard – $42/month (per user)

- Single app – $28/month (per user)

One Enterprise

- Standard – $58/month (per user)

- Single app – $42/month (per user)

Vtiger Pros and Cons

- Great integrations

- Powerful pipeline management

- Awesome client management

- Fantastic reporting & integrations

- The mobile app is a bit lacking

- Advanced features have a bit of a learning curve

Monday.com: Best For Automation

Monday.com

Learn More Today!-

Tons of Project Management Tools

-

Affordable Pricing & Free Forever Plan

-

Powerful Analytics & Reporting

Why We Picked Monday.com

Monday.com earns its spot on our list of the best venture capital CRM platforms for several reasons.

For starters, it’s chock-full of powerful features.

Here are a few standouts:

- Workflow automation

- Lead management

- Project management

- Client management

- Reporting & analytics

Monday.com is a fantastic all-in-one solution for venture capital firms looking to streamline their operations across the board.

It’s extremely affordable, feature-rich, and easy to use—what’s not to love?

Monday.com Features

If you’re looking to scale your venture capital firm (without cutting corners), you’ll need some impressive workflow automation.

Thankfully, Monday.com knocks it out of the park regarding automation.

Here are some standout aspects of this feature:

- Premade automation templates

- Unique visual editor

- Automation hub (to easily view all active automations)

- Fantastic user interface

Monday.com makes it easy to automate your entire venture capital operation (from the ground up).

