It’s important that private equity professionals have a reliable customer relationship management (CRM) platform for their business.

Without one, you risk losing valuable deals, mishandling portfolios, and, ultimately—damaging your reputation.

I’m AJ—here to help. I’ve spent the better part of a decade building my business to a successful seven-figure exit.

I’ve learned what works (and doesn’t) and aim to share that knowledge with fellow entrepreneurs.

So, let’s get into my list of the best private equity CRM platforms in the business.

Hang out until the end to catch some pro tips on pinning one down!

After years of SBB testing, here is our list of the best CRMs for private equity firms:

- Best CRM For Private Equity Firms For Integrations: HubSpot

- Best CRM For Private Equity Firms For Workflow Automation: Monday.com

- Best CRM For Private Equity Firms For Client Management: Vtiger

- Best CRM For Private Equity Firms For Lead Management: Zoho CRM

- Best CRM For Private Equity Firms For Simplicity: Less Annoying CRM

How Did We Test The Best CRM For Private Equity Firms?

My team and I went in-depth into each platform.

Here’s what we looked at:

- Scalability

- Ease of Use

- Feature Assessment

- Customer Support

- Hands-On Experience

- Third-Party Reviews

How We Objectively Test Each Platform:

AJ's got a knack for kick-starting businesses, putting them on autopilot, and setting them up for acquisition. Over the past decade, he's been right in the thick of things with hundreds of small businesses, helping them with just about everything under the business sun. If you need advice on software suites and choices? AJ's your guy.

We roll up our sleeves and dive into the top CRM features we think are pretty crucial for small businesses. Stuff like reports and analytics, options to customize your pipelines, and the ability to link up with other apps and services. We know what makes small businesses tick, so we know what features they need to get the job done.

Money matters, folks! When it comes to picking a CRM system, price is usually the deal-breaker. We give a big thumbs up if a provider charges $30 or less per user each month for their starter plan. Extra brownie points for throwing in a freebie plan or trial, options to scale up or down as needed, and the freedom to pay monthly or yearly. We're looking for flexability for small businesses.

We all know support is mega important when you're choosing a CRM platform. This is especially true for those smaller businesses or sales teams who can't afford to have tech wizards on their payroll. We put our detective hats on to see if these companies offer round-the-clock support, and we looked at the different ways you can get help. We're talking live chat (like, real-time convo), email tickets, a good old-fashioned phone call, and self-service tools (for the DIY-ers out there).

When you're in the business of picking a CRM, integrations are like the secret sauce that takes your burger from 'meh' to 'mind-blowing'. Imagine, all your favorite apps and tools, working together in perfect harmony, making your workflow smoother than a fresh tub of Nutella. When we review a CRM, we look at the integrations most SMB owners are looking for.

When you're reviewing a Customer Relationship Management (CRM) system, it's essential to pay close attention to its ease of use. After all, a CRM is as beneficial as its usability. A simple, intuitive interface saves you and your team a great deal of time and headache. When we're reviewing each CRM, this is a crucial aspect that we look for.

The importance of Mobile CRM cannot be overstated in today's digital age. It's essential for fostering strong customer relationships and managing business activities. Mobile access to CRM makes it possible for sales teams to update and access customer information in real time, improving efficiency and ensuring up-to-date data. Mobile CRM can have a massive impact on SMBs, so thoroughly testing it is essential for each one of our reviews.

HubSpot CRM: Best for Integrations

HubSpot

Learn More Today!-

Tons of Free Tools From Each Hub

-

Live Chat Capabilities

-

Robust Integrations

Why We Picked HubSpot CRM

HubSpot offers incredibly powerful CRM software for private equity firms.

Here are some standout features:

- Client management

- Tons of integrations

- Workflow automation

- Campaign management

- Deal flow management

- Data analytics & reporting

HubSpot is feature-rich, easy to use, and best of all—100% free forever.

Give it a try if you’re serious about scaling your wealth management business (from the ground up).

HubSpot CRM Features

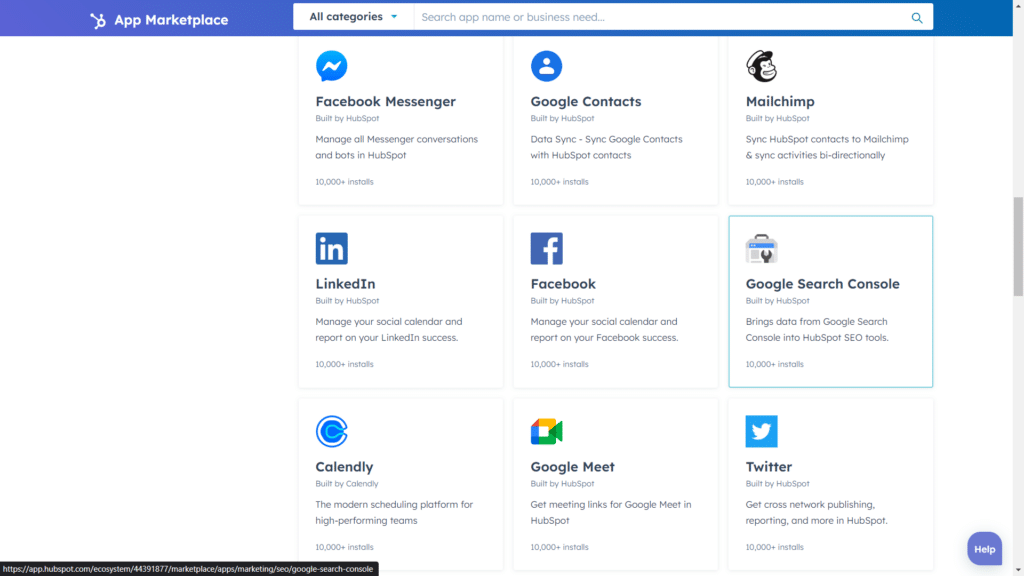

When it comes to integrations, nobody beats HubSpot.

The CRM solution offers over 500 native integrations to help streamline and automate your business processes.

Some notable integrations for private equity investors include:

- Salesforce

- Mailchimp

- DocuSign

- Zoom

- Google Workspace

- Xero

- Google Contacts

In addition to these popular tools, HubSpot offers a Zapier integration that unlocks thousands of additional third-party platforms.

Everything is incredibly easy to search for, thanks to HubSpot’s App Marketplace (shown below).

The integration process is as easy as just a few clicks, and you’re in business!

The nitty gritty: HubSpot takes the cake when integrating all your favorite platforms with your CRM.

Give it a try, and watch as your productivity soars.

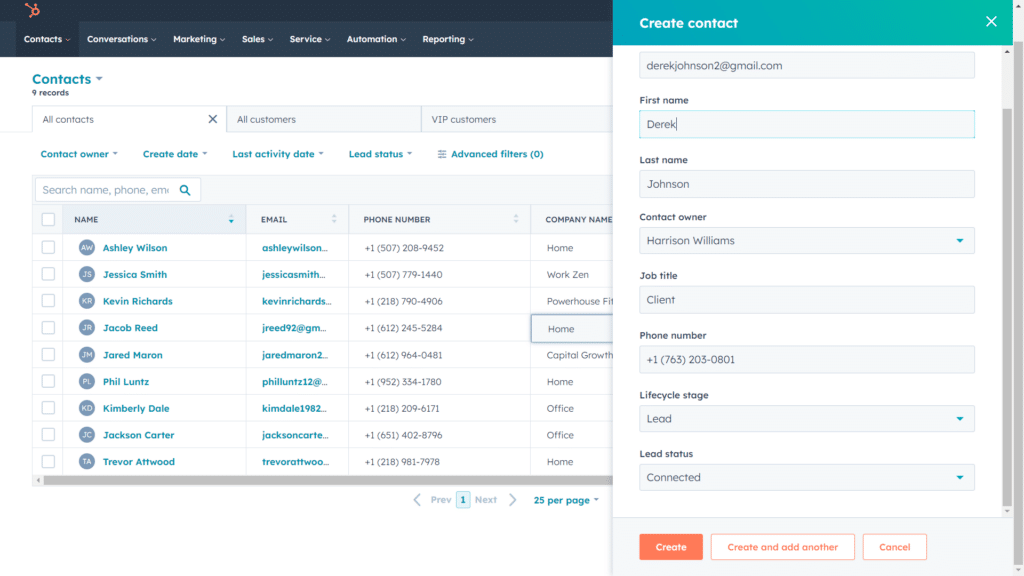

Without customers, you’re just someone with great ideas and some cool accounting software.

