I have worked in the insurance industry with some top companies and insurance businesses.

Throughout my time, I have learned much about insurance CRM software and how the program can help insurance agencies stay organized and automate the sales process.

I have also discovered how important it is to choose the right insurance CRM software the first time around.

Switching programs can be a headache and time-consuming if an insurance agency does not initially select the right CRM.

Therefore, I have reviewed and ranked this year’s top customer relationship management programs!

What is Insurance CRM Software?

Insurance CRM software is a program that helps different types of insurance agencies manage and improve customer relationships.

Insurance CRM programs are designed to help agents track leads, store customer information, and organize contact details.

Additionally, CRMs can automate marketing campaigns, schedule follow-up appointments, and streamline business!

The top Insurance CRM programs offer reporting functions so that you can easily access the analytics of the data collected from customers.

These tools are essential for insurance agents to remain organized and efficient in their daily operations.

Why Should Insurance Agents & Businesses Use a CRM?

There are many reasons insurance agencies should use insurance CRM software for their practice.

Let’s take a closer look at these reasons!

Lead Organization

Insurance CRM software helps agents stay organized, so they do not lose track of any leads.

Tracking customer data allows insurance agents to quickly discover what customers want and need without searching through multiple files or documents.

Tracking this information makes it easier for the agent to know the right contact for a specific product or service.

Increased Task Efficiency

Insurance CRMs are designed to make the sales process more productive.

With insurance CRM software, agents can quickly access customer contact information and send automated messages for follow-up emails and appointment reminders.

The ability to automate specific tasks helps agents reduce the time it takes them to respond to customers’ inquiries or requests.

Insurance CRM tools can also help agents easily access customer data and records to save time searching multiple documents.

If you’re an insurance agent looking to increase your efficiency, then insurance CRM software is the way to go!

Better Follow Up Emails

The ability to send automated messages and follow-up emails are essential email marketing tips for small businesses.

Insurance CRM software allows you to create a library of messages that can help you quickly respond to customer inquiries.

With Insurance CRM, you can customize these messages to be more relevant to the customer’s needs or questions.

Sending these follow-up emails can help agents increase customer engagement and satisfaction.

It also helps build relationships with customers so they will think of your agency whenever they need insurance services or products in the future.

Marketing Automation

Insurance CRM software also helps agents with their marketing efforts.

The program can help you create targeted campaigns tailored to customers’ interests.

You can also use insurance CRMs to track the success of each campaign so you know what strategies work best for your business.

This data can help you optimize your campaigns and get better returns on your marketing investments.

Features to Look for in an Insurance CRM

When looking for the best CRM insurance software, it is vital to consider each platform’s features before making a decision.

Let’s go over the main features most CRM software offers insurance companies!

Insurance Claims Management

Insurance claims management is one of the key features to look for when selecting an insurance CRM.

This feature lets insurance agents quickly and easily manage customer claims with a few clicks.

The insurance CRM software will allow you to store customer information, track each claim, and automate customer notifications about their status updates.

Further, this feature helps agents keep customers informed and satisfied with their service.

Marketing Automation Tools

Another essential feature to look for in insurance CRMs is marketing automation tools.

These tools will help insurance agents save time and money by automating tasks such as creating campaigns, scheduling follow-up emails, and analyzing customer data.

The ability to quickly create targeted campaigns helps agents increase efficiency and reach potential customers accurately.

If you’re an insurance agent, CRM software is essential to streamlining your operations and improving customer satisfaction.

Look for insurance CRMs that offer marketing automation tools to help you get the most out of your business.

Lead Tracking & Notifications

Lead tracking and notifications are also important features in insurance CRM software.

A notification feature can help you better understand customer needs and interests so that you can target them with more relevant content.

Insurance CRMs that offer lead tracking and notifications can also help agents monitor their progress by allowing them to see successful campaigns and track customer engagement.

This information can help you adjust your strategy to ensure you get the best return on your marketing investments.

Commission Tracking

Commission tracking is a must-have feature for insurance CRM software.

Without this feature, agents would have to track commissions, which can be time-consuming and tedious manually.

An insurance CRM with commission tracking will allow you to keep track of all your sales in one easy-to-access location.

Commission tracking will help you quickly identify the most profitable products so that you can adjust your strategy accordingly.

The ability to track commissions also helps insurance agents stay organized and ensures they never miss out on a commission payment.

Made for Insurance Agents

When selecting an insurance CRM, looking for one specifically for insurance agents is essential.

A CRM tailored for insurance agents will include many of the features mentioned above and other tools designed to help insurance agents be more successful.

For example, a good insurance CRM will include an insurance quoting engine that helps insurance agents quickly identify the best insurance options for their customers.