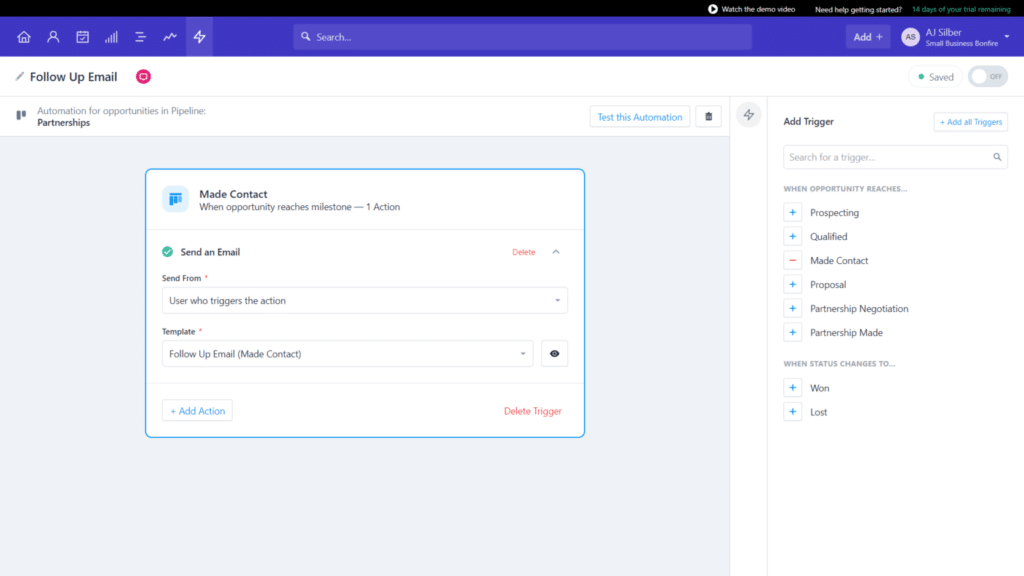

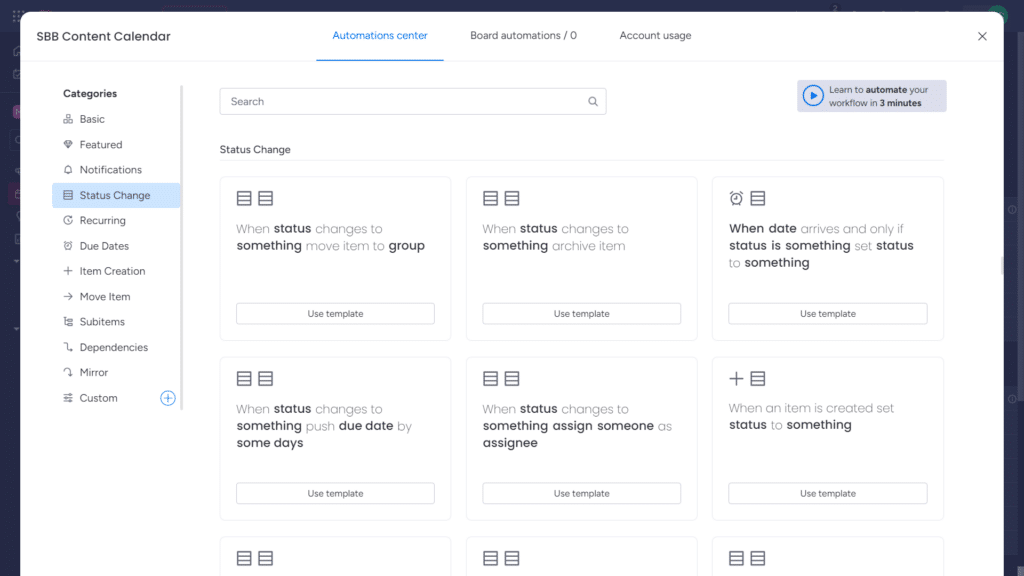

The CRM solution offers fantastic premade automation templates (shown below) to get started with.

These templates eliminate any barrier to entry for beginners looking to create powerful automation right out of the gate.

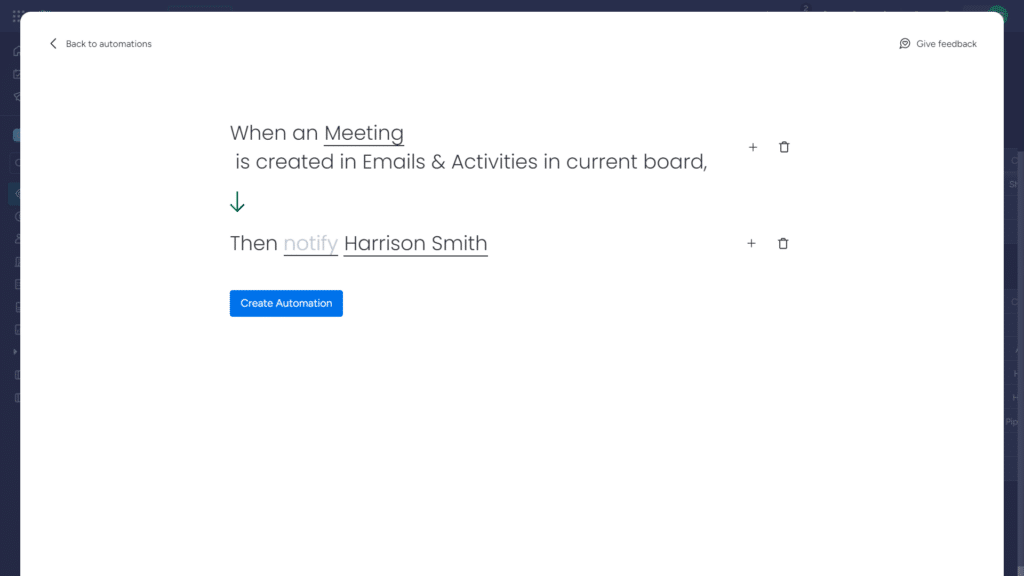

Monday.com offers a fantastic visual editor with a streamlined “When/Then” creation process.

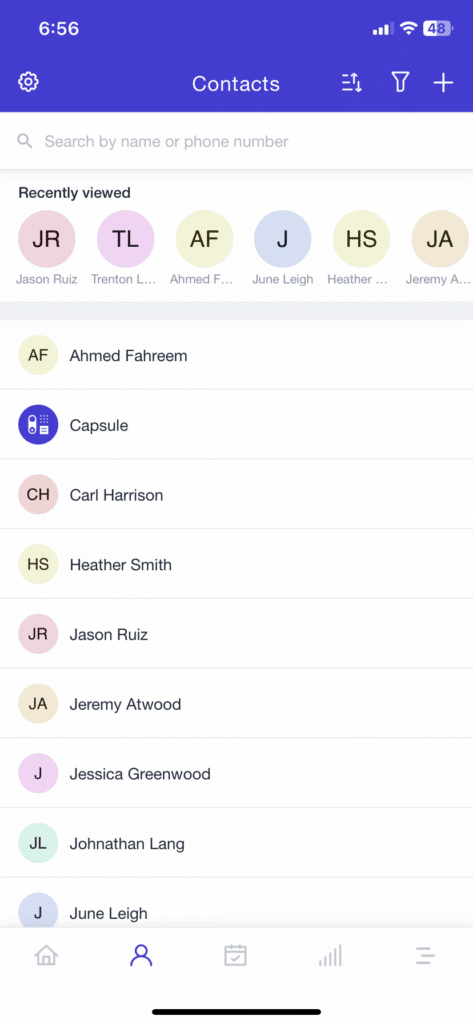

Here’s how it looks in action.