Private equity investors need a way to stay on top of their client relationships, which is where HubSpot comes in.

With HubSpot, you can easily do the following:

- Keep track of every interaction with a client

- Automatically log emails and calls straight to their contact record

- Organize deals by pipeline and stage

- View all communication and touchpoints in one place (including social media)

- Automate tasks and reminders

The interface is clean and intuitive (and puts everything at your fingertips).

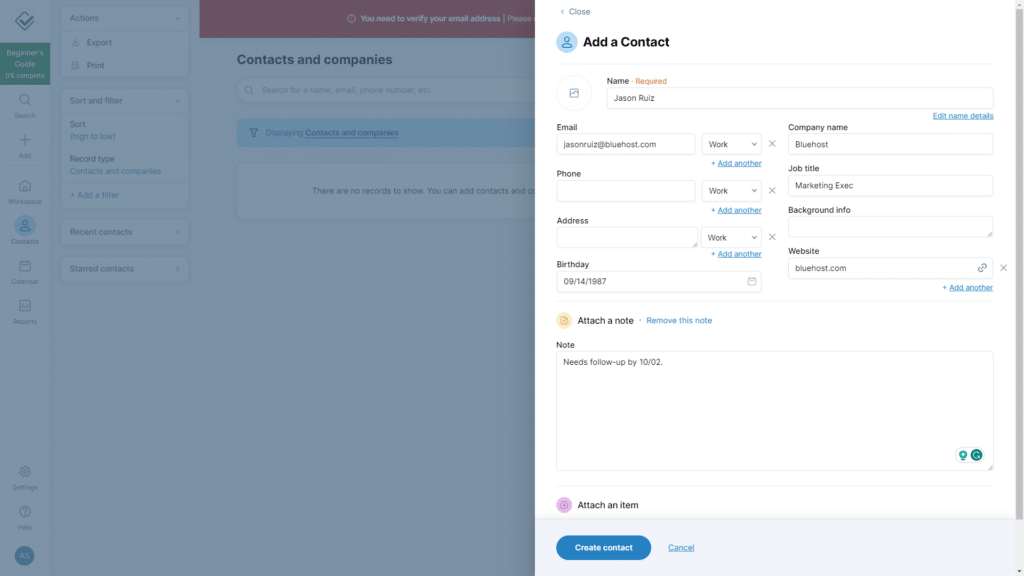

Here’s a look at a new client card (to give you a better idea).

Within each card, you can easily access (and edit) the following info:

- Name

- Job title

- Contact owner

- Lead status

- Email & phone

- Lifecycle stage

- Notes & tags

- Attachments

- Custom fields

This gives you a great view of the entire custom journey from start to finish, allowing you to stay on top of everything as you scale.

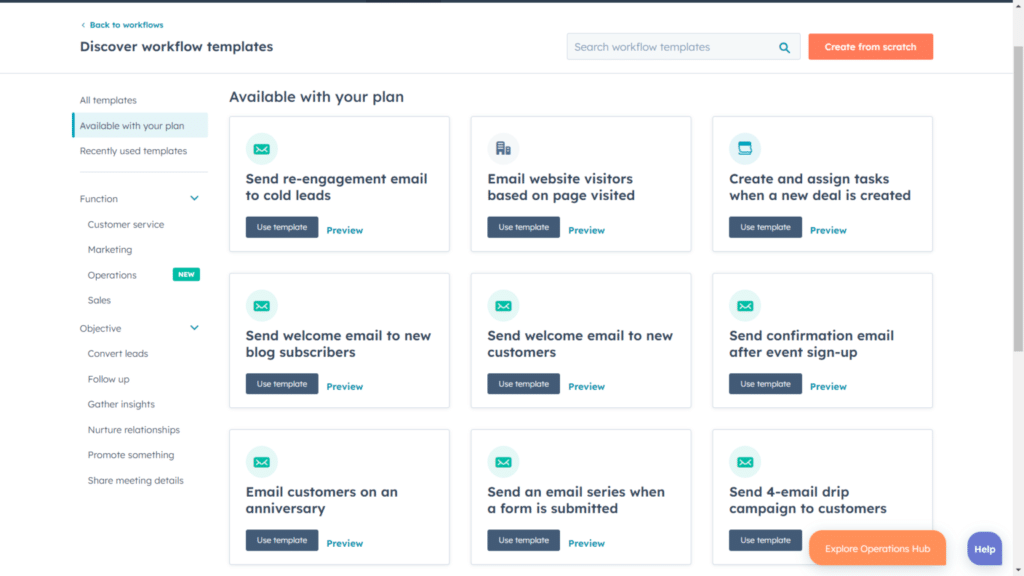

HubSpot’s automation capabilities offer an excellent way to streamline your business processes and save time (while scaling).

With HubSpot, you can easily automate the following tasks:

- Lead nurturing

- Lead scoring

- Deal progression

- Email marketing

- Social media posting

- Follow-up tasks for sales reps

This feature is perfect for private equity firms looking to automate repetitive tasks and focus on high-value activities.

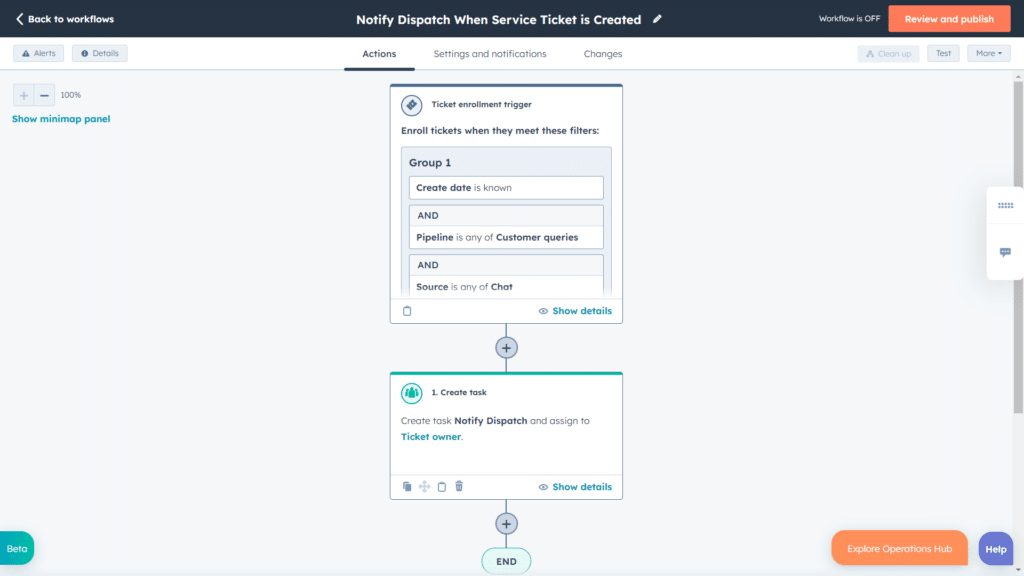

HubSpot even provides many helpful premade automation templates (shown below).