Another feature to look for is a Customer Relationship Management (CRM) tool, which will help insurance agents build strong relationships with their clients and better understand their needs.

Choosing an insurance CRM for insurance agents will ensure they have the tools they need to succeed.

What are the Best CRMs for Insurance Agents?

CRM for insurance agents can initially seem complicated and time-consuming, but it does not have to be.

The Small Business Bonfire team and I continually review and test the leading CRM systems on the market each year, ensuring you can find the best CRM software solution for your company.

We have ranked the following software programs by their pros and cons, pricing plans, key CRM features, and how well they meet the demands of insurance brokers.

Here are the best insurance CRM software programs in 2023!

Monday.com is an excellent CRM that helps various industries manage multiple channels and speed up business processes.

Monday.com is best suited for individuals or small companies looking for ways to promote business growth.

That said, Monday.com provides top-notch customer support and an intuitive interface.

Why We Picked It

Monday.com is a cloud-based platform that allows users to create and manage their work and contact management tools.

Additionally, Monday.com allow users to implement various third-party integrations, which is perfect for insurance agencies.

Lastly, Monday.com is affordable, allowing companies to enjoy automated workflows and organized project management without breaking the bank.

Pricing

Monday.com is a free CRM software with four different pricing plans for users at monthly or annual rates.

The annual pricing plans include the following:

- Individual: $0 (free forever)

- Basic: $8 per seat per month

- Standard: $10 per seat per month

- Pro: $16 per seat per month

- Enterprise: Customized pricing

Monday.com also allows customers to enjoy a free trial on each of the company’s plans.

Pros

- Users can customize various aspects (marketing campaigns, dashboards, etc.)

- Modern, easy-to-use dashboard

- Hundreds of pre-made templates for creating boards and automation

Cons

- Larger companies may need more tools than what Monday.com offers

- There is a minimum team size of three people for paid plans

AgentCubed provides an all-in-one solution for insurance and healthcare companies.

The platform includes key features such as tools that monitor and organize sales activities.

Also, AgentCubed integrates quoting and enrollment, speeding up business processes.

Why We Picked It

AgentCubed is designed for medium to large insurance agencies and call centers.

The platform’s plans help with sales forecasts, ROI calculation, and cross-selling.

Although AgentCubed may be more expensive than other CRMs in the insurance industry, the advanced tools are worth the cost.

Pricing

AgentCubed builds plans around each company.

Therefore, potential users must contact AgentCubed for pricing information.

However, the company offers users a demo of its products before purchasing.

Pros

- Special tools for the insurance business (policy management, organized sales figures, etc.)

- Automated renewals, reminders, and follow-ups for policies

- Includes features for property and real estate insurance teams

Cons

- Steep learning curve

- The program is more expensive than others in the industry.

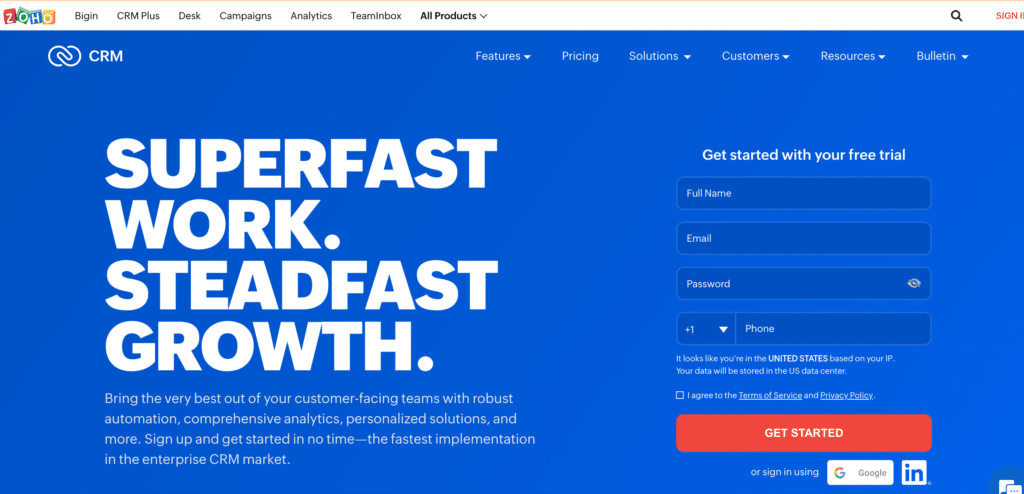

Zoho CRM makes it easier for an insurance company to have more project and task management.

Also, Zoho CRM includes full sales process management software, helping manage new and existing clients.

If a company is looking for an easy-to-use CRM in the insurance sector, Zoho CRM is the right choice.

Why We Picked It

Zoho CRM is an excellent tool for an insurance firm that has never used CRM.