This means you can create incredibly complex automation in just a few clicks (without navigating confusing menus or coding).

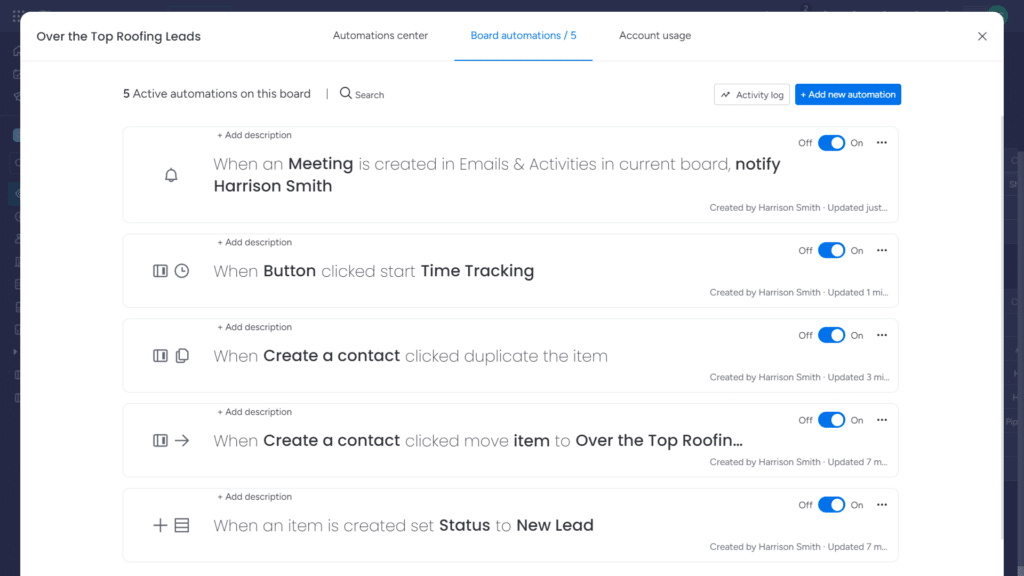

Once everything is set up, you can view each automation from Monday.com’s convenient hub (pictured below).

From this screen, you can get a clear picture of every active automation (on each of your boards).

You can quickly toggle each automation off and on, making it easy to stay in control of your entire workflow.

The breakdown: Monday.com offers top-tier automation creation with impressive beginner-friendly features.

It’s easy to get started, affordable, and jam-packed with features that make it the ideal choice for venture capital firms looking to scale (from the ground up).

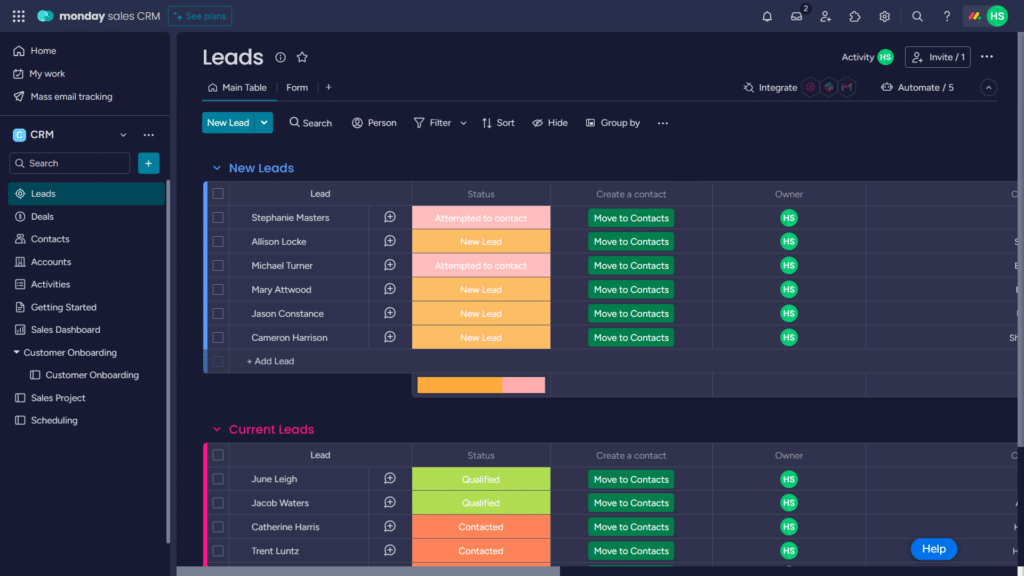

Monday.com excels in lead management, making it a great choice for venture capital firms looking to streamline their sales processes (as they scale).