These allow beginners to hit the ground running with complex automation (no coding knowledge needed).

If custom automations are more your speed, HubSpot’s got your back.

The CRM system provides a fantastic automation builder (shown below) that makes it easy to create powerful sequences (in minutes).

Trust me when I say—HubSpot offers some of the best automation in the biz. It’s not quite as intuitive as Monday.com, but it’s the next best thing.

HubSpot CRM Pricing

HubSpot CRM offers a free plan in addition to three paid plans:

- Free Plan – Free Forever

- Starter CRM Suite – $30/Month

- Professional CRM Suite – $1,335/Month

- Enterprise CRM Suite – $5,000/Month

Check out our in depth HubSpot pricing guide!

HubSpot CRM Pros and Cons

- Stellar customer support (with live chat)

- Powerful client management

- Tons of useful native & third-party integrations

- Intuitive user interface

- Great free tools

- Higher-tier plans are expensive

- CMS Hub lacks advanced customization options

Monday.com: Best For Workflow Automation

Monday.com

Learn More Today!-

Tons of Project Management Tools

-

Affordable Pricing & Free Forever Plan

-

Powerful Analytics & Reporting

Why We Picked Monday.com

Monday.com is a powerhouse work management platform that doubles as a CRM solution.

It’s jam-packed with features to help private equity firms succeed.

Here are a few of our favorites:

- Lead & client management

- Reporting & analytics

- Workflow automation

- Deal management

- Project management

- Mobile app

Monday.com is extremely affordable and intuitive (and packs quite a punch).

It’s a no-brainer for any private equity company looking to streamline its business processes (and get ahead of the alternative investment firms).

Monday.com Features

As you scale your portfolio management business, you need a way to track and manage your leads.

Luckily, Monday.com offers a fantastic lead management feature that keeps everything organized and easily accessible within your CRM software.

Using Monday.com, you can easily do the following:

- Track leads from multiple channels (email, website, social media)

- Assign leads to team members for follow-up

- Automatically log communication with leads

- Set reminders for follow-up tasks

- Score leads based on custom criteria

- Create web forms to capture leads (with custom fields)

- View lead activity history and touchpoints

This feature is perfect for private equity firms looking to scale their lead generation efforts (without fumbling through spreadsheets and emails).

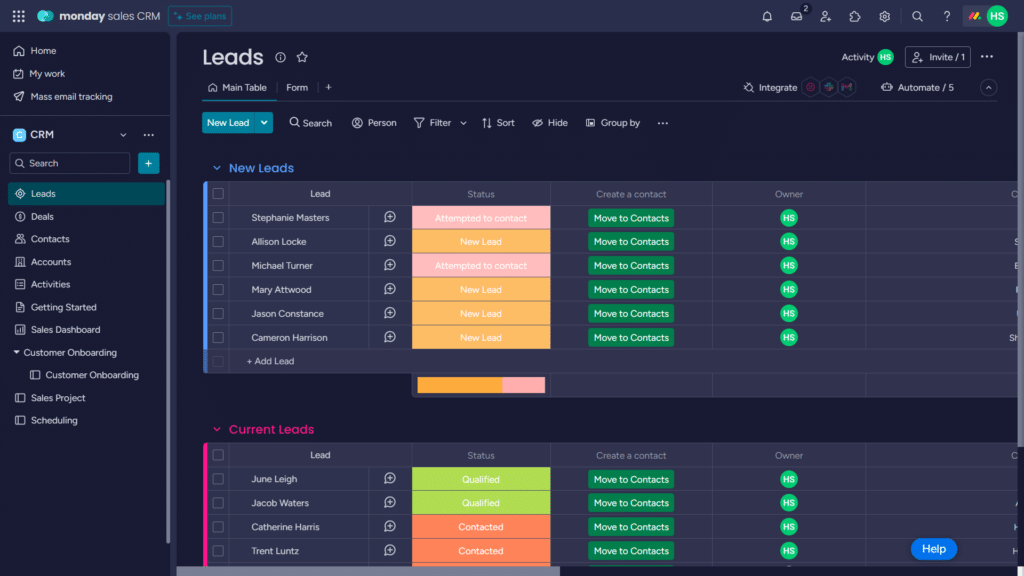

Here’s a look at Monday.com’s gorgeous user interface (with some sample data added).

The CRM software lets you click the dashboard directly to edit lead information (shown below).

This allows you to stay in lock-step with your team as you nurture leads through the sales process.

If you’re not using automation to scale your business, you’re leaving money on the table.

Monday.com realizes this and makes it easier than ever to feel like a tech wizard (even if you don’t have a degree in computer science).

Here’s what you can accomplish with Monday.com’s workflow automation:

- Eliminate manual data entry

- Automatically nurture leads

- Set reminders & tasks for team members

- Get notifications when deals move through the pipeline

- Send emails based on specific lead actions

- Automatically update deal status based on triggers (e.g., email opens, website visits)