With that, Zoho CRM offers numerous features that streamline business processes.

Additionally, Zoho CRM includes a comprehensive and intuitive dashboard that lays out everything a company needs.

Pricing

Zoho CRM provides a free trial and four pricing options at annual or monthly rates.

Here are the annual plans they offer users:

- Standard: $14 per user per month

- Professional: $23 per user per month

- Enterprise: $40 per user per month

- Ultimate: $52 per user per month

Pros

- The CRM system is available on a mobile app.

- Customer service is helpful and knowledgeable.

- AI software makes predictions and suggestions that assist with lead generation.

Cons

- The basic plan does not include advanced CRM tools that sales teams need.

- Integrations are more limited compared to other software

- There is a maximum of ten users

AgencyBloc is a CRM system designed for insurance agencies, specifically life and health insurance companies.

AgencyBloc’s tools help businesses increase profitability and strengthen customer loyalty.

This cloud-based CRM system organizes client data and other pertinent information, helping health insurance companies stay on top of business operations.

Why We Picked It

AgencyBloc is one of the best CRM systems in the instance sector because it has tools specifically designed for insurance needs.

For instance, AgencyBlog helps companies track policies, generate reports, and track commissions that help sales teams stay organized.

Further, the dashboard allows users to observe ongoing activities at a glance.

Pricing

AgencyBloc’s plans start at $75 a month, and each plan is customized for the company in question.

That said, users must contact AgencyBloc to receive a monthly quote.

AgencyBloc also provides a demo for users to test the software before purchasing it for their company.

Pros

- The commission upload feature is extremely helpful

- Insurance marketing automation

- The program completes prospect and contact management tasks for a company.

Cons

- The program is a little pricey

- Steep learning curve

- Managing import data can be difficult

ClickUp is a popular CRM option for various industries.

And although ClickUp isn’t explicitly designed for an insurance business, it offers plenty of helpful tools and automation.

Also, ClickUp has built-in automation features that most CRMs do not provide.

Why We Picked It

ClickUp differs from many CRMs because the plans include several features you don’t have to pay extra to receive.

For instance, ClickUp has document-editing tools, time-tracking, and project management software.

Lastly, ClickUp is easy to use, regardless of a user’s experience with agency management and CRM tools.

Pricing

ClickUp is a free CRM with four subscriptions users can choose from at annual or monthly rates.

These are the annual plans they provide:

- Unlimited: $5 per member per month

- Business: $12 per member per month

- Business Plus: $19 per member per month

- Enterprise: Custom pricing

Pros

- Various ways to view project progress

- Key features are advanced

- Customer support is very helpful and responsive

Cons

- Customization options can be overwhelming for smaller companies

- The automation builder is hard to use

- The software isn't great for compiling project feedback.

InfoFlo is an integrated CRM platform that users can access online, or it can be installed on-premise.

InfoFlo’s software helps with lead management, customer interactions, computer telephone integration, and automation.

Why We Picked It

InfoFlo has impressive features, including email marketing, automated meetings and appointments, and Skype and Outlook integration.

Also, team members can view everything happening within the company in real time.

Pricing

InfoFlo provides two different pricing plans based on the user’s business needs.

These plans include the following:

- Cloud: $30 per month

- Own Your Data: $99 (one-time cost)

Additionally, InfoFlo offers users a 30-day free trial and a complementary demo session.

Pros

- Powerful organizational tool

- Affordable add-on tools

- A free trial is available

Cons

- No user guideline

- Customer service could improve

- Outdated design

NetSuite is an advanced CRM software for insurance businesses.

It is part of the Oracle business software suite, including several industry-leading tools that help companies stay organized and enhance customer relationships.

NetSuite is perfect for an insurance provider because it includes dedicated financial CRM functionalities that most software systems lack.

Why We Picked It

NetSuite listed top CRM solutions because the program is incredibly flexible.

For instance, NetSuite allows users to customize budgeting, forecasting, and revenue management.

Additionally, the CRM solution has various sales tools that provide lead management and follow-ups that nurture leads.

Because of how many tools this insurance agency CRM software includes, it is best suited for large-scale companies with the personnel to implement such a comprehensive system.

Pricing

When insurance businesses use NetSuite, they subscribe to an annual license fee.

The license consists of three components, which include the following:

- Core platform

- Optional modules

- The number of users

NetSuite also charges a one-time implementation fee for the initial setup.

Potential users must contact NetSuite to receive pricing information.

Pros

- There is full sales force automation.

- Users can easily integrate other software for insurance agents.

- Extremely customizable features

Cons

- An overwhelming number of tools may be hard for an insurance business to master.

- The program is expensive for a small insurance agency.

- There is no free trial available.