The CRM platform offers robust lead tracking and scoring features, allowing you to stay on top of every potential investment opportunity.

You can easily create custom fields for each lead, track interactions, and even assign tasks to specific team members for follow-up.

Here’s how the leads dashboard looks with Monday.com.

The color-coded system makes it easy to see the status of each lead at a glance, and you can quickly drill down into each individual lead for more details.

Plus, editing each lead is as simple as clicking the dashboard directly and entering the information.

This means no more navigating confusing menus and tabs to update your leads.

The verdict: Monday.com is perfect for venture capital firms looking to manage their leads from one convenient dashboard.

It’s easy to use, visually appealing and offers impressive lead-tracking features—making it a great fit for scaling operations.

Without powerful reporting and analytics, tracking your venture capital firm’s success is impossible.

That’s where Monday.com’s impressive reporting and analytics capabilities come in.

With Monday.com, you can easily track the following:

- Deal flow

- Pipeline progress

- ROI on investments

- Sales metrics (by team member)

Monday.com’s visual reports and dashboards make it easy to see your venture capital firm’s progress at a glance.

You can quickly spot areas for improvement, measure the success of each investment opportunity, and track ROI from one location.

Plus, Monday.com offers customizable dashboards and reports for just about every metric you could need to measure.

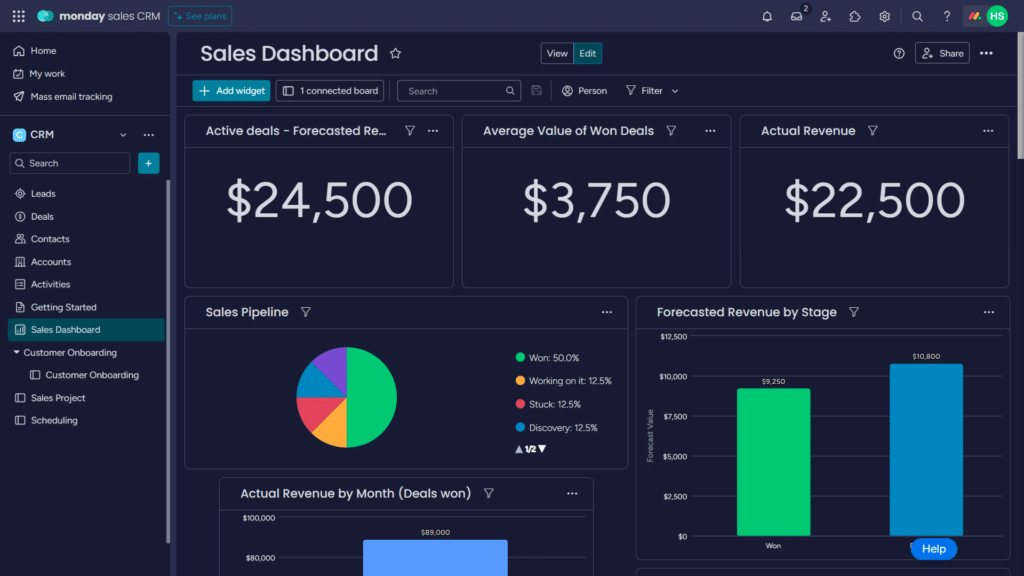

Here’s a look at one of Monday.com’s customizable dashboards (to give you a better idea).

The drag-and-drop interface makes it easy to add, remove, and rearrange widgets for a personalized view of your firm’s performance.

The rundown: Monday.com offers robust reporting and analytics capabilities that are easy to use and understand (even for beginners).

With Monday.com, you can track every aspect of your venture capital business from one hub, making it a no-brainer for firms looking to scale their operations.

Monday.com Pricing

Monday.com offers four paid plans in addition to a free plan.