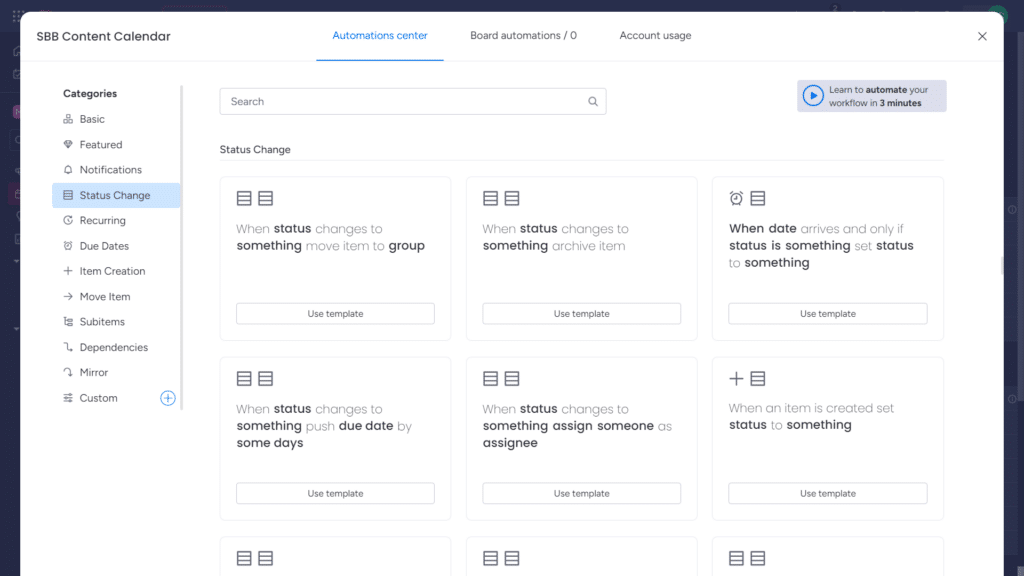

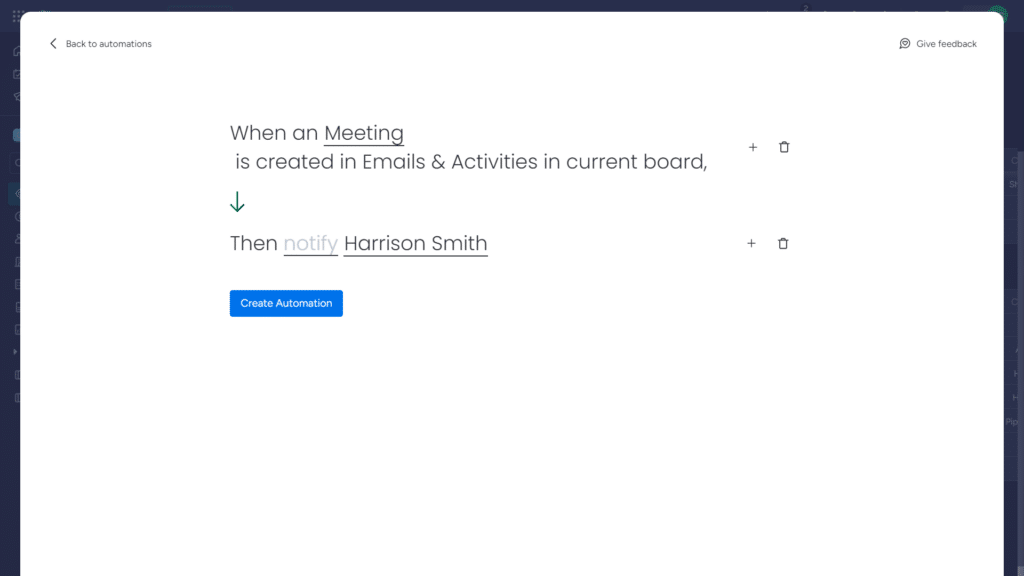

Monday.com provides awesome premade templates (shown below) that take the guesswork out of setting up automations.

These templates are fully customizable and cover everything from sales processes to internal workflows.

If you’re more of a DIY type, Monday.com’s unique “When/Then” automation builder (shown below) is both user-friendly and powerful.

Simply set your triggers and actions, and you’re off to the races—automating tasks and processes like never before.

Our take: Monday.com leads the pack when it comes to workflow automation.

If you want to kick back while your CRM does the heavy lifting, our money is on Monday.com.

In the financial services industry, making data-driven decisions is a must.

Luckily, Monday.com offers powerful reporting capabilities to take advantage of.

With Monday.com, you can easily track the following:

- Sales performance

- Lead & deal sources

- Deals won/lost

- Team member productivity

- Deal pipeline

- Revenue & expenses

Monday.com’s reporting dashboards are fully customizable, so you can mix and match data to create the perfect view for your business.

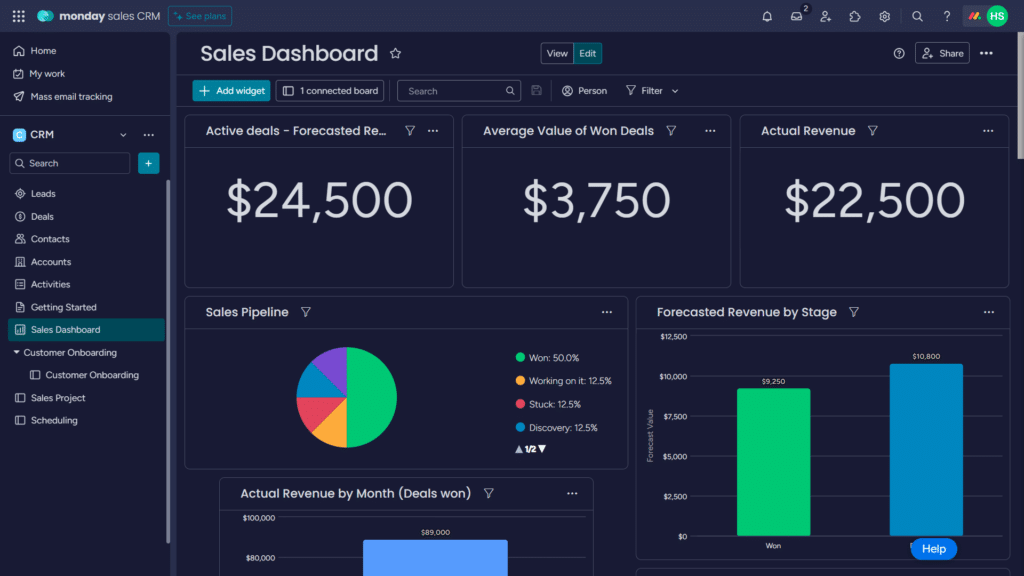

Here’s a look at a customizable sales dashboard with Monday.com.

The CRM solution provides a drag-and-drop report builder, making it easy to create data visualizations (without needing a degree in graphic design).

In a nutshell: Monday.com can easily take your private equity business to the next level by helping you make informed decisions (based on your data)!

Monday.com Pricing

Monday.com offers four paid plans in addition to a free plan.

These include the following:

- Free – Free Forever

- Basic – $10/Month

- Standard – $12/Month

- Pro – $20/Month

- Enterprise – Custom Pricing

Take a look at our extensive Monday.com pricing guide!

Monday.com Pros and Cons

- Great lead management

- Exceptional customer support (with live chat)

- Powerful workflow automation

- Intuitive user interface

- Awesome project management tools

- Limited free plan

Vtiger: Best For Client Management

Vtiger

Learn More Today!-

Deal, Task, Project, & Sales Management

-

Great Ticketing Tools

-

Powerful Analytics and Reporting

Why We Picked Vtiger

Vtiger is a feature-rich platform with a ton of utility for portfolio companies.

Here are some of our favorite features:

- Client management

- Deal management

- Reporting & analytics

- Scheduling calendar

- Tons of integrations

Vtiger offers a sleek user interface, seamless integration capabilities, and an affordable price tag.

It’s great for scaling financial services firms that want a comprehensive solution to help manage their business.

Vtiger Features

Your customers are the heart and soul of your business, so it’s important to manage those relationships above all else.

Vtiger offers the following features to help you do just that:

- Comprehensive contact cards

- Deal flow management for each client

- Customizable dashboard & fields

- Task & activity management

- Communication tracking

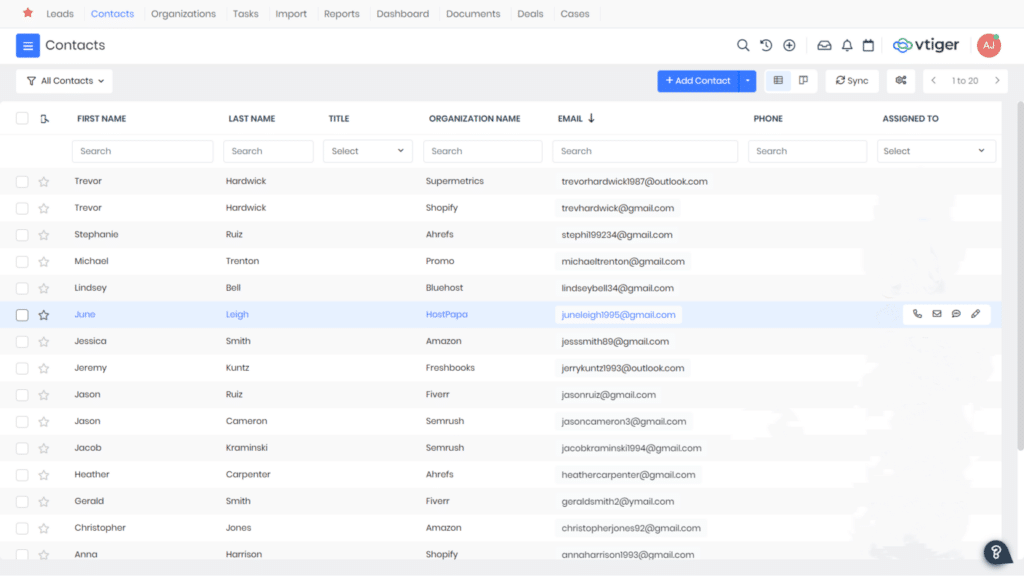

With Vtiger, you can get a bird’s eye view of all your clients from the dashboard (shown below).