FreeAgent is a CRM solution and work management tool best designed for teams.

However, FreeAgent does not have specific features tailored to insurance needs.

Still, FreeAgent has helpful features any insurance agent will enjoy, such as sales forecasting tools for insurance policy ROI.

Why We Picked It

In terms of software for insurance agents, FreeAgent is a suitable option, especially for small-scale operations.

FreeAgent has essential customer management tools, helping agents acquire data throughout the customer journey.

Additionally, FreeAgent provides sales pipeline visibility.

Lastly, FreeAgent has lead generation tools that are extremely helpful for sales processes.

Pricing

FreeAgent offers three different pricing plan options at monthly and annual rates.

Here are the three annual subscriptions FreeAgent provides:

- Starter: $35 per user per month

- Professional: $75 per user per month

- Enterprise: $100 per user per month

Pros

- Very easy to learn how to use

- Excellent customer support and initial training modules

- Users can add custom fields that are unique to their organization

Cons

- Does not have features that are specifically designed for insurance sales and operations

- The search function can be time-consuming

- The integration capabilities are challenging

VanillaSoft is an all-in-one insurance agent CRM program.

Therefore, it is one of the best CRM for insurance agents.

VanillaSoft’s unique priority-based contact management system helps companies stay organized and manage phone calls.

Why We Picked It

VanillaSoft is a CRM for insurance agents that includes intelligent lead generation and queuing technology.

Further, VanillasSoft has scripting suggestions that give insurance agencies the proper outreach messages and information.

Lastly, VanillaSoft has automated marketing tools that reach existing customers and improve customer interactions.

Pricing

VanillaSoft’s CRM features and plans start at $99 per month.

VanillaSoft customizes pricing based on a customer’s needs.

Therefore, users must contact VanillaSoft’s team to receive a personalized price.

Fortunately, VanillaSoft offers a free demo of the company’s CRM features.

Pros

- Excellent customization

- User-friendly

- Cost-effective for any insurance agency

Cons

- Users must take considerable time to learn the system to make the most out of it.

- Some users report security issues.

- Lack of control with some features

Salesforce is cloud-based software that leads the CRM industry year after year.

Salesforce is best suited for large insurance agencies that need automated workflows, sales pipeline information, and detailed reports.

Also, Salesforce is perfect for companies in the insurance industry that want to customize their CRM.

Why We Picked It

Salesforce is excellent for companies that want to streamline their sales tools.

Also, Salesforce makes it easy to integrate third-party software an insurance business relies on daily.

Further, Salesforce has lead management and analytics tools that organize insurance policies and promote company growth.

Pricing

Salesforce offers customized prices and builds plans around what an insurance agency needs.

Contact their team to receive a customized quote.

Pros

- Easy to integrate other tools (with over 1,000 integrations available)

- Sales and marketing automation capabilities

- Users can customize almost anything

Cons

- Some users may find it complicated to learn how to use

- Expensive for smaller companies in the insurance sector

- Very time-consuming

Conclusion

Insurance CRM software is a valuable tool for insurance agents.

It can help you stay organized, track commissions, and provide marketing automation tools that can help you reach more prospects and make more sales.

When selecting an insurance CRM, the key is to choose one made explicitly for insurance agents.

We’ve outlined the top insurance CRMs with unique features and pricing plans.

You can find the right insurance CRM for your business by exploring your options.

Overall, insurance CRMs make life easier for insurance agents by simplifying everyday insurance tasks and providing the insights needed to make smarter decisions.

Frequently Asked Questions

Yes, insurance companies use CRM to help Insurance agents manage their workflows, track commissions, and market Insurance products.

The best Insurance CRM for Insurance brokers depends on your individual needs and budget. It is best to do your research to find the Insurance CRM that has all the features you need at a price you can afford.

The most popular CRM is Salesforce because it serves large-scale companies and streamlines business operations. Most insurance companies use insurance CRM software to manage their insurance operations, track commissions, and automate Insurance marketing. Popular insurance CRMs include Monday.com, HubSpot CRM, Zoho, AgencyBloc, ClickUp, InfoFlo, Netsuite, FreeAgent, VanillaSoft, and Salesforce.

The three types of CRMs are operational, analytical, and collaborative. Operational CRMs manage customer data and relationships, while analytical CRMs analyze customer behavior and trends. Collaborative CRM connects customers with insurance agents to streamline insurance operations.

Aflac uses Salesforce as its primary CRM. Salesforce is a cloud-based CRM that helps agents manage customer relationships, track commissions, and automate marketing. Aflac’s CRM provides personalized customer service to ensure each agent has the support they need to be successful.

Newsletter Signup

Join The Leads Field Guide Newsletter for tips, strategies and (free) resources for growing your leads, and closing more deals.