These include the following:

- Free – Free Forever

- Basic – $10/Month

- Standard – $12/Month

- Pro – $20/Month

- Enterprise – Custom Pricing

Take a look at our extensive Monday.com pricing guide!

Monday.com Pros and Cons

- Great lead & client management

- Powerful automation creation

- Intuitive user interface

- Affordable pricing plans

- Informative reporting & analytics

- The free plan is limited

Zoho CRM: Best For Lead Management

Zoho CRM

Learn More Today!-

Powerful Automation Capabilities

-

Deal, Lead, & Contact Management Tools

-

Customizable Pipelines & Dashboards

Why We Picked Zoho CRM

Zoho CRM is a comprehensive solution to help manage every aspect of your venture capital firm.

Here are some noteworthy features:

- Lead management

- Reporting & analytics

- Pipeline management

- Project management

- Workflow automation

Zoho CRM offers a fantastic user interface, powerful features, and affordable pricing plans to help growing portfolio companies succeed!

Zoho CRM Features

If you can’t manage your leads, you can’t grow your venture capital firm—it’s as simple as that.

Zoho CRM offers many tools to help venture capitalists and their portfolio companies manage leads effectively.

Here are some of the lead management features you can expect from Zoho CRM:

- Lead capture forms

- Automated lead scoring

- Effective lead nurturing

- Custom dashboards & reports

- Social media integration

Zoho CRM’s lead management system is incredibly user-friendly and easy to navigate. It offers a streamlined process for managing leads and nurturing potential investments (to help your business grow).

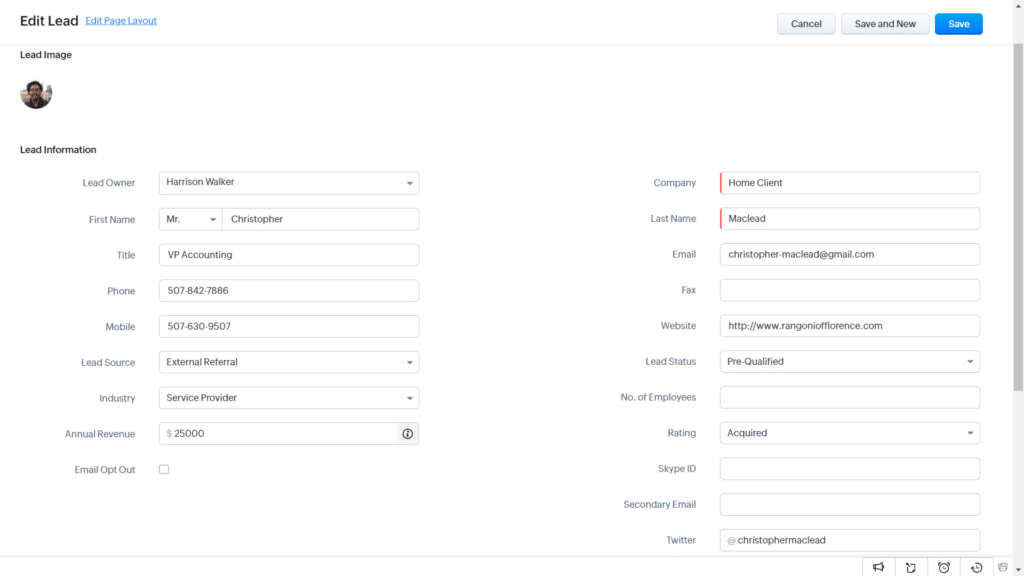

Adding a new lead (shown below) takes just a few seconds.

Simply fill out the following fields and hit save:

- Lead owner

- Name

- Title

- Contact info

- Lead source

- Industry

- Company

- Lead status

- Rating

Zoho CRM makes it easy to take a ton of information and make it easily digestible (so you can focus on the most important leads in your pipeline).