As you can see, the interface is sleek and easy to navigate, with all your information organized in one place.

Vtiger is fully customizable, meaning you can tailor it to your business needs.

This is a major plus, especially for venture capital firms with unique processes and workflows.

The breakdown: If you need an effective way to manage your investor relations, look no further than Vtiger.

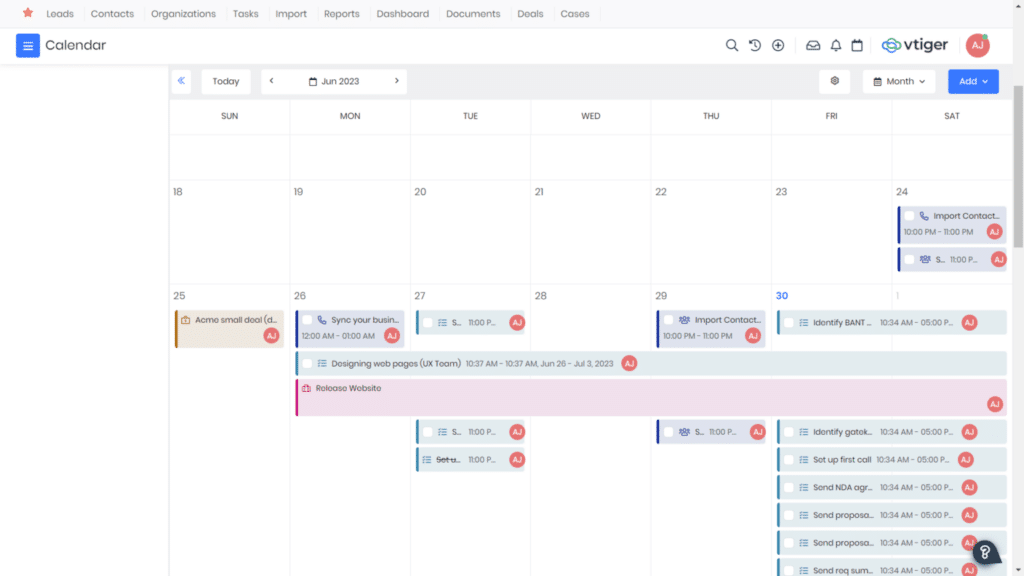

Private equity professionals are constantly juggling meetings, calls, and other tasks.

Vtiger’s scheduling calendar is a massive help in this regard.

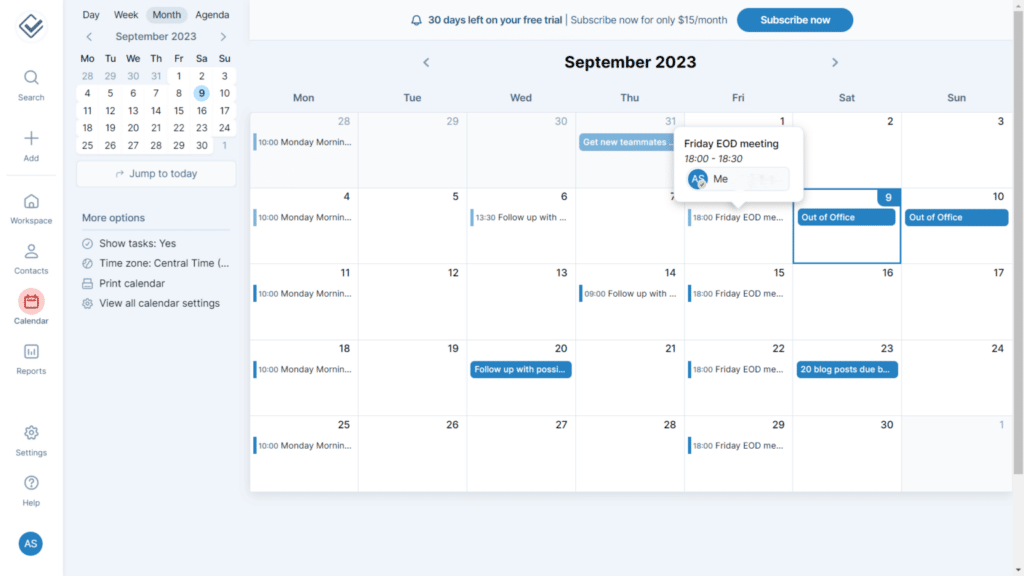

Here’s what you get with Vtiger’s scheduling calendar:

- Automated reminders & notifications

- Activity planning for multiple team members

- Multiple calendar sync (e.g., Google Calendar)

- Task organization by priority

- Color-coded tasks for easy management

Using Vtiger’s scheduling calendar lets you easily stay on top of important appointments and deadlines.

Here’s a look at this feature in action.

The interface is clean and intuitive, making it easy for you and your team members to use.

The bottom line: For teams that need an efficient way to manage their schedules, Vtiger’s scheduling calendar is a game-changer.

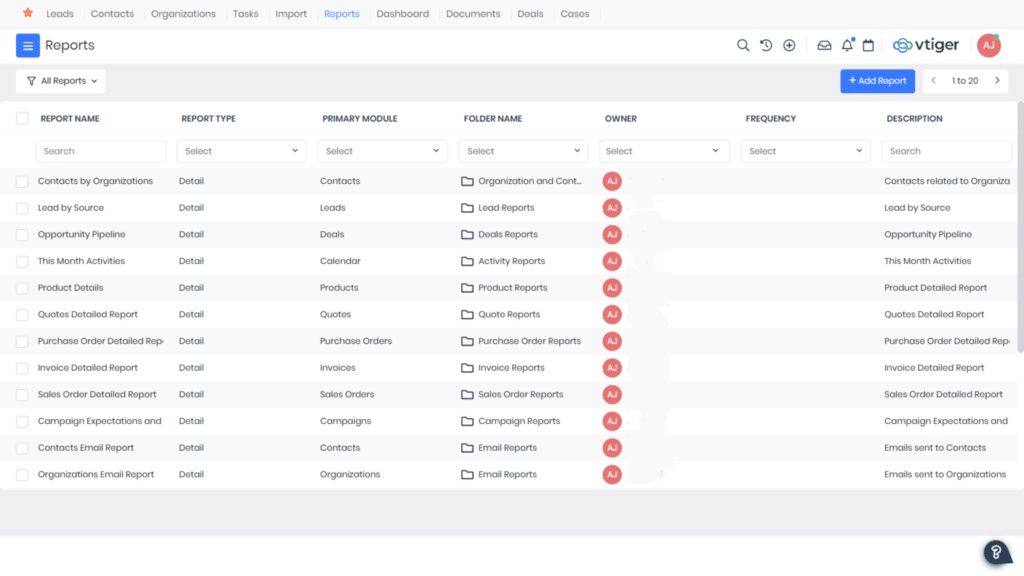

Data is critical for making informed decisions in the private equity business.

Vtiger offers powerful reporting and analytics capabilities to help you gain insights into your business performance (as you scale).

