By Steve Cartin

Cash flow issues can strangle your small business. Startups require operating funds. The need to upgrade technology and equipment threatens to choke your growth and expansion. Adding insult to injury, a lack of cash flow can cause small business owners to delay retirement savings. The impact on one’s golden years can be huge and irreversible.

An October 11, 2006 Fox News online report quotes Tom Foster, national spokesperson for the retirement plans group and vice president of The Hartford Financial Services company: “I am seeing more and more business owners postponing retirement longer than I’ve ever seen in the past 35 years.”

The IRS: Your New Best Friend

In 1997, the Hospital Corporation of American sued the IRS in Tax Court over what they said were archaic rules for depreciating commercial property. HCA won! As a result, the IRS wrote and implemented new regulations – Cost Segregation Rules – for speeding up the depreciation of certain components of your commercial property. The gist of it is this: Some portion of your commercial property can be fully depreciated in 5 years, some in 7, some in 15 and the rest in 39. Taking your money earlier rather than later can be a smart move if you have an investment to make in your business or even your retirement.

Your CPA Sees a Big Mac®

IRS.gov states that the preferred and most accurate method for implementing Cost Segregation is an IRS-defined, engineering-based study. Here’s why: When an accountant looks at a building, he sees a Big Mac. When an engineer looks at the same building, she sees two all-beef patties, special sauce, lettuce, cheese, pickles, onions on a sesame seed bun. She sees the money that is hiding under the floors, above the ceilings, within the walls, in the decorative elements and even in your parking lot.

Special Sauce, Lettuce, Cheese and Lots of ROI

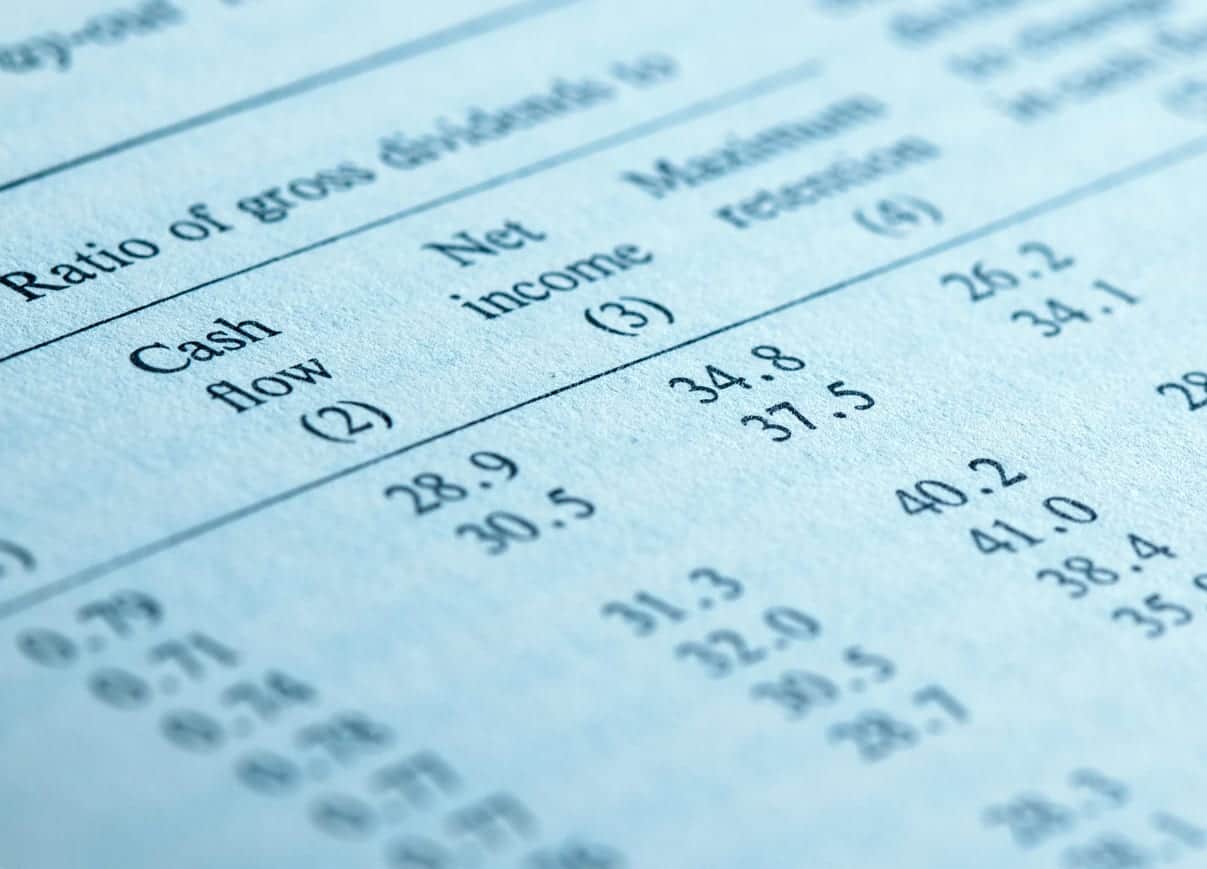

As with most every service, there is an upfront investment which will vary by vendor. But ROIs of 8:1 to 12:1 can be common for commercial property with a depreciable basis of only $225K. Properties whose depreciable basis is $750K or more can often see ROIs in the range of 15:1 to as much as 30:1.

One business owner recently paid $2,775 for his study (after taxes) and received a total of $118K. Figured at an 8% present rate of return, this amounted to $612K as the cumulated future value of invested savings. Not bad for a $2,775 investment! Your money comes to you in the form of tax credits. But since you must pay taxes as a business owner, each dollar in tax credits is a dollar you do not take from your wallet and send to the IRS. Another business owner received $58K in tax credits as a result of her study. She used it to fully pay all her quarterly taxes for three quarters and part of the fourth. What you could expect to receive will be based upon several factors.

Results Vary

Your ROI increases with your tax bracket, the depreciable basis of your property and the specifications to which it was built. Another factor is the year in which your building was placed into service. If you have fully depreciated your building, there will be no monies to claim back from the IRS. Conversely, if you have just conducted the ribbon cutting on your new building, all your savings will be future. Buildings which have been in service a few years yield some immediate savings and some future.

It Won’t Cost Your to Explore… but be Smart

Most reputable Cost Segregation companies provide a free analysis which will estimate how much you will receive in return. If the estimate is low and you receive more after completion of the study, some companies will raise their fee accordingly. Some will not raise their fee at all but will rather pass along the increased return to further grow your ROI. You and your CPA will decide whether this is a good cash flow solution for you. The best companies do all the work and file all the require forms as part of their service. All your CPA really has to do is to provide the depreciation schedule you are using.

If you think the government can do a better job holding on to all your money for the next 39 years, Cost Segregation is not for you. But if you and your accountant agree that you could come out ahead with a small investment, you owe it to yourself and your family to check it out.

What could you do with an extra $50-100K when you file your next quarter’s taxes?