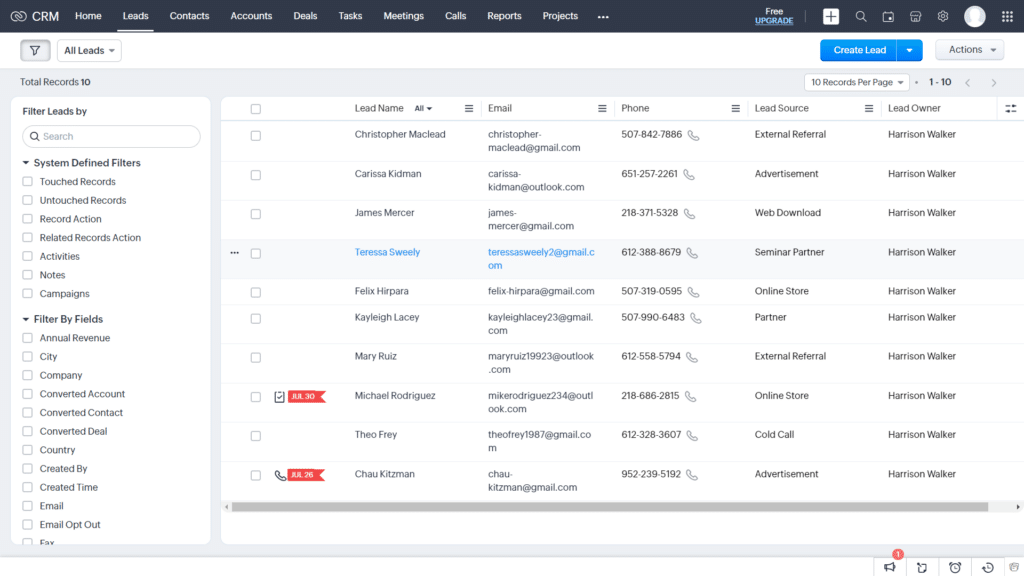

Once you have all your leads in place, you can easily view them with the leads dashboard (shown below).

This dashboard gives you a top-down view of your entire business (so you never fumble when it comes to managing your leads).

The rundown: Zoho CRM offers kick-a*s lead management capabilities that are in a whole other league!

If you need the next best thing in lead management, look no further than Zoho CRM.

Great reporting and analytics capabilities allow you to make data-driven decisions to help your business thrive.

Here are some of the features Zoho CRM brings to the table:

- Customizable dashboards

- Interactive charts & graphs

- Real-time data insights

- Custom reports

- Drag-and-drop interface for report creation

- Mobile reporting

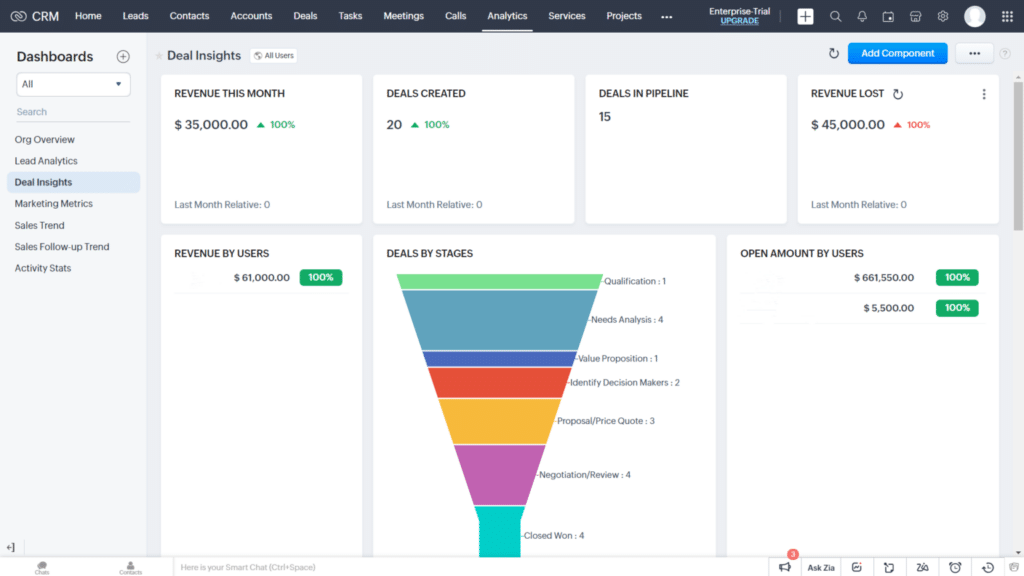

Zoho CRM’s reporting and analytics tools make it easy to track your venture capital firm’s performance and identify areas for growth.

You can easily create custom reports and dashboards (like the one shown below) that display the data you need to make informed investment decisions.

The drag-and-drop interface makes it easy to customize your reports (without needing any technical knowledge or coding skills).

The nuts and bolts: Zoho CRM provides robust reporting and analytics features that make it easy to track your venture capital firm’s performance and make informed decisions (to help you scale).