Here are some standout aspects of this feature:

- Customizable dashboards

- Real-time data & reports

- Performance tracking by individual or team

- Visual charts and graphs for easy analysis

- Exportable reports (e.g., Excel, PDF)

Here’s a quick snapshot of just a fraction of the custom reports you can create with Vtiger.

Each report is fully customizable to fit your specific business needs.

This feature is especially useful for private equity teams who need to track investment performance and monitor progress over time.

The need to know: Vtiger’s reporting and analytics capabilities make it a solid choice for private equity firms looking to make data-driven decisions (as they expand their horizons).

Vtiger Pricing

Vtiger’s pricing can seem a little confusing at first glance.

They offer a free plan and two paid plans, but each of the paid plans contains a “standard” cost and a “single app” cost.

Standard plans give access to the full platform, including sales, marketing, and service.

Single app plans give read/write access to one aspect of the platform and read-only access to the rest.

Here’s a breakdown of the plans:

One Pilot

- Free forever plan

- 10 users

One Professional

- Standard – $42/month (per user)

- Single app – $28/month (per user)

One Enterprise

- Standard – $58/month (per user)

- Single app – $42/month (per user)

Vtiger Pros and Cons

- Great free plan

- Stellar customer support (with live chat)

- Powerful client management

- Informative reporting & analytics

- Sleek user interface

- There's a bit of a learning curve to some features

- The mobile app needs some work

Less Annoying CRM: Best for Simplicity

Less Annoying CRM

Learn More Today!-

All Features Included for $15/Month

-

Customizable Workspace

-

Extremely Intuitive User Interface

Why We Picked Less Annoying CRM

Less Annoying CRM cuts through the BS and delivers an outstanding platform for private equity investors.

Here are some noteworthy features:

- Client management

- Scheduling calendar

- Task tracking

- Reporting & analytics

- Deal management

Less Annoying CRM offers all its features for just $15/month, meaning there are no hidden costs down the road.

Less Annoying CRM Features

Less Annoying CRM offers a streamlined approach to client management that focuses on simplicity and ease of use.

Here’s what you can expect from this feature:

- Custom fields & dashboard

- Comprehensive client cards

- Segmentation & filtering options

- Activity, deal, & communication tracking

- Automated reminders & notifications

Adding a new contact is as easy as clicking “new contact” and filling out a few fields.

Within each card, you can easily add and edit the following fields:

- Name

- Company name

- Phone & email

- Address

- Background info

- Job title

- Website

- Birthday

- Notes & tags

- Custom fields

As you can see, there’s a ton of available info, but Less Annoying CRM does a fantastic job of making it all manageable and organized.

The brass tacks: Less Annoying CRM is perfect for private equity professionals who prioritize simplicity and efficiency in their client management process.

Less Annoying CRM delivers a scheduling calendar that’s simple yet effective.

It doesn’t have all the bells and whistles of other CRMs, but it gets the job done (without the headache).

Here’s what you get with Less Annoying CRM’s scheduling calendar:

- Team-wide activity planning

- Sync with Google & Outlook Calendar

- Automated reminders & notifications

- Task prioritization

- Color-coded tasks

Here’s a look at Less Annoying CRM’s scheduling calendar (with some sample data added).

As you can see, it’s straightforward to navigate, making it a great choice for private equity companies who don’t need all the extra features.

It’s extremely beginner-friendly, perfect for anyone just starting with customer relationship management software.

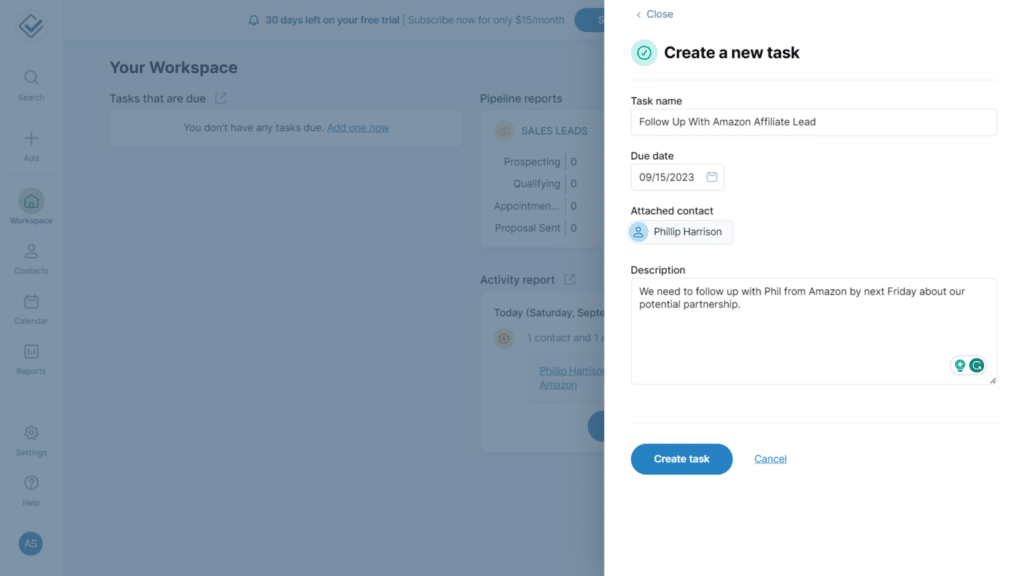

Task management is vital for private equity professionals, who often have a ton of different tasks to stay on top of.

Less Annoying CRM offers a straightforward task management system that helps keep you organized and on track as you grow your business.

Here’s what you get right from the jump:

- Task creation & editing

- Task prioritization

- Assigned tasks for team members

- Automated reminders & notifications

- Activity tracking & organization

Here’s a look at a new task card (to give you a better idea).

You can easily assign priority to each task and filter by task type (to see what’s on your plate for any given day).

While it may not be the most advanced task management system on the market, Less Annoying CRM provides a solid foundation for managing your tasks and staying productive.

Less Annoying CRM Pricing

Less Annoying CRM keeps it simple by offering only one pricing plan for $15/month.

The plan includes everything the CRM solution has to offer, meaning no additional charges down the line.

Check out our Less Annoying CRM pricing guide for more information!

Less Annoying CRM Pros and Cons

- Streamlined user interface

- All features included in one plan

- Affordable pricing

- Great client management

- Fantastic scheduling calendar & task management

- No mobile app

- No free plan

Zoho CRM: Best For Lead Management

Zoho CRM

Learn More Today!-

Powerful Automation Capabilities

-

Deal, Lead, & Contact Management Tools

-

Customizable Pipelines & Dashboards

Why We Picked Zoho CRM

Zoho CRM is an all-in-one platform designed to help you take control of your business as you scale.

Here are some of our favorite features for the private equity industry:

- Lead management

- Reporting & analytics

- Deal management

- Workflow automation

- Email marketing

Zoho CRM is tailor-made for private equity firms looking to scale (without sacrificing firepower).