Effective pipeline management is vital to the success of any venture capital firm.

With Zoho CRM, you can easily manage your deal flow and stay on top of all your potential investments.

Here are some features included in Zoho CRM’s pipeline management:

- Drag-and-drop interface

- Integration with calendar

- Customizable stages & fields

- Deal scoring

- Automated workflows

- Comprehensive deal cards

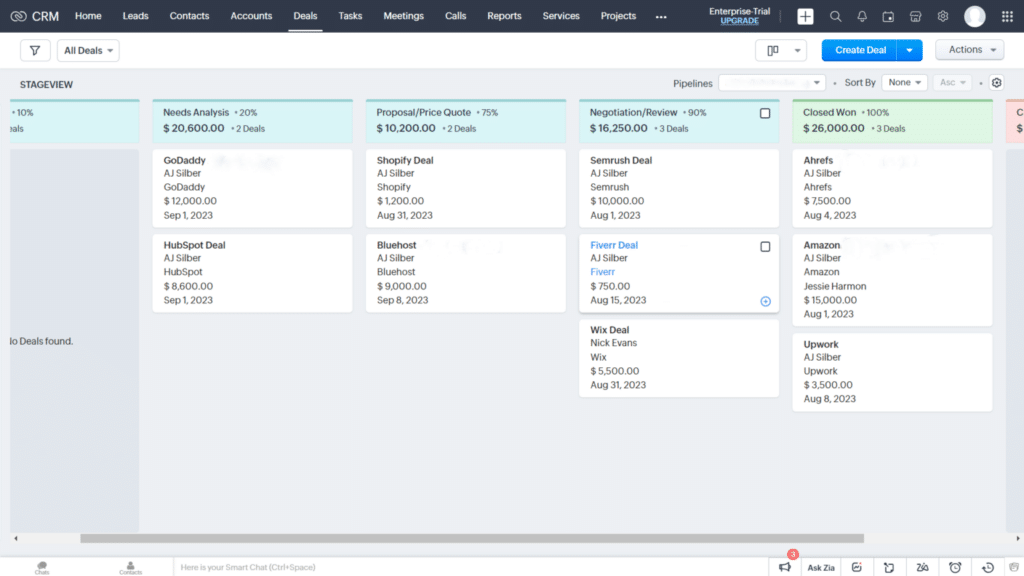

Zoho CRM’s pipeline management dashboard (shown below) offers an intuitive and customizable interface to help you keep organized as your business scales to new heights.

The drag-and-drop interface makes it easy to move deals around in real time and keeps everyone on the same page.

Our two cents: Zoho CRM provides impressive deal flow management capabilities perfect for venture capitalists.

The fact that it’s easy to use and affordable makes Zoho CRM tough to pass up!

Zoho CRM Pricing

Zoho offers a free plan in addition to four affordable paid plans.

They are the following:

- Free Version – Free for up to three users

- Zoho Standard – $20/Month

- Zoho Professional – $35/Month

- Zoho Enterprise – $50/Month

- Zoho Ultimate – $65/Month

Zoho CRM Pros and Cons

- Fantastic customer support

- Great mobile app

- Intuitive user interface

- Powerful lead & deal management

- Informative reporting & analytics

- Extremely affordable pricing plans

- Limited advanced marketing features

- The free plan is limited to 3 users

What is a Venture Capital CRM?

A venture capital CRM is essentially any platform that can manage the day-to-day business operations of venture capital professionals.

Benefits of Having a CRM for VC

There are a ton of benefits to having a CRM for venture capital.

Some of our favorites include the following:

- Improved sales

- Better customer relationships

- Greater efficiency

- More effective marketing campaigns

- Detailed reporting & analytics

- Let’s look at an overview of each benefit.

Improved Sales

Having a CRM for your venture capital firm can greatly improve your sales process.

With features such as lead management, deal flow process management, and automated task assignments, you can easily track your sales pipeline (and ensure that nothing falls through the cracks).

A CRM solution can help you take your sales management up a notch (as you scale your business to new heights).

Better Customer Relationships

A CRM allows you to keep your client information in one location for easy access.

This makes it easier to keep track of your client interactions, needs, and preferences (leading to stronger relationships and better relationship intelligence overall).

Greater Efficiency

With workflow automation and centralized data storage, a CRM can streamline your venture capital firm’s operations.

This means less time spent on manual tasks (and more time focused on growing and managing your investments).

More Effective Marketing Campaigns

A CRM offers powerful marketing features to help you run more effective campaigns.

Here are some specific ways a CRM can do this:

- Automated email campaigns

- Segmented audience lists

- Lead tracking & management

- Personalized messaging

With these features, you can easily reach out to potential investors and keep them engaged with your firm’s updates and opportunities.

Detailed Reporting & Analytics

With a CRM, you can track and analyze important metrics such as ROI, sales performance, and customer data.

This allows you to make more informed business decisions (and continuously improve your processes).

Does a Venture Capital Firm Need a CRM?

A venture capital firm absolutely needs a CRM solution to help get organized and scale.

CRM software can help you keep all your client and investment information in one place, streamline processes, automate tasks, and ultimately increase efficiency as you grow your business.

Trust me when I say—you don’t want to try to manage all of your investments without one.

After testing, we compiled a thorough list of our favorite CRMs for Small Businesses. Check it out now! The list might surprise you.

Venture Capital CRM Top Features

Let’s look at some of the best features of a venture capital CRM.

It can be tough to manage relationships as your business grows.

A CRM can help you keep track of all your client interactions, preferences, and needs in one location.

Be sure the CRM system you go with offers the following client management tools:

- Comprehensive contact cards

- Custom field creation

- Unlimited storage

- Customizable contact dashboard

- Relationship building capabilities

Integrating your CRM with other tools and platforms can greatly improve efficiency and streamline processes for your venture capital firm.

Look for a CRM that offers integrations with commonly used tools such as:

- Email marketing software

- Accounting software

- Project management tools

Workflow automation is a key feature that makes CRMs invaluable for venture capital firms.

The best customer relationship management software will offer the following automation tools:

- Automated data entry & organization

- Task assignment automation

- Automated email marketing campaigns

Like any other sales process, a venture capital firm’s deals go through a pipeline.

Great CRM software can help you manage your deal flow with ease.

Look for features such as the following:

- Deal tracking & management

- Automated updates & alerts

- Deal sourcing & filtering

With the fast-paced nature of the venture capital industry, having access to your CRM on the go is essential.

Make sure the CRM you choose has a mobile app that offers all of the features available on the desktop version.

Tracking and analyzing important metrics is crucial for any successful venture capital firm.

Look for a CRM that offers detailed reporting and analytics tools, such as customizable dashboards and advanced data visualization options.

How to Choose a CRM for Venture Capital

Here are some can’t-miss steps to choosing a venture capital CRM.

Step 1: Choose CRM Goals

What do you want your CRM to do? This is the most important question to answer before diving into the search.

Here are some common goals for venture capital firms:

- Streamline day-to-day operations

- Increase efficiency

- Improve investor relationships

- Gain better insights & analytics

Step 2: Select a CRM from Our List!

We did the heavy lifting by thoroughly testing each platform on this list (over six months).

I can safely say each platform is capable of helping scale your venture capital company with ease.

Step 3: Test Drive Your Venture Capital CRM

Most CRMs offer a free trial (or demo) that you can test out before committing to a purchase.

Here are some things you should look for when taking a test drive:

- Ease of use

- Customizability

- Integrations with commonly used tools

- Reporting & analytics features

- Mobile app functionality

Be sure to test the CRM alongside your team members to get their input.

They’ll be the ones using it day in and day out, so their opinion is critical.

Step 4: Finalize & Implement Your CRM

Once you’ve chosen and tested your CRM, it’s time to implement it into your venture capital firm’s operations.

Here are some tips for a successful implementation:

- Train all team members on how to use the CRM

- Ensure all necessary integrations are set up correctly

- Migrate data from previous systems accurately

- Continuously review and improve processes with the CRM

How Much Does a VC CRM Cost?

A good CRM system for venture capitalists will typically run you anywhere from completely free to about $50/month.

Some platforms charge extra for additional storage, users, or features, so it’s important to read the fine print before committing with your wallet.

Final Thoughts on Venture Capital CRMs

Now you’ve got what it takes to decide for yourself!

Each platform on this list is perfect for venture capital professionals who are serious about scaling.

Plus, they all offer a free plan (or trial), so you can check them out today—no risk, all reward!

Newsletter Signup

Join The Leads Field Guide Newsletter for tips, strategies and (free) resources for growing your leads, and closing more deals.