Zoho CRM Features

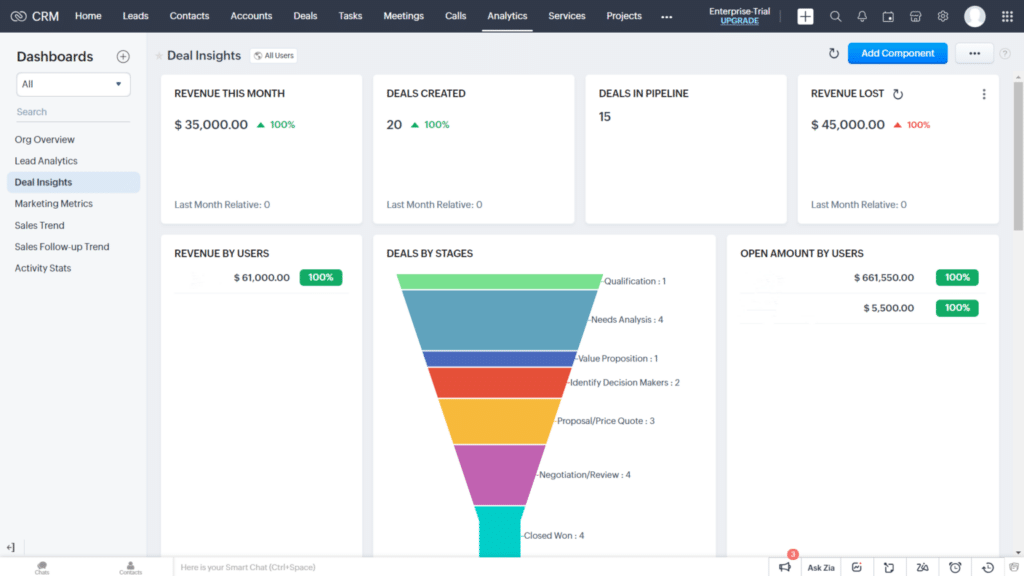

Learning from your data is essential to scaling your private equity business.

After all, how can you make informed decisions if you don’t know what’s working and what isn’t?

Zoho CRM offers a variety of powerful reporting and analytics tools to help you do just that.

Some notable features include:

- Custom dashboards & reports

- Advanced analytics

- Real-time data visualization

- Sales forecasting

Here’s a look at a customizable dashboard with Zoho CRM.

The drag-and-drop interface makes it easy to create and customize reports that matter most to your business.

You can also schedule reports to be delivered regularly, ensuring you’re always up-to-date with the latest data.

This is especially important in an industry where timing is crucial.

The lowdown: Zoho CRM’s got the goods regarding reporting & analytics. It’s perfect if you’re looking to make more data-driven decisions for your private equity firm.

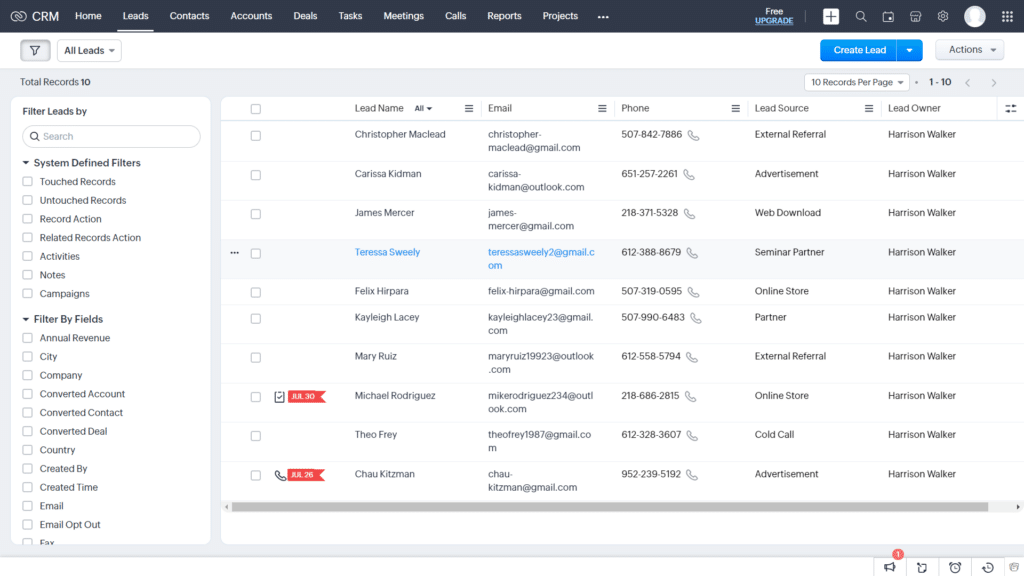

Managing leads is a crucial aspect of running a successful private equity firm.

After all, the more hot leads you successfully nurture, the more deals you close.

Zoho CRM’s lead management feature makes it easy to capture, track, and nurture leads through the entire sales process.

Here are some key features:

- Lead scoring (based on custom criteria)

- Automated lead assignment to team members

- Real-time lead tracking & activity history

- Web forms to capture leads (with customizable fields)

Zoho CRM’s lead scoring feature lets you prioritize your efforts on the most promising leads, helping you close deals faster.

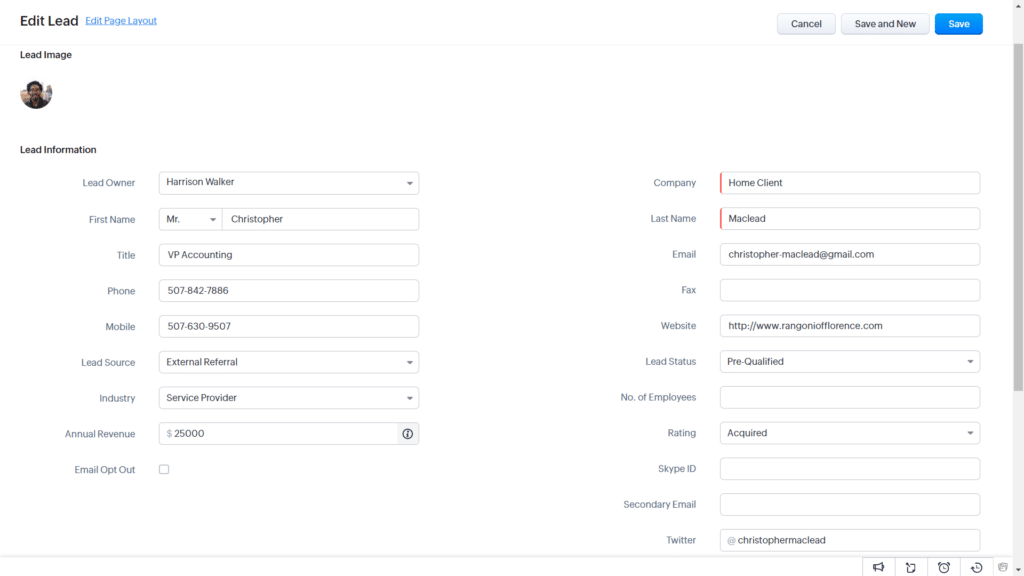

Adding a new lead is as easy as one click (and filling out a few fields).

Here’s how a new lead card looks (to help paint a picture).

Each card holds a ton of info that’s easy to track and update as leads move through the pipeline.

The leads dashboard (shown below) is fully customizable, meaning you can choose what lead information is most important to you and your team.

Our two cents: Zoho CRM is a lead management powerhouse.

If you’re looking to top the charts regarding efficiency, you can’t go wrong with Zoho CRM.

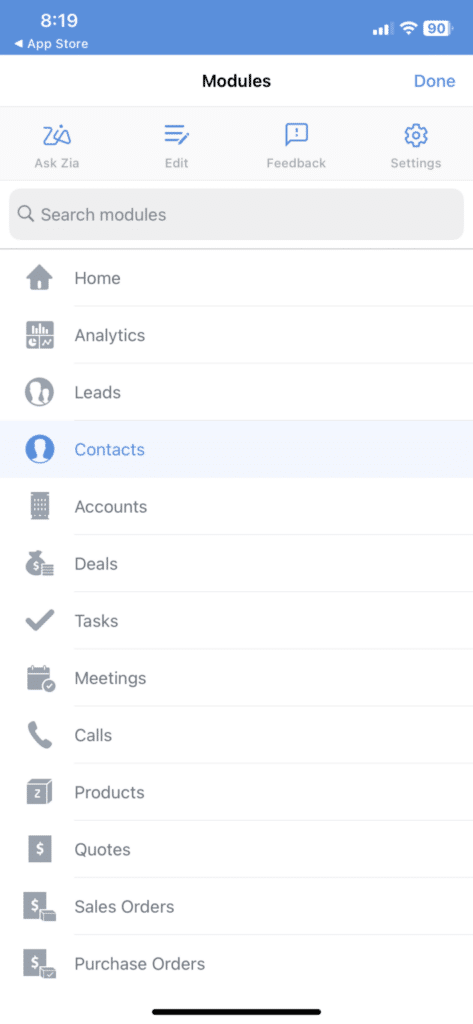

In today’s fast-paced world, being tied to a desk is no longer an option.

Thankfully, Zoho CRM offers a powerful mobile app that allows you to access your data and stay on top of your business from anywhere, anytime.

Key features of the app include:

- Real-time notifications

- Remote access to important data

- Mobile lead, deal, & contact management

- In-app calling & messaging

- Integration with other Zoho apps

Here’s a look at the app in action.

Zoho CRM’s app is like having a fully-fledged CRM that you can put in your pocket.

It’s perfect for mobile portfolio companies or managers who need to stay on top of their business (while out of the office).

Zoho CRM Pricing

Zoho offers a free plan in addition to four affordable paid plans.

They are the following:

- Free Version – Free for up to three users

- Zoho Standard – $20/Month

- Zoho Professional – $35/Month

- Zoho Enterprise – $50/Month

- Zoho Ultimate – $65/Month

Zoho CRM Pros and Cons

- Affordable, scalable pricing

- Great lead & client management

- Powerful reporting & analytics

- Stellar mobile app

- Awesome customer support (with live chat)

- The free plan is limited (to 3 users)

- Limited advanced marketing features

What is a Private Equity CRM?

A private equity CRM is any platform that can help you manage every aspect of your business (from lead generation to portfolio management).

It’s basically a supercharged version of traditional CRMs, with added features tailored to the private equity market.

Benefits of Having a Private Equity CRM

Let’s look at some of the most important benefits of having a private equity CRM.

These include the following:

- Improved sales

- Streamlined reporting & analytics

- Efficient lead nurturing

- Improved investor relations

Improved Sales

A private equity CRM can help you increase sales by providing a central hub for lead management, deal tracking, and efficient workflows.

This means your team can work smarter (not harder) to close more deals.

Streamlined Reporting & Analytics

Data is key in the private equity industry.

A customer relationship management platform can help with the following:

- Identifying successful investment strategies

- Monitoring portfolio performance

- Forecasting potential deals

Having all this information in one place and easily accessible can save time and provide valuable insights for decision-making.

Efficient Lead Nurturing

A private equity CRM allows you to track and nurture leads from start to finish.

This ensures that no opportunities fall through the cracks and that you are always on top of lead activity and progress.

Improved Investor Relations

Maintaining strong relationships with investors is crucial for private equity firms.

With a CRM, you can easily track all interactions and communication with investors, ensuring prompt follow-up and timely updates.

Does a Private Equity Firm Need a CRM?

Private equity firms unequivocally need a CRM.

Here’s why:

- To stay organized and efficient

- To have better insight into data & deals

- To improve overall sales & performance

- To build and maintain strong investor relationships

A private equity CRM is essential for success in a highly competitive and time-sensitive industry.

It can help streamline processes, improve communication and collaboration, and provide valuable data for decision-making.

After testing, we compiled a thorough list of our favorite CRMs for Small Businesses. Check it out now! The list might surprise you.

Private Equity CRM Top Features

Let’s take a look at the top features to consider when choosing a private equity CRM.

The ability to integrate with other apps and platforms is crucial for a private equity CRM.

This allows for seamless communication and data sharing between different tools and systems.

The best private equity CRM systems typically integrate with the following:

- Email clients (such as Gmail & Outlook)

- Marketing automation tools (like Mailchimp or Constant Contact)

- Portfolio management software

- Accounting & financial software (such as Quickbooks or Xero)

Having a mobile app is essential for keeping up with the competition.

It’s important to choose a CRM that offers a robust and user-friendly mobile app for on-the-go access to data, client info, and more.

Maintaining strong relationships with clients is crucial for private equity firms.

The best private equity CRM solutions will typically have the following features:

- Contact management

- Custom fields & tags for segmentation

- Activity tracking (such as emails, calls, meetings)

Lead generation is a key part of any business, and financial services firms are no exception.

Here’s what to look for in private equity CRM software for lead management:

- Lead capture & tracking

- Automated lead nurturing workflows

- Lead scoring & qualification

Time is money, especially in the private equity business.

Great private equity CRMs will make it easy to create complex automations (without knowing how to code).

This can save time and improve efficiency by eliminating manual tasks.

Data is crucial for making informed decisions in the alternative investment industry.

Choose a CRM that offers robust reporting and analytics features, including:

- Customizable dashboards

- Real-time metrics

- Advanced filtering & segmentation options

How to Choose a Private Equity CRM

Choosing the right CRM for your private equity firm can be overwhelming.

Here are some steps to help make it easier:

- Identify your private equity firm needs

- Choose a private equity CRM from our list!

- Test drive your CRM

- Choose a winning private equity CRM

Step 1: Identify Your Private Equity Firm Needs

The first step is arguably the most important.

Sit down with your team and discuss the following:

- What are our current pain points or challenges?

- What features do we need in a CRM to address these issues?

- How much are we willing to invest?

- What integrations do we require?

By understanding your specific needs, you can narrow your search for the perfect private equity CRM.

Step 2: Choose a Private Equity CRM from Our List!

We did the hard part by carefully testing each platform on this list.

As a result, we can safely guarantee that every platform is up to the task of streamlining your business while you scale.

Step 3: Test Drive Your CRM

Once you’ve locked in a few solid options, it’s time to take them for a test drive.

Most private equity CRMs offer free trials or demos, so take advantage of this to get a feel for the platform and its features.

During this process, consider the following questions:

- Is the interface user-friendly?

- Does it have all the features I need?

- Will it integrate well with our current tools?

You’ll want to make sure your team is on board with any platform you choose, as they are the ones who will be using it daily.

Step 4: Choose a Winning Private Equity CRM

After testing out different options, it’s time to make the final decision and choose a winning private equity CRM software.

Be sure to consider not only the features and integrations but also factors such as pricing, customer support, and scalability as your firm grows.

Now, all that’s left is implementing your CRM and getting your team trained and ready to use it effectively.

How Much Does a Private Equity CRM Cost?

A good private equity CRM will run you anywhere from completely free to about $50/month.

Be sure to read the fine print and consider factors that can increase the cost.

These include:

- Number of users

- Storage capacity

- Integrations & add-ons

While it may be tempting to opt for the cheapest option, keep in mind that investing in a robust CRM can provide significant returns in terms of efficiency and profit.

Final Thoughts on Private Equity CRMs

Here we are, folks—the end of the road. Now, you’ve got the knowledge you need to lock down a CRM for your business.

Every platform on this list is a top contender in the private equity CRM space, so you really can’t go wrong.

Plus, they all offer a free plan (or trial) to take advantage of—no risk, all reward!

Newsletter Signup

Join The Leads Field Guide Newsletter for tips, strategies and (free) resources for growing your leads, and closing more